In this uncertain market environment, the educated investor would do well to seek out some signal that can cut through the noise and indicate the sound stock purchase choices. Following the legendary investors, the traders who build multi-billion dollar fortunes on the stock market trading scene, is a popular strategy – and when two of those investing legends agree… well, there’s a stock that should definitely get a second look.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

George Soros and Steve Cohen have both built fortunes, for themselves, for the hedge funds they manage, and for their customers, although their backgrounds are about as different as different can be. But a look at their last 13F filings shows that they did find at least one thing in common, two stocks that they both saw fit to bet on going forward.

We’ve use the TipRanks platform to pull up the details on those ‘common bets,’ and found that each is a Buy-rated equity with upside potential solidly in the double digits. Both Soros and Cohen saw fit to buy in, to tune of millions of dollars. Let’s take a closer look at them, and find out why they were so compelling to these two market legends.

Celanese Corporation (CE)

We’ll start with Celanese Corporation, an industrial chemicals firm based in Texas – but operating in a global niche. Celanese specializes in acetyl chain products, a set of molecular compounds with wide applications in multiple vital industries. The company is also a major manufacturer of vinyl acetates and cellulose acetates, important components in the production of polymers and adhesives. In addition , Celanese also makes engineered materials and food ingredients, and has manufacturing facilities in North America, Europe, and Asia.

All of this is big business, and Celanese has been working to expand it. In November of last year, the company completed its acquisition of DuPont’s Mobility and Materials (M&M) business. The acquisition brought Celanese a broad set of additions to its products portfolio, including engineered thermoplastics, elastomers, global production assets, and a top-tier infrastructure. In addition, Celanese received ownership of several of DuPont’s brand names.

By the numbers, Celanese posted net sales of $2.35 billion in 4Q22, up from $2.28 billion one year earlier, and had a net income of $769 million for a 46% year-over-year gain. However, the top line missed expectations by $60 million, while the adjusted diluted EPS of $1.44 was 21 cents below forecasts.

Even though the company’s revenues and earnings came in below expectations, Celanese still had the confidence to maintain its common share dividend payment. The company, in its February declaration, set the payment at 70 cents per share. This annualizes to $2.80 per share and give an above-average yield of 2.6%.

Both George Soros and Steve Cohen opened new positions on this stock, per their last quarterly filings. Soros’ fund management firm bought in for 170,030 shares of CE, a stake that is currently worth just under $17.9 million. Cohen’s Point72 Asset Management opened its stake in CE with 134,300 shares, a holding now worth $14.12 million.

In his coverage of this stock, Well Fargo’s 5-star analyst Michael Sison saw the recent M&M acquisition as the key point to consider, and the driver of future performance.

“We believe the earnings power of CE with M&M should still approach $4B in EBITDA and could see a firm inflection point in EPS heading into 2Q23E… Since the closing of M&M in Nov, CE has faced a difficult macroeconomic backdrop, leading to weaker-than-expected M&M results/ guidance in 4Q22 and 1Q23E, though earnings should improve in 2H23E (majority of $100-135MM in synergies are targeted for 2H23E). We sense M&M could reach its initial run rate target of $700-750MM in EBITDA in 2023, with upside as CE improves operational efficiencies and order books continue to recover,” Sison opined.

Building on these comments, Sison rates the stock as Overweight (i.e. Buy), with a price target of $140 to suggest a potential gain of 33% on the one-year time horizon. (To watch Sison’s track record, click here)

Overall, there are 15 recent analyst reviews on file for Celanese shares, and they include 9 Buys, 4 Holds, and 2 Sells – for a Moderate Buy consensus rating. The shares are selling for $104.96, and the average price target of $129.20 implies an upside of 23% for the year ahead. (See Celanese stock forecast)

SoFi Technologies (SOFI)

The second stock we’re looking at, SoFi, is a San Francisco-based personal finance company, whose name is short for ‘Social Finance.’ As that suggests, SoFi takes a modern tech approach to banking, working purely online to give its customers, more than 5.22 million as of the end of 2022, access to home and personal loans, credit cards, investment banking, credit scoring, and refinancing for existing student and/or car loans.

