General Dynamics stock (NYSE:GD) has been reaching new all-time highs by the day lately. Yet, shares could have further upside potential. The ongoing, highly unstable geopolitical environment has formed a great revenue and earnings growth driver for the aerospace & defense giant. With global defense budgets surging, General Dynamics has amassed a huge order backlog and remains well-positioned to sustain its ongoing momentum. Consequently, I remain bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Geopolitical Tensions Sustain Strong Order Momentum

Geopolitical tensions are running high worldwide, driving defense budgets higher. As a major supplier of equipment and weapons to Western allies, aerospace & defense giant General Dynamics is one of the primary beneficiaries of this evolving landscape.

Prominent conflicts today include the ongoing war in Ukraine and the Israel-Hamas conflict. In Ukraine, relentless battles continue with no resolution in sight, while the Middle East remains highly volatile, with intense fighting in the northern Gazan town of Jabalia. Additionally, the continuous attacks by the Houthis in the Red Sea further contribute to the region’s instability.

Given General Dynamics’ critical role in securing the military capabilities of many nations, with its armored vehicles and weapon systems integral to Western countries’ arsenals, the company has been inking highly profitable contracts during this unstable period. To illustrate this, General Dynamics grew its revenues by 7.3% to a record $42.3 billion last year. The company also ended 2023 with a record backlog, set to drive sales and profits to new all-time highs this year. Its Q1-2024 performance already showed relevant signs.

Q1-2024: Kicking Off Another Year of Record Revenues & Profits

Based on General Dynamics’ Q1 results, current backlog, and overall momentum, the company has kicked off another promising year that appears poised for record revenues and profits. More specifically, General Dynamics posted its best first quarter in its history in terms of revenues, which landed at $10.7 billion, up 8.6% compared to last year. Almost all divisions, apart from Technologies, contributed positively to top-line growth. Let’s take a deeper look at each division.

Aerospace

Revenues in the Aerospace division rose by 10.1% to $2.08 billion. Remember that this division is wholly unrelated to military operations or conflict. Instead, General Dynamics benefits from strong demand for corporate jet fleet replenishment. Despite some slowdown in transactions due to ongoing inflation, U.S. monetary policy, and concerns about the Middle East conflict, the division remains robust, thanks to the sustained growth of the private and corporate jet market.

Combat Systems

Revenues in the Combat Systems division rose by almost 20% to $2.1 billion. Here, we see the beneficial effects of the ongoing geopolitical instability on General Dynamics’ underlying results. Revenue growth was powered by an increased volume of new international tank programs, artillery volume, and piranha programs and bridges. The company also saw strong demand for Abrams tanks. All these drivers reflect the Western Allies’ substantial weapons deliveries to Ukraine.

Marine Systems

Turning to Marine Systems, General Dynamics’ shipbuilding units once again demonstrated impressive performance. To provide some context, the division’s revenues increased 9.1% in Q1 2020, 10.6% in Q1 2021, 6.8% in Q1 2022, and 12.9% in Q1 2023. This quarter, revenues reached $3.3 billion, an 11.3% rise over Q1 2023, sustaining incredible momentum.

The division’s expansion is being driven by the escalating demand from the U.S. Navy for ships, with a particular emphasis on submarines. As a labor-intensive heavy manufacturing sector, shipbuilding has faced significant challenges due to the demographic disruptions caused by COVID-19. This, along with the reliance on a few sole-source suppliers for intricate components, has formed hurdles for the industry to match the rising demand. This has created a favorable market environment for General Dynamics.

Technologies

The Technologies division was the only one that didn’t post growth. Its revenues were $3.2 billion, 0.8% lower year-over-year. Still, General Dynamics received $4 billion in orders during the quarter, boosting its book-to-bill ratio to 1.2. Thus, the division’s growth will likely accelerate in the coming quarters.

GD’s Growth Potential Is Strong

As I mentioned, the current geopolitical landscape has led to an influx of orders for General Dynamics. As a result, the company ended the quarter with a record backlog of $93.7 billion, up 4.4% from the year-ago quarter. Based on the company’s ongoing pace of deliveries, Wall Street expects revenues to hit a record $46.94 billion this year, marking a year-over-year increase of 11.1%. Meanwhile, earnings per share is expected to grow by a notable 21.4% to $14.59—also a record figure for the company. These factors can sustain the stock’s momentum.

Is GD Stock a Buy, According to Analysts?

As far as Wall Street’s view on the stock goes, General Dynamics maintains a Strong Buy consensus rating based on 13 Buys and four Holds assigned in the past three months. At $312.94, the average General Dynamics price target suggests 5.4% upside potential.

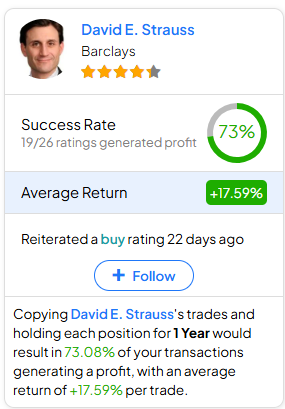

If you’re not sure which analyst you should follow if you want to buy and sell General Dynamics stock, the most profitable analyst covering the stock (on a one-year timeframe) is David E. Strauss from Barclays (NYSE:BCS). He has a track record with an average return of 17.59% per rating and a 73% success rate. Click on the image below to learn more.

The Takeaway

Summing up, it’s clear that General Dynamics is one of the main beneficiaries of the current geopolitical environment. Bolstered by escalating global tensions, the company’s pivotal role as a supplier to Western allies positions it for enduring growth. The exceptional performance in Q1, particularly evident in Combat Systems’ revenue growth, underscores this theme.

This momentum is set to persist throughout the rest of the year, with Wall Street expecting record revenues and earnings. Thus, the ongoing bullish sentiment fueling the stock could persist despite its recent all-time highs.