Specialty retailer GameStop (NYSE:GME), which offers games and entertainment products via its stores and e-commerce platforms, will release its Q3 financial results after the market closes on December 6. While the company faces headwinds from weak hardware sales, its focus on growing the product catalog, improving the customer experience, and making cost cuts should support its top and bottom lines.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s dig deeper.

GameStop: Q3 Projections

Wall Street expects GME to post net sales of $1.18 billion in Q3 compared to revenue of $1.19 billion in the prior-year quarter. Although supply constraints could affect its hardware sales in Q3, the strength of its software sales will likely support its top-line numbers.

Further, improving the product mix, expanding margins through operational discipline, and optimizing its workforce are expected to cushion its bottom line. As a result, Wall Street expects GameStop to post a loss of $0.08 per share in Q3, reflecting a significant improvement from the prior-year quarter’s loss of $0.31 per share.

What is the Outlook for GameStop?

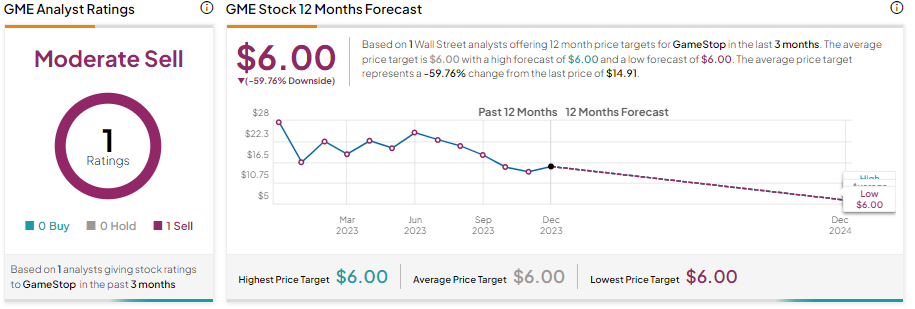

Wedbush’s Michael Pachter is the only analyst offering a 12-month price target for GameStop in the last three months. Pachter is bearish about GME’s prospects and reiterated a Sell rating on the stock on November 30. The analyst believes that the company may struggle to deliver growth as it has lost market share.

Pachter’s price target of $6 implies a downside potential of 59.76% in GME stock from current levels.

Insights from Options Trading Activity

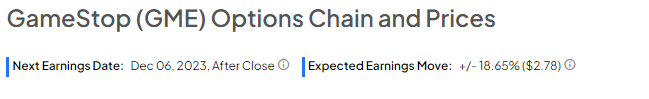

Options traders are pricing in a +/- 18.65% move on earnings, greater than the previous quarter’s earnings-related move of 0.75%.

Bottom Line

GME’s focus on increasing the size of its addressable market via expanding its product catalog across multiple segments, including PC gaming, collectibles, consumer electronics, augmented reality, and virtual reality, augurs well for long-term growth. However, macro headwinds and weakness in hardware sales will likely remain a short-term drag. Nonetheless, the company’s sales mix shift towards software and cost cuts should enable GameStop to deliver improved performance on the bottom line.