While artificial intelligence (AI) continues to be one of the dominant market themes of 2023, the subsequent robust interest makes individual sector plays either overvalued or extremely risky. Fortunately, with Chinese technology juggernaut Alibaba (NYSE:BABA), investors may enjoy a compelling AI trade at a discount. Therefore, I am bullish on BABA stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BABA Stock Undercuts the AI Hype Train

To be sure, AI represents one of the most significant innovations and therefore, companies are justified in banking on it. For example, Microsoft (NASDAQ:MSFT) co-founder Bill Gates shared his views on the digital intelligence wave, stating, “Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.”

Unsurprisingly, Microsoft has been a big winner so far this year thanks to its partnership with OpenAI, the creator of the chatbot ChatGPT. Since the January opener, MSFT shares returned over 47%. Another big winner in the space is Nvidia (NASDAQ:NVDA), perhaps most famous for its advanced graphics processing units (GPUs).

Of course, AI protocols require intense processing capacity to run quickly and efficiently. Therefore, because experts project burgeoning demand for various AI applications, the narrative bolstered Nvidia’s GPU business. Since the start of this year, NVDA has gained over 210%.

Still, the dilemma for investors just entering the arena is the value proposition. Trading at a forward (projected) earnings multiple of 31 times, MSFT isn’t overly expensive, depending on how you classify the underlying company (since it touches multiple sectors). However, it’s not the best bargain you can pick up in the segment.

NVDA makes comparisons much clearer. At the moment, NVDA trades at a forward multiple of 58.48, well exceeding the semiconductor sector’s average forward multiple of 28. On the flip side, BABA stock – having gained just 3.3% for the year – is flying under the radar.

Alibaba Makes a Case for Itself

With so much attention paid to ChatGPT and domestic tech players like Nvidia, it’s easy to forget that Alibaba has been hard at work on its own AI solutions. For example, the Chinese tech juggernaut developed its own ChatGPT-style generative AI tool called Tongyi Qianwen. Potentially accelerating customer adoption of its cloud computing service, Alibaba deserves a closer review.

Indeed, Alibaba CEO Daniel Zhang laid out the framework for the forward success of BABA stock during the company’s fiscal fourth-quarter earnings call. “The development of AI technology presents a huge new opportunity for the cloud business because artificial intelligence applications will result in an exponential increase in demand for computing power,” Zhang stated.

“This kind of computing power needs to be provided as a kind of public service or infrastructure. So, this is a huge opportunity for us going forward,” the CEO added. According to a CNBC report, ample demand undergirds Tongyi Qianwen, translating to 200,000 enterprise-level customers applying for trial access.

In all fairness, BABA stock has been a troubling proposition for many investors because of the woeful trifecta of the COVID-19 crisis, the government crackdown on large tech enterprises, and the steady but slow economic recovery in China.

Nevertheless, there’s no denying that popular AI trades have become overheated, and the general pessimism toward Chinese stocks does not represent a unanimous opinion. For example, billionaire Ken Griffin sees upside in the world’s second-largest economy. Therefore, BABA stock can ride coattails on a possible contrarian bullish wave.

Enticing Bargain Valuation

If the overheated competition and the arguably strong narrative for Alibaba don’t excite investors, one factor might push the hesitant — BABA stock trades at an enticing bargain valuation.

Currently, Alibaba shares trade at a forward multiple of 10.5. This stat has fluctuated over the past several months from a low of 9.37x at the end of December 2022 to a high of 12.87x at the conclusion of last year’s first half. No matter how you cut it, BABA stock looks undervalued.

Even better, no matter how you classify Alibaba, whether as a retail specialist or a software provider, the company offers a bargain. The same cannot quite be said about its U.S.-based rival Microsoft, and it absolutely cannot be said about Nvidia.

Is BABA Stock a Buy, According to Analysts?

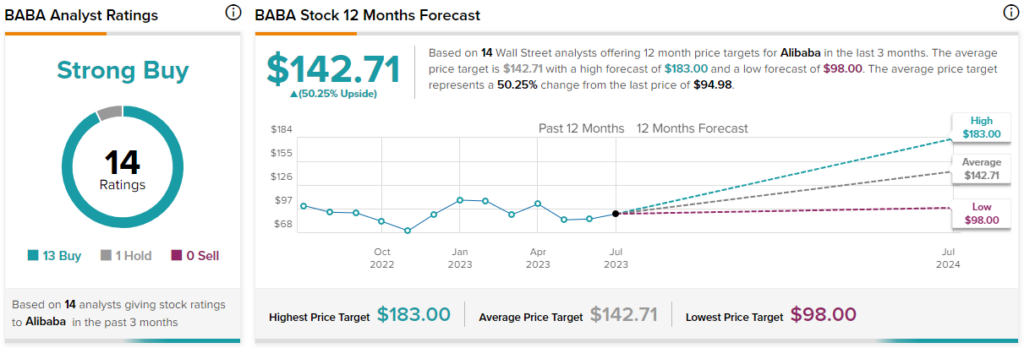

Turning to Wall Street, BABA stock has a Strong Buy consensus rating based on 13 Buys, one Hold, and zero Sell ratings. The average BABA stock price target is $142.71, implying 50.25% upside potential.

The Takeaway: BABA Stock is AI for Cheaper

Although AI offers long-term opportunities for tech investors, right now, most of the usual suspects are overvalued. That’s not the case with BABA stock, though, which offers an attractive forward earnings multiple. While the underlying Chinese economy presents risks, Alibaba offers similar innovations for a massive market. Therefore, it’s a contrarian idea for astute investors.