With the Electronics Entertainment Expo—formerly E3—now about as dead as Sears, how new games are introduced to the public has changed wildly. New games give us a barometer by which video game stocks can be measured. So, let’s have a look at the three biggest console makers out there—Sony (NYSE:SONY), Microsoft (NASDAQ:MSFT), and Nintendo (OTHEROTC:NTDOF)—and see how their summers shaped up.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sony’s Show Was a Disappointment

We begin with Sony, who was first in the lineup for summer showcases. Sony stepped up to the plate, sat down, and began dealing itself a hand of solitaire. Sony’s show was widely regarded as a disappointment. Forbes’ Paul Tassi described one big reason: “PlayStation showed too many Xbox games in its disappointing showcase.” It didn’t help when Sony began showing trailers for the upcoming “Gran Turismo” movie. At that point, Sony was no longer in the right ballpark of a successful show.

Microsoft took the opportunity to score points, posting an image on Twitter that did for it what the 2013 Official PlayStation Used Game Instructional Video did for Sony. Microsoft posted a collage of upcoming titles, from “Alan Wake 2” to “Marathon.” Immediately to the collage’s left was the damning phrase: “Coming to Xbox.”

Worse, the misfire showcase came out after a series of State of Play events that left Sony gamers cold, as Yahoo Entertainment revealed. The only high point in the show was one that fans already knew for months was coming: “Spider-Man 2.” However, Sony did show off some new hardware that caught users’ engagement, including the Project Q Remote Play system and a set of PlayStation-themed earbuds.

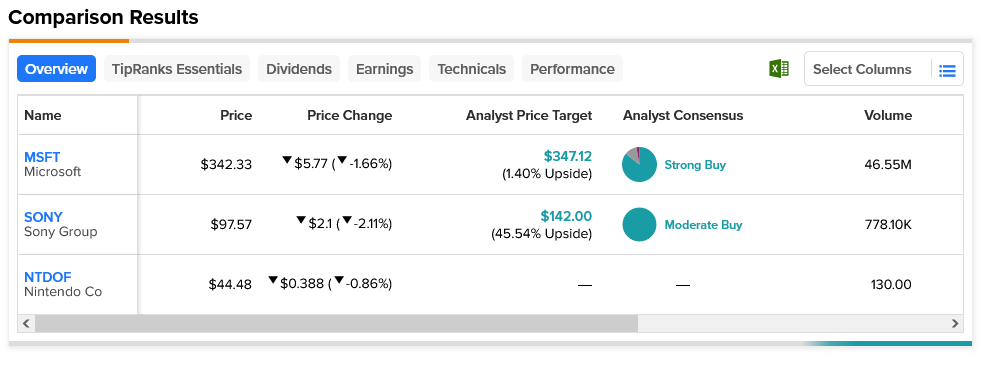

A look at Sony shares over the last year does suggest a positive trend. Sony is well off its lows from October 2022, and the stock is actually just off of a 52-week high. This in and of itself might frighten more investors than it encourages; how long can share prices sustainably break a 52-week record? Every time Sony gets above $100.95, it’s setting a new 52-week record. Sony made a big splash with PS5 sales, handily blowing Microsoft out of the water, but to suggest that it’s squandering its lead is inevitable.

Microsoft Blows Everyone Away

Microsoft delivered as it brought out the dozen games that Sony already brought out and a range of heavy hitters from its own IP. The long-lost return of “Fable” hit screens. The giant question mark that was “Avowed” got filled in a very big way. Sequelmania hit in grand style with “Payday 3,” “Hellblade 2,” “Cities Skyline 2,” and more. “Cyberpunk 2077’s” massive downloadable content (DLC) entry, “Phantom Liberty,” got its first showing. Microsoft even had some hardware with its new, one-terabyte Xbox Series X, a great move given that the console doesn’t have a physical disc drive. Then, Bethesda showed up and unveiled “Starfield” gameplay ahead of its September release.

GameRant declared that Microsoft’s showcase was “the win Microsoft needed.” Microsoft got off to a rocky start, with sales of the Xbox Series X and Xbox Series S hampered by misunderstandings about what the consoles’ key differences were. Availability problems reigned thanks to pandemic-related supply chain issues.

A look at the last year in trading for Microsoft shares, meanwhile, suggests the exact same set of conditions as Sony. It’s well off its lows, set back in early November 2022, and is just now off a 52-week high.

That, too, suggests potential trouble ahead for the exact same reason it’s a problem for Sony. Worse, Microsoft is not only flirting shamelessly with a new 52-week high every minute of every trading day, but it’s also about at its theoretical limit, according to analysts.

Nintendo: Missing in Action?

Of the three major console makers out there, Nintendo is the only one left to show. And Nintendo buffs will be waiting for quite some time. In fact, Nintendo will very nearly miss having a summer show at all. Nintendo announced its event would run alongside the Penny Arcade Expo (PAX) West show in September. The move gives the PAX show a lot of extra firepower; Geek to Geek Media declared that this would be “…the biggest PAX West event yet!” The PAX West show will take place Labor Day weekend, running between September 1 and September 4, bringing out a host of indie developers and, of course, Nintendo itself to exhibit what’s coming up.

That’s a near-miss for Nintendo; its event will hit just two days before the release of “Starfield.” The risk of being swamped in news cycles—or at least potential user engagement—would have been astonishing had the two events overlapped. But by coming out just ahead of the big event, Nintendo has assured itself enough quiet time to get its word out.

There are several likely appearances in the making. “Fire Emblem: Engage” is on the list, as is “The Legend of Zelda: Tears of the Kingdom.” Unresolved questions will also be on hand, like the appearance of “Metroid 4.” The notion of a new Switch has already been debated, so Nintendo may keep quiet on hardware this September.

A look at Nintendo’s last year of trading is much more volatile. Nintendo’s slump, unlike Sony’s and Microsoft’s, hit earlier this year. However, it bounced off that low nicely and is pushing a new 52-week high. That poses the same problem for it that it posed for its competitors.

Final Thoughts: Microsoft’s Revenue Diversity Gives It an Edge

The key point that gives Microsoft its edge is its phenomenal diversity. Nintendo is a pure-play video game stock. Sony is more diversified, with a media arm and electronics to go with its video games. But Microsoft not only has gaming, but it also has cloud computing, software, and a host of other revenue vectors providing income for the company as a whole. Even if every video gamer on Earth gave up the hobby tomorrow, Microsoft would still be a potent stock. Sony would be in play, certainly, but Nintendo would be mostly out.

Sony may have significantly more upside potential, but it’s already slamming against 52-week highs. So are Microsoft and Nintendo, but Microsoft is a lot more likely to achieve maximum potential than Sony. The combination of remarkable diversity and a spectacular game showcase makes Microsoft the clear front-runner among video game stocks. Forget about the Activision-Blizzard (NASDAQ:ATVI) acquisition; Microsoft has too much else going on for that to pose a serious long-term risk.