The investing world has gone through significant changes over the last two or three years. One of the most significant changes has been the addition of meme stocks. In this piece, we used TipRanks’ Comparison Tool to evaluate two meme stocks — GME and BBBY. The two companies share many similarities. However, there is one critical difference between these two that makes BBBY look shakier than GME. Nonetheless, I am bearish on both stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors should do their due diligence carefully before diving into such highly-volatile names. Unfortunately, many less experienced investors jump on the bandwagon when they see these meme names skyrocket, often too late to earn any money.

The extreme volatility of meme stocks can be a double-edged sword. On the one hand, investors can make millions of dollars in a single day by investing in these stocks, but on the other, attempting to capture such gains can be like trying to catch a falling knife.

A Brief History of Meme Stocks

Meme stocks are so volatile because of their cult-like followings, generally consisting of retail investors who coordinate their purchases of these shares on social media. Such steep rises and falls may seem like a pump and dump scheme, but these movements lack the influence of a professional promoter who is paid to pump up the price of a stock.

The stock prices aren’t pumped up with the goal of defrauding other investors. Instead, retail investors appear to want to see how high they can get the stock to go.

Virtually any stock can be classified as a meme stock simply because chatter on an online forum suddenly picks up. In GameStop’s case, chatter about it on the well-known (and notorious, some would say) Reddit forum WallStreetBets started abruptly in August 2020.

Investors on the forum started gobbling up its shares, egging each other on in the process and ultimately triggering a short squeeze in January 2021.

Many or even most of the companies that capture the attention of the masses lack the fundamentals to back up the sudden surges in their prices. For example, GameStop shares soared despite the retailer announcing plans to shutter 1,000 stores by March 2021. Another common trait of meme stocks is high short interest.

In addition to triggering a short squeeze, the mob that pumped up GameStop’s stock also delighted in causing pain for hedge funds. In a David-versus-Goliath narrative, several hedge funds ran into serious trouble due to their sizable short positions in the video game retailer. At least one hedge fund required a bailout to avoid collapse due to the size of its short position.

GameStop

As is typical with meme stocks, GameStop enjoys positive sentiment among retail investors but negative news sentiment and bearish blogger sentiment. The retailer’s P/E stands at -23.4x.

A negative P/E ratio indicates that GameStop is losing money, which should be the first clue that it’s in financial hot water. However, given Wall Street’s euphoric behavior in recent years, money-losing companies often have high stock prices, so a deeper analysis is required.

GameStop surged suddenly on August 16, climbing from about $39 to almost $45 a share in less than an hour. However, the stock started to reverse course the same day, and it now finds itself in the $36 range.

It should be noted that GameStop management took advantage of the hype by performing a four-for-one split on July 21. In its most recently completed quarter, the retailer reported losses of $0.52 per share, or $157.9 million, on $1.38 billion in revenue.

The consensus had suggested per-share losses of $0.36 on $1.32 billion in sales, so the losses were significantly worse than expected. GameStop even lost money during the all-important holiday shopping quarter, reporting $147.5 million ($0.49 per share) in losses on $2.25 billion in revenue.

Ultimately, it’s hard to find anything to like about GameStop. While bankruptcy may not look as imminent as it did before it gained meme-stock status, the company is losing money at such a rapid clip that it’s hard to imagine that it has many more years left without a major overhaul of its business model.

The only good news for GameStop is its balance sheet, which shows $1.035 billion in cash and equivalents with $617 million in debt (when including lease obligations) and $1.67 billion in total liabilities. Retail investors have given the company so much money over the last couple of years that it was able to raise $1.68 billion by selling more shares to shore up its balance sheet.

GameStop has been trying to reinvent itself, starting with the addition of Chewy (CHWY) co-founder Ryan Cohen as chairman of its board in June 2021. However, the retailer’s future is far from a sure thing, so at this point, its valuation hinges on the whims of the masses, making it impossible to predict its price movement.