While SoFi, like many leading tech-oriented firms, still operates at a net loss each quarter, the most recent quarter, 4Q22, showed that the loss had moderated significantly year-over-year. The company was 40 million in the red at the end of the quarter, translating to a net loss per diluted share of 5 cents. These figures compared to year-ago net-loss results of $111 million and 15 cents per diluted share. In addition, the diluted EPS was 4 cents better than had been predicted.

At the top line, the company continued its trend of revenue gains. The Q4 total net revenue was reported as $456.7 million, up 60% from the $285.6 million reported in 4Q21. For the full year 2022, revenues came to 1.57 billion, up from 984.9 million in 2021; another 60% increase. SoFi ended 2022 with $1.42 billion in cash and cash equivalents, compared to $494 million at the end of 2021; the company’s total assets, at more than $19 billion, were up 106% y/y from $9.2 billion.

Turning to the Soros and Cohen positions, we find that Steve Cohen had already bought into SOFI, in the third quarter of 2022. In Q4, he increased his position by 1.623 million shares, a bump up of 47%. Cohen now holds 5,132,743 shares of SoFi, worth $28.58 million. Soros, on the other hand, opened a new position in this stock in Q4, buying up 1.25 million shares, which are now valued at $6.96 million.

The hedge magnates are not the only bulls here. Kevin Barker, 5-star analyst from Piper Sandler, has been monitoring this stock, and he likes what he sees. Barker points out that consumer lenders like SoFi are less likely to suffer from the contagion that hit SVB and its peers. The analyst also explains his upbeat view of SoFi in particular, writing, “We remain confident the company can continue to execute on its plan to generate peer-leading revenue growth and potentially achieve GAAP profitability by the end of 2023. This goal should be supported by the combination of efficiencies within the Technology segment, coupled with more deposit funding, and a pickup in student loan originations in latter half of the year.”

Looking ahead from this, Barker sees fit to rate SOFI shares an Overweight (i.e. Buy), with a $7.50 price target implying a 28% upside for the next 12 months. (To watch Barker’s track record, click here)

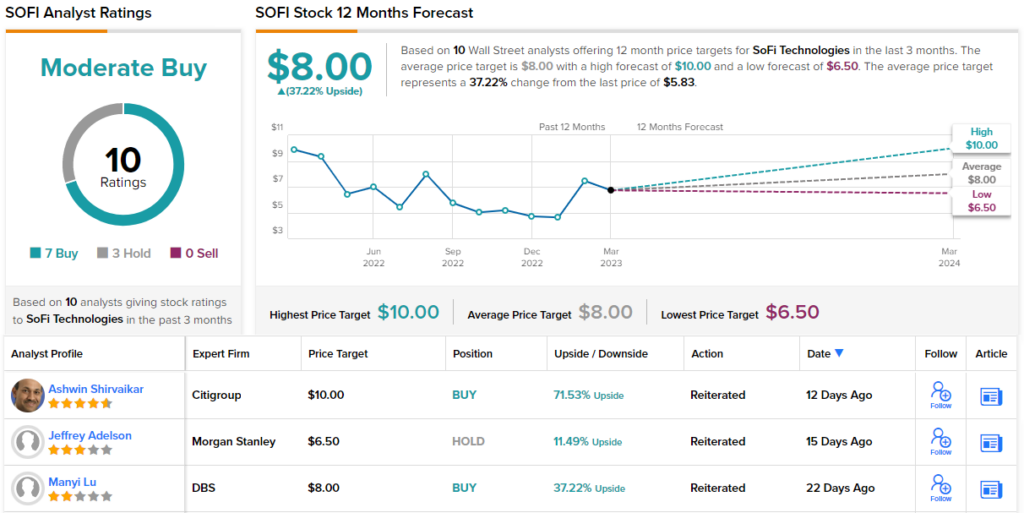

All in all, the 10 most recent analyst reviews on SoFi’s stock break down 7 to 3 in favor of Buys over Holds, giving the shares a Moderate Buy consensus rating. The stock’s selling price, at $5.83, and average price target, at $8, make for a 37% upside going out to the one-year time frame. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.