Tech stocks were extending their recent recovery on Tuesday, with the tech-heavy NASDAQ surging 1.74%. The good news, according to Wedbush’s Daniel Ives – a 5-star analyst rated in the top 2% of the Street’s stock pros – is the development of a tech rally that is anticipated to conclude the year on a bullish note.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Ives doesn’t hesitate to explain his stance, writing in a recent note on the situation and prospects for tech stocks: “We see tech stocks rallying into year-end as the new tech bull markets powers through near term Fed worries… It’s the rocket ship-like trajectory of AI driven growth that will hit the shores of the tech industry over the next 12-18 months that speaks to our unabated bullishness for tech stocks.”

Against this backdrop, Ives has pinpointed an opportunity in two AI-driven stocks that he thinks are ready to make the most of this new tech bull market. We ran the pair through the TipRanks database to find out what other Street analysts have to say too. Let’s check the results.

Consensus Cloud Solutions (CCSI)

Say ‘fax,’ and you’ll be hopelessly transported back to the 1990s for most people. However, today’s industry has an answer in the form of digital cloud faxing. The first stock we’ll look at is Consensus Cloud Solutions, an information tech firm that specializes in this niche, offering digital cloud faxing and other data transmissions to a variety of industries. The company has a particularly strong position in the healthcare industry, but it also serves clients in finance, insurance, real estate, and manufacturing.

Consensus Cloud’s products include eFaxCorporate, the industry’s #1 e-faxing platform, as well as platforms for interoperability, API connectivity, NLP/AI document processing, and HIPAA compliant e-signatures. With a 25-year history of creating and marketing advanced data solutions for regulated industries, the company has combined its experience with the latest in secure cloud and data document transmission solutions.

To give one example, Consensus Cloud announced earlier this month the release of its Clarity Clinical Documentation service, a tool optimized for the healthcare industry. Clarity DC leverages natural language processing and AI to extract relevant data from unstructured documents, such as faxes, handwritten notes, and scanned pages, ensuring they are correctly attributed to the corresponding patient record.

Strong services added up to an earnings beat in the last quarterly report, despite a revenue miss. Consensus Cloud reported $92.8 million at the top line for 2Q23, $1.3 million below the estimates. Revenue for the quarter was up a modest 1.8% year-over-year. On the bottom line, the company’s earnings came in at $1.36 per adjusted diluted share by non-GAAP measures. This result was down 5.6% y/y, but at the same time beat the forecast by 11 cents per share.

In Daniel Ives’ view, Consensus Cloud has sound long-term prospects ahead of it. The top analyst sets out an upbeat view of that path: “Consensus Cloud Solutions delivered relatively strong FY2Q23 results featuring a miss on the top-line and a beat on the bottom-line as the company continues to witness slow decision making and increased large deal scrutiny as a result of a difficult macro backdrop… While the company anticipates to see further headwinds into 2H23, CCSI is well-positioned to scale its upsell and cross sell opportunities within its customer base while expanding to new market for further top-line growth.”

“We view this as a generally positive quarter in the CCSI story with the go-to-market strategy realignment now positioning the company in a great opportunities to expand its pipeline across multiple industries with its expansive product portfolio,” Ives summed up.

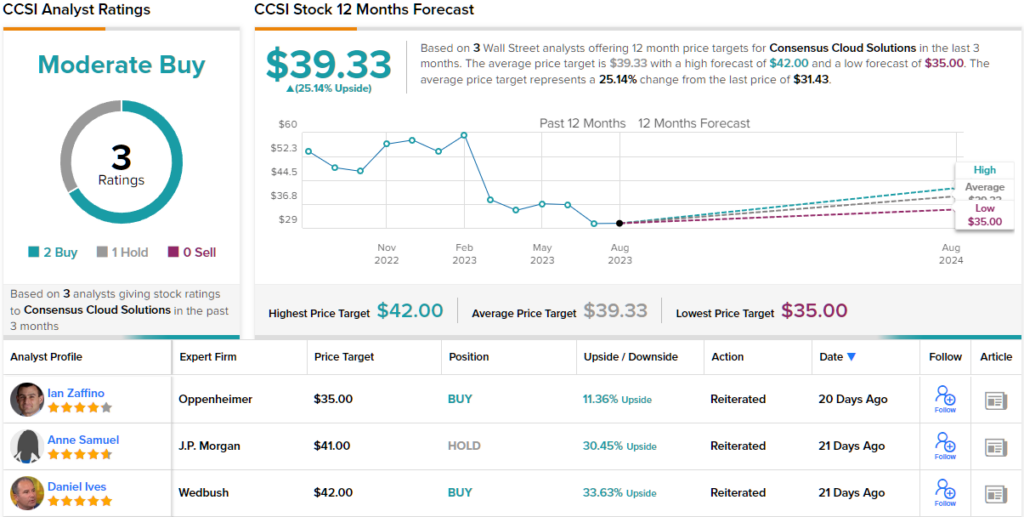

Ives uses these comments to back up his Outperform (i.e. Buy) rating on CCSI , and his $42 price target implies that the stock will appreciate by ~34% in the year ahead. (To watch Ives’ track record, click here)

