The industrial scene is home to some intriguing wide-moat companies — like GD, CSX, and PH — often overlooked by beginner investors seeking to invest in something “sexier.” While the big-name industrial giants may not stand to benefit from generative artificial intelligence (AI), at least not anytime soon, they do stand out as having potentially overlooked growth drivers that could help keep portfolios robust as the next phase of the market cycle kicks in.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

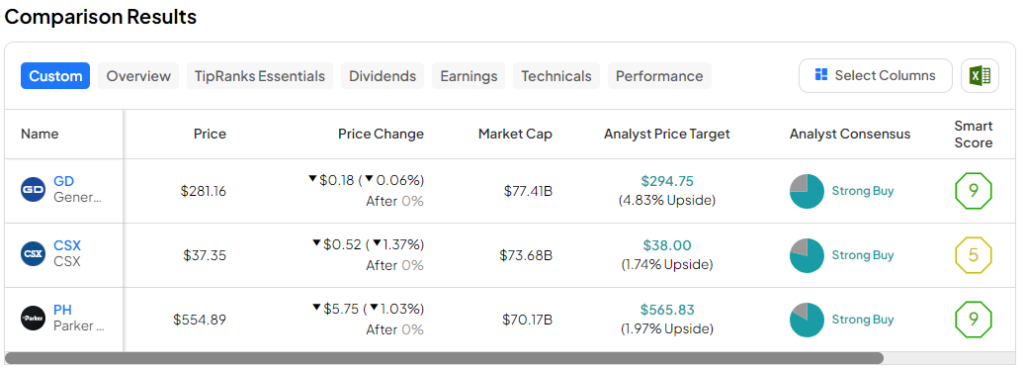

Therefore, let’s use TipRanks’ Comparison Tool to determine which of the following three Strong Buy-rated industrials will fare the best over the year ahead.

General Dynamics (NYSE:GD)

In my prior piece covering the name (back on January 17), I noted that General Dynamics stock stood out as one of the cheapest (and more diversified) options in the defense scene. Since then, the stock has gone on to rally almost 13%—not a bad return in just under three months. Following the latest upside surge that took GD stock to new highs, I’m not about to tone down my bullishness — not after the company’s latest $210 million army contract win amid rising threats from around the globe.

Add the still-modest valuation, a solid recent quarter (revenue grew by 8% to $11.67 billion), and aerospace tailwinds to the equation, and it’s no mystery why the Wall Street crowd still views GD stock as a Buy near its all-time high. CEO Phebe Novakovic also noted of the “significant growth in [the] backlog” late last year.

At writing, shares of GD trade at 23.43 times trailing price-to-earnings (P/E) and just 19.4 times forward P/E, both of which are below that of the aerospace & defense industry averages of 36.1 and 20.2 times, respectively. Though not as cheap as a few months ago, GD stock still has plenty of tailwinds that could propel shares to even greater heights.

What Is the Price Target of GD Stock?

GD stock is a Strong Buy, according to analysts, with 12 Buys and four Holds assigned in the past three months. The average GD stock price target of $294.75 implies 4.8% upside potential.

CSX (NYSE:CSX)

If defense companies aren’t your cup of tea, perhaps a well-run railway company is. CSX and the rest of the railway stocks have recently awoken, with shares nearing all-time highs. Though only time will tell if this marks CSX’s multi-year breakout, I find the current valuation to be more than fair.

With a very generous quarterly dividend hike of 9% (by a penny to $0.12 per share) in the books, it may be time to hop aboard the dividend grower as shipping demand for a broad range of categories (chemicals, intermodal, and all the sort) returns to healthier levels. All things considered, I remain bullish on the stock.

The company’s investments to improve operational efficiencies will also allow CSX to take advantage of positively shifting industry dynamics. Perhaps the key takeaway from recent management commentary was that efficiency gains will not come at the cost of safety and service.

As the company taps into predictive artificial intelligence (AI) technologies, my bet is that CSX can always find ways to make things even more efficient (and safer). Undoubtedly, generative AI gets so much buzz these days, but what about its predictive abilities? CSX and the industry at large are the beneficiaries as AI hits the rail tracks.

The company has been looking into IoT-enabled predictive maintenance for quite some time now. As AI advances, look for the firm’s predictive maintenance efforts to go into making its biggest gains to date.

