If you’re going to invest in a growth stock, then it should represent a growing company. Ginkgo Bioworks (DNA) fits this description perfectly, as this biotechnology business is advancing new cell engineering programs that push the boundaries of science. Plus, a well-known investing guru recently increased her position in DNA stock. For these reasons, I am bullish on Ginkgo Bioworks stock.

Ginkgo Bioworks provides a platform to program cells, almost like coders can program computers. Cellular programming has a wide variety of potential applications, from food/agriculture to pharmaceuticals to industrial chemicals and more. Ginkgo Bioworks isn’t a gigantic company, but for U.S.-based investors, DNA stock is one of a very small number of pure plays in this exciting niche scientific specialty.

Best of all, you don’t have to be a scientist to participate in Ginkgo Bioworks’ emergence into a potential market leader. The shares are easily affordable for most portfolios, and while there’s high risk involved, the rewards as an early investor could be outstanding. So, prepare to delve into a truly unique biotech firm – and just maybe, position yourself alongside a famous innovation bull.

Ginkgo Bioworks to Purchase Epidemic-Study Assets

In a time when COVID-19 and monkeypox are major public health concerns, Ginkgo Bioworks is proudly expanding its infrastructure to include epidemic-study assets. Ginkgo Bioworks is doing this by purchasing assets from a company that’s already established in the area of epidemiological tracking and forecasting.

Specifically, Ginkgo Bioworks will acquire epidemiological data infrastructure assets from Delaware-based Baktus, Inc. Through this major purchase, Ginkgo Bioworks will own “proprietary datasets, modeling and analytic tools, and a software platform with the capabilities to track, model, and forecast epidemics and associated risks and impacts.”

Baktus subsidiary Metabiota, Inc., possesses a sizable database of infectious disease outbreaks and deploys this information to help governments and other entities better understand pathogens and, therefore, epidemics and pandemics.

Leveraging Baktus’ epidemiological modeling and predictive capabilities will enable Ginkgo Bioworks to “continue making the data we gather on pathogen spread and evolution that much more meaningful and actionable for public health leaders and communities,” according to Matt McKnight, General Manager for Biosecurity at Ginkgo.

Ginkgo Bioworks’ New Cell Programs Signal More Growth

It’s exciting to see how Ginkgo Bioworks is developing its biosecurity platform through the addition of infrastructure for epidemic tracking and modeling. Yet, this isn’t the only area in which the company is growing. Notably, Ginkgo Bioworks is also pushing the boundaries in its core Foundry business through the addition of new cell engineering programs.

Even beyond the company’s financial highlights, Ginkgo Bioworks’ operational expansion stood out during 2022’s second quarter. In particular, Ginkgo Bioworks added 13 new cell programs to its Foundry platform in Q2 2022, representing 86% growth compared to the prior-year period. This could just be the start of something much bigger and better, however, as Ginkgo is preparing to add 60 new cell programs to its Foundry platform in 2022.

It’s not an exaggeration to claim that Ginkgo Bioworks’ Foundry division is the company’s bread and butter. During Q2 2022, Ginkgo generated Foundry-segment revenue totaling around $44 million, representing a 105% year-over-year increase.

This isn’t to suggest that the company’s Biosecurity division wasn’t a major revenue generator as well, though. In the second quarter of 2022, Ginkgo Bioworks’ Biosecurity business generated revenue of $100 million for the company while indicating a very healthy gross profit margin of 36%.

All in all, Ginkgo Bioworks demonstrated excellent top-line results in Q2 2022. The company’s total revenue for this period was $145 million, signifying a massive 231% improvement over the result from 2021’s second quarter.

Even with all of that, Ginkgo Bioworks co-founder and CEO Jason Kelly still had one more fiscal statistic to add to the mix. “Our strong cash balance of approximately $1.4 billion affords us the ability to play offense when compelling opportunities arise, while we remain focused on our cash runway and can consider multiple levers as we drive towards profitability,” Kelly asserted.

Cathie Wood’s Funds Hold Millions of Shares of DNA Stock

Reportedly, none other than ARK Invest fund manager Cathie Wood has approved the purchase of millions of DNA stock shares. For example, her ARK Genomic Revolution ETF (ARKG) holds nearly 25 million DNA shares. Wood’s funds are well known for investing in disruptive and innovative businesses.

Pardon the pun, but I guess you could say that making high-risk, high-reward bets is part of Wood’s DNA. Granted, her purchase doesn’t mean that you have to make a huge bet on Ginkgo Bioworks. It’s just nice to know, however, that a famous investor is on your side if you choose to own Ginkgo Bioworks stock.

Is DNA a Good Stock to Buy?

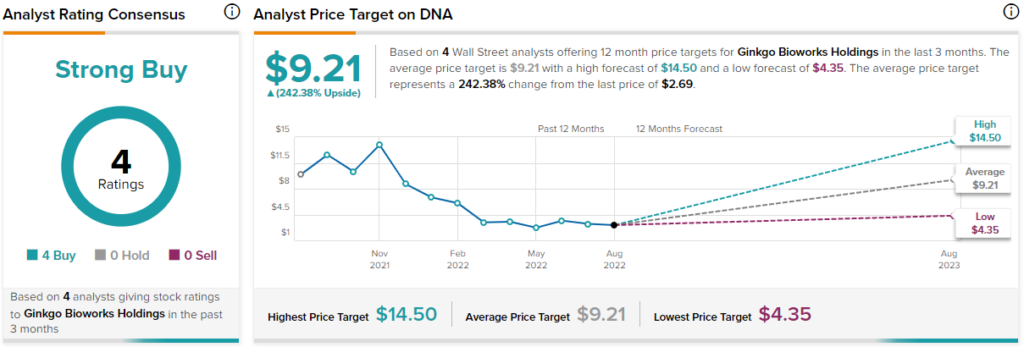

Turning to Wall Street, DNA stock comes in as a Strong Buy based on four unanimous Buy ratings. The average Ginkgo Bioworks price forecast is $9.21, implying 242.2% upside potential.

Conclusion: Should You Consider Ginkgo Bioworks Stock?

It’s definitely worth considering a long position in Ginkgo Bioworks stock if you’re a biotechnology sector investor. This stock is cheap – under $3 at the moment – and has the potential to triple or more, according to analysts.

If DNA stock does go higher, it should be based on Ginkgo Bioworks’ bold expansion in its core Foundry division as well as its addition of epidemic-study assets. Yet, it’s nice to also consider that Cathie Wood has the stock, so you’ll be in good company if you choose to take a stake in DNA stock.