Aerospace and defense major General Dynamics (NYSE:GD) boasts a strong market presence and a history of consecutive annual dividend increases for 29 consecutive years. Based on this impressive dividend history, GD has earned its place among the esteemed Dividend Aristocrats (stocks that have raised their dividends for at least 25 consecutive years). It offers a dividend yield of 2.1%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors seeking stability and consistent returns often focus on such companies, utilizing dividends as a dependable source of income. To add on further positives, GD is currently loved by top Wall Street analysts, giving it a Strong Buy consensus rating.

Investors should note that TipRanks ranks the top analysts according to industry, timeline, and benchmarks. The ranking reflects an analyst’s ability to deliver higher returns through recommendations.

With this backdrop, let’s delve deeper into General Dynamics stock.

Here’s What Makes GD Stock Worth Considering

General Dynamics’ diversified business profile shields it from economic downturns and allows it to maintain a steady dividend growth. Due to ongoing geopolitical tensions, GD’s core aerospace and defense businesses are benefiting from strong demand for military hardware and commercial aircraft. Further, the company is investing heavily in new technologies, such as artificial intelligence (AI) and cybersecurity, which should further fuel its growth prospects.

John Eade, a top-rated analyst from Argus Research, is bullish on General Dynamics’ Aerospace segment. Eade cited robust order growth and a healthy backlog as key drivers of the segment’s future performance. The company’s long-term strategy emphasizes modest sales growth, margin expansion, and share buybacks as catalysts for continued value creation.

Eade reaffirmed a Buy rating on GD stock on November 9 and raised the price target to $265 (6.9% upside potential) from $260.

Another analyst, Ronald Epstein from Bank of America Securities, reiterated a Buy rating on GD stock following the company’s upbeat performance in the third quarter of 2023. Additionally, Epstein noted that GD’s record backlog signals continued strong demand.

Is General Dynamics Stock a Good Buy?

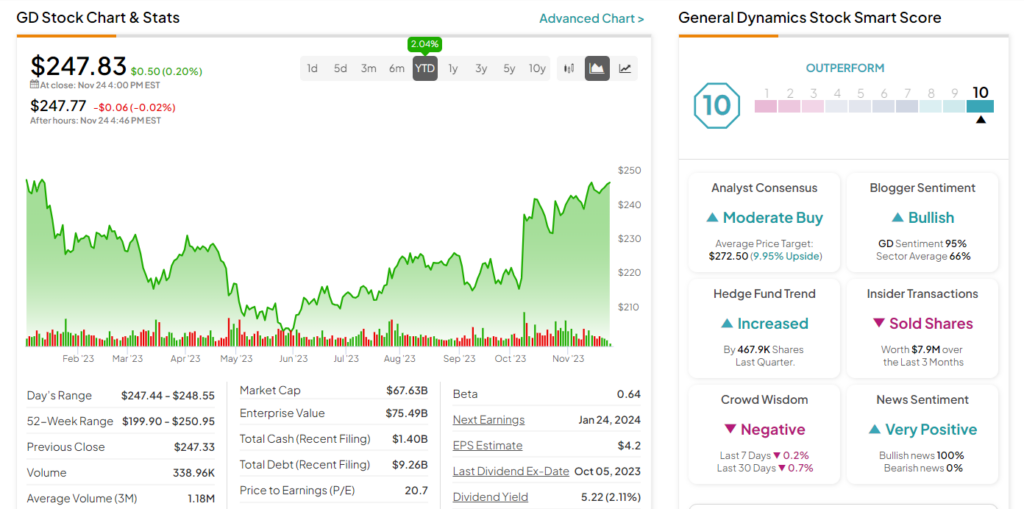

Among the 11 Top analysts covering GD stock, nine rated it a Buy and two assigned a Hold rating. The average GD price target of $272 implies a 9.8% potential upside from the current level. Shares of the company have gained 2% so far in 2023.

It is worth mentioning that General Dynamics carries a “Perfect 10” Smart Score on TipRanks. These stocks have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Ending Note

General Dynamics is a well-established company with a strong track record of financial performance and dividend growth. Moreover, its diversified business segments, robust free cash flow generation, and focus on innovation make it a solid investment choice for income-focused investors.