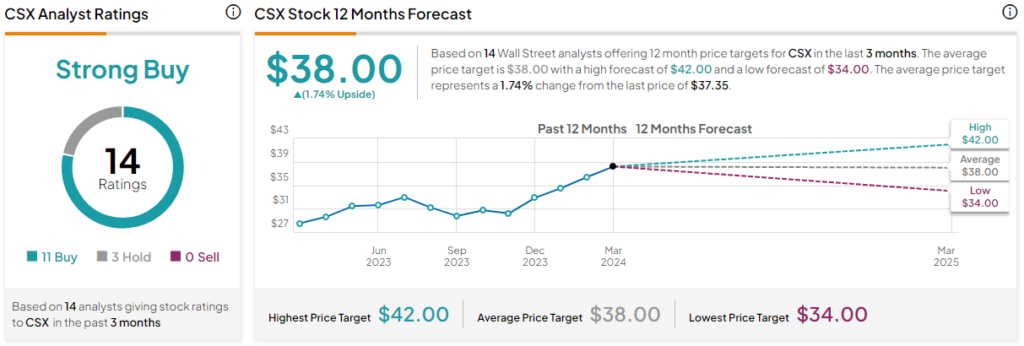

What Is the Price Target of CSX Stock?

CSX stock is a Strong Buy, according to analysts, with 11 Buys and three Holds assigned in the past three months. The average CSX stock price target of $38.00 implies 1.7% upside potential.

Parker Hannifin (NYSE:PH)

Parker Hannifin is an intriguing industrial company that’s also been picking up traction in recent years. The stock is up more than 75% over the past year and 93% in the last two years. Undoubtedly, the motion and control system maker’s meteoric rise is due in large part to recoveries in the industries it serves. After staying mostly dormant for a few years following the pandemic-era surge, shares finally look to be waking up.

As the company’s aerospace systems segment continues to benefit from increased defense spending, PH stock seems like one of the breakout plays with room to move higher. Like Wall Street analysts, I’m staying bullish on the stock at today’s more-than-fair multiples.

Currently, the stock trades at a modest 27.7 times trailing P/E, below the specialty industrial machinery industry average of 31.5 times — a slight discount to the industry for an industrial that’s proven it may be worth more of a premium.

Late last year, Nathan Jones of Stifel remarked on “long-term tailwinds,” which he believes “support a favorable outlook.” Though shares went on to surpass Mr. Jones’ $500 price target (by around 10%), I still think some upgrades could be in order as the firm continues to execute under Jennifer Parmentier’s magnificent leadership.

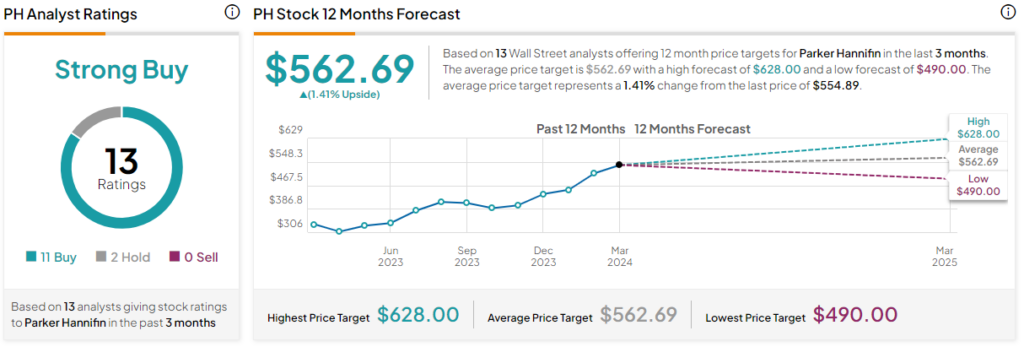

What Is the Price Target of PH Stock?

PH stock is a Strong Buy, according to analysts, with 11 Buys and two Holds assigned in the past three months. The average PH stock price target of $562.69 implies 1.4% upside potential.

The Bottom Line

The industrial scene is full of some pretty enticing breakout plays that aren’t all too expensive, at least compared to some of the tech-savvier plays out there. Of the trio, analysts currently see the most upside in GD stock (4.8%). The implied upside may look depressed today, but wait for analysts to revisit the drawing board. I think we’ll see a handful of price target hikes and Buy reaffirmations.

At this juncture, I view CSX stock as the best bet of the three. It’s back on the right track with improved industry dynamics, operational enhancements, and a very reasonable price tag.