Looking at the consensus breakdown, 2 Buys and 1 Hold have been issued in the last three months. Therefore, CCSI gets a Moderate Buy consensus rating. Based on the $39.33 average price target, shares could surge ~25% in the next year. (See CCSI stock forecast)

Pegasystems Inc. (PEGA)

Next up is Pegasystems, a tech company offering a user-friendly platform to streamline business operations. The company’s software is designed for business process and customer relationship management, enabling users to work smarter, adapt faster, and unify their experiences. Pegasystems has been in business since the early 80s and is based in Cambridge, Massachusetts.

Pegasystems offers a wide range of products, providing solutions for client onboarding, sales automation, customer service and engagement, as well as intelligent automation. Users can access real-time business intelligence, automate decisions and workflows, and scale the systems according to their needs. The company’s clientele includes Cisco Systems, the US Census Bureau, and the insurance company Aflac.

Key to Pegasystems’ approach is process automation. The company employs generative AI technology to create a smarter, more adaptive automation system, offering product users a faster and more personalized experience. Additional benefits of AI in the Pega platform encompass autonomous development of low-code apps, real-time creation of customer engagement content, and quicker derivation of insights from raw data.

For Pegasystems, this comes down to profits. The company is generally profitable, although 2Q23 saw both the top and bottom lines miss expectations. Revenue came in at $298.3 million, about $12 million below the forecast, while the EPS of 1 cent per share missed by 3 cents. However, we should note that the revenue figure was up 8.7% year-over-year, and that the company reported record cash flow for 1H23. Operating cash flow in the first six months of the year was over $110 million, while the free cash flow exceeded $120 million.

Overall, despite the lukewarm Q2 results, Daniel Ives is bullish on PEGA’s prospects, enough to call the stock a ‘Best Idea.’

“We view Pega has an under the radar AI play as PEGA is automating processes for enterprises driving faster time-to-value, reduced implementation times, and improved sales cycles. The company continues to increase value with existing customers while Pega’s model stabilizes leading to more recurring revenue and higher gross margins driven by Pega Cloud as the company continues down the path of becoming a Rule of 40 company. We remain highly confident in the Pega Cloud adoption story through leveraging generative AI with 2024 being the inflection year… We are adding PEGA to the Wedbush Best Ideas List and we see a compelling risk/ reward in shares at current levels,” Ives stated.

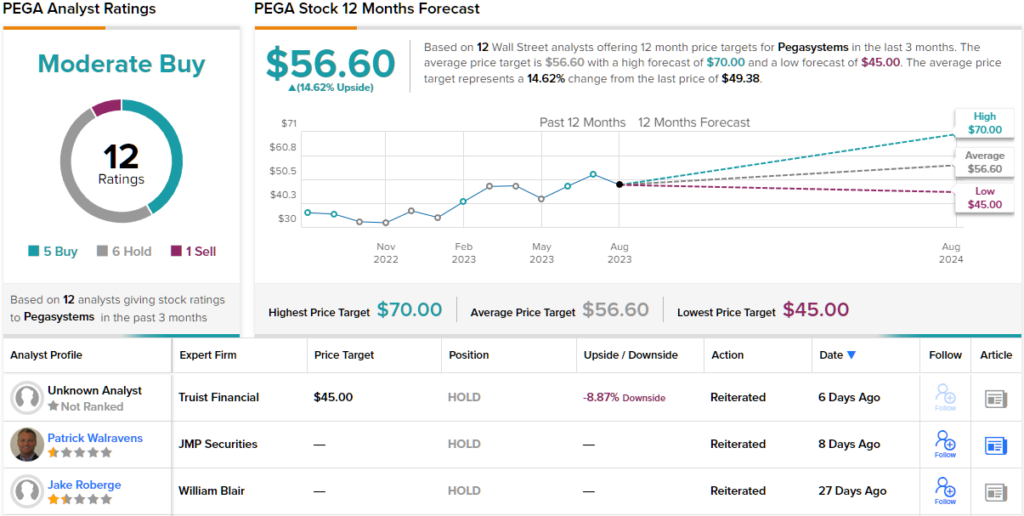

Put into specifics, Ives rates PEGA shares an Outperform (i.e. Buy), and his $65 price target suggests that it will gain ~32% on the one-year horizon. (To watch Ives’ track record, click here)

Looking at the consensus breakdown, we have an almost even split. 5 Buys and 6 Holds received in the last three months add up to a Moderate Buy consensus rating. With a $56.60 average price target, the upside potential is ~15%. (See PEGA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.