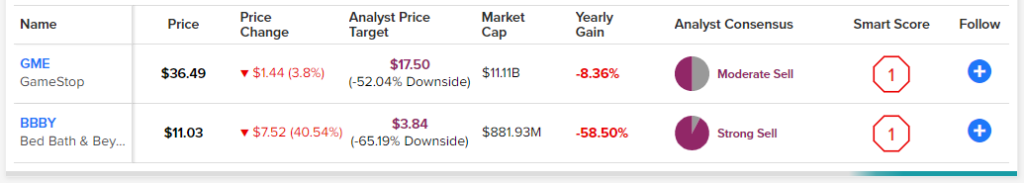

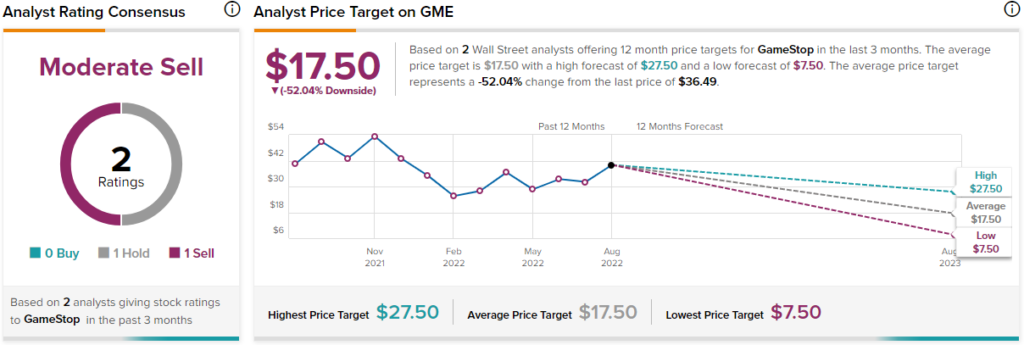

On Wall Street, GameStop has a Moderate Sell consensus rating based on zero Buys, one Hold, and one Sell rating assigned over the last three months. At $17.50, the average GameStop price target implies downside potential of 52%.

Bed Bath & Beyond

Bed Bath & Beyond shares plunged over 40% on August 19, erasing some of the gains they’ve enjoyed over the last month. The stock has more than doubled over the last 30 days, and like GameStop, it has a negative P/E ratio, coming in at -1.0x.

Bed Bath & Beyond is also bleeding money, posting losses of $357.67 million or $2.83 per share on $1.46 billion in sales for the most recently completed quarter. The consensus had called for losses of $1.39 per share on $1.51 billion in revenue.

Like GameStop, Bed Bath & Beyond didn’t even report a positive holiday quarter, as its February earnings report revealed losses of $159.1 million or $1.79 per share on $2.05 billion in sales. Also, like GameStop, there isn’t much to like about Bed Bath & Beyond either.

However, the video game retailer is actually in a better cash position. Bed Bath & Beyond’s balance sheet is anemic, with $107.5 million in cash and equivalents versus nearly $3.3 billion in debt and total liabilities of $5.17 billion.

The retailer reportedly tapped law firm Kirkland & Ellis, which specializes in bankruptcies and restructuring, to deal with its debt problem. Additionally, it hasn’t taken any steps to try to rectify its situation like GameStop has in its intended transformation.

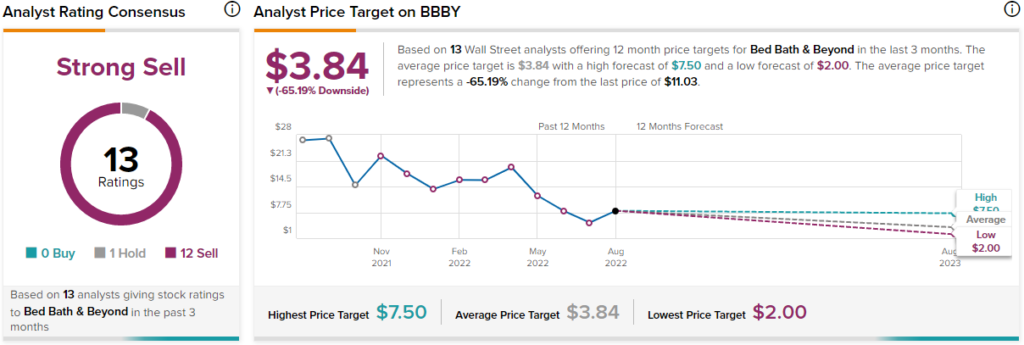

Unsurprisingly, Bed Bath & Beyond has a Strong Sell consensus rating based on zero Buys, one Hold, and 12 Sell ratings over the last three months. At $3.84, the average Bed Bath & Beyond price forecast implies downside potential of 65.2%.

Conclusion: Meme Stocks Should Probably be Avoided Altogether

If comparing the original meme stock with the mob’s new favorite reveals anything, it should be that stocks that earn meme status generally should be avoided. It can be exciting to hitch a ride to the clouds, but investors who weren’t the ones driving the original rise via social media should be wary. The bottom can fall out at any time, and if there’s no cash to cushion the company’s fall, investors will go down with it.