In this piece, I evaluated two legacy automaker stocks, General Motors (NYSE:GM) and Ford Motor (NYSE:F), using TipRanks’ comparison tool to determine which is better. General Motors is a multinational automaker best known for its four core brands: Buick, Cadillac, Chevrolet, and GMC. Ford Motor is a multinational automaker that sells cars, trucks, SUVs, and commercial vehicles under its Ford brand and luxury vehicles under its Lincoln brand.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

GM shares are down 8% year-to-date and off 11% over the last year, while Ford stock is up 11% year-to-date but up only 5% over the last year.

With such a dramatic difference in stock-price performance, it shouldn’t be a surprise that Ford has a much higher valuation than General Motors. In this article, we’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and look at the major trends and challenges faced by each to determine which is better.

General Motors (NYSE:GM)

At a P/E of around 4.3, General Motors is trading at a steep discount to Ford and on the low side relative to its own five-year history. Excluding the periods when its valuation went through the roof, including in late 2018/early 2019 and late 2020/early 2021, GM has traded at a P/E of between 4.0 and 7.0 (roughly). Thus, its low valuation, combined with its positive sales momentum, suggests a bullish view may be appropriate for GM.

Both GM and Ford are dealing with a union strike among auto workers that threatens to idle their plants and cut into their sales. In fact, GM reported that the United Auto Workers (UAW) strike cost $200 million in just the first two weeks alone. As a result, the company has established a $6 billion line of credit in case of a prolonged work stoppage.

Unfortunately, GM stock is down 21.8% over the last three months, erasing its long-term momentum and dragging its five-year returns down to just 2%. Hedge funds appear to be spearheading that negative move, unloading 14.5 million shares in the last quarter. It’s a major bearish signal reflective of the negative sentiment that has plagued General Motors recently.

However, the market is failing to acknowledge the positive aspects of this automaker. GM reported a 21% year-over-year increase in third-quarter sales, outpacing analysts’ expectations of a 15% to 16% increase in new vehicle sales for the industry during the quarter. Meanwhile, Ford reported only an 8% year-over-year increase in auto sales for the quarter — without any impact from the ongoing strike, which is expected to hit automakers’ results starting in October.

GM has also been growing its electric vehicle (EV) sales, an area of critical importance for the long-term survival of legacy automakers. The automaker reported a 28% increase in EV sales from the second to the third quarter. Finally, GM’s net income margin has remained strong in recent years, ranging from 5% in 2020 to 8% in 2021 and 6% for the last 12 months. Meanwhile, Ford saw negative net income margins in 2020 and 2022.

I believe the market is wrong about General Motors, but it may take time for this bull thesis to play out, especially if the strike goes on much longer. Rising interest rates are also a factor because most consumers need to finance auto loans. However, GM shares have sold off so much recently that future upside seems very likely.

What is the Price Target for GM Stock?

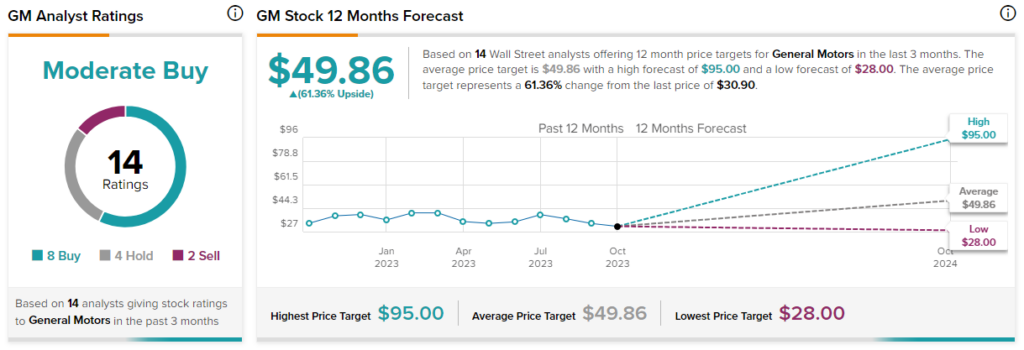

General Motors has a Moderate Buy consensus rating based on eight Buys, four Holds, and two Sell ratings assigned over the last three months. At $49.86, the average General Motors stock price target implies upside potential of 61.4%.

Ford Motor (NYSE:F)

At a P/E of around 11.6, Ford Motor is trading at a much higher valuation than GM. Over the last five years, Ford’s P/E during its profitable periods has ranged from about 4.0 to 5.0 in 2022 to 21 this past July, putting the current valuation roughly in the middle. Despite its higher valuation versus GM, Ford’s positive sales trends and long-term stock-price gains suggest a bullish view may still be appropriate.

Ford faces the same challenges and enjoys many of the same benefits as GM, but its valuation is significantly higher. Hedge funds snapped up 4.1 million shares in the last quarter, although Ford is down 19% over the last three months. Some of those purchases may have been motivated by the special dividend the automaker paid after selling most of its ownership stake in Rivian Automotive (NASDAQ:RIVN), which boosted its trailing dividend yield to over 10%.

However, Ford shares are up 67% over the last five years, even after the three-month decline of 19%. This suggests that the stock could be a strong buy-and-hold position over the long term, even though the automaker lost money in 2020 and 2022, resulting in net income margins of -1% for those years. Notably, Ford enjoyed a net income margin of 13% in 2021.

Finally, Ford continues to enjoy solid sales momentum and managed to edge out GM on EV sales during the third quarter, coming in at almost 21,000 versus GM’s total of just over 20,000.

What is the Price Target for F Stock?

Ford Motor has a Moderate Buy consensus rating based on seven Buys, seven Holds, and one Sell rating assigned over the last three months. At $15.37, the average Ford Motor stock price target implies upside potential of 28.1%.

Conclusion: Long-Term Bullish on GM and F

While both General Motors and Ford receive bullish ratings, they are for totally different reasons. GM trades at a steep discount to Ford as sentiment restrains its share price despite the positives — a situation I view as temporary. On the other hand, Ford enjoys long-term positive momentum in its stock price and fundamentals that suggest further upside is likely, even if not in the near term.