Shares of Take-Two Interactive (NASDAQ:TTWO) have been incredibly hot this year, now up 33% year-to-date. As excitement over the company’s upbeat quarter fades, investors who missed the run may have another chance to give the underestimated video game stock a second look. Indeed, the company is well on its way to returning to profitability.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With a strong quarter in the books, impressive mobile assets that will help diversify the firm away from its less-frequent blockbusters, and a Grand Theft Auto VI (GTA VI) release that’s as close as ever (there were some hints at a potential 2024 launch), Take-Two stock has arguably never looked timelier. Despite the hot run, I’m staying bullish on the name ahead of what could be a huge year for the $23.2 billion game developer.

Take-Two Interactive’s Latest Quarter Draws in a Crowd

Take-Two’s latest quarter was decent, but the impressive guidance and clues over a GTA VI release captured the investors’ hearts. The company technically missed on earnings, with fourth-quarter EPS coming in at $0.59, just below the $0.68 analyst consensus, and sales came in at a sound $1.4 billion, just ahead of the $1.31 billion to $1.36 billion guidance.

I guess you could say the quarter was mixed, but given the low bar going into the number and confident commentary from management, the sudden surge in the stock shouldn’t have come as a shock.

Indeed, Take-Two has been a “sleeper” pick (or two-hit wonder) in the gaming space for quite some time, and there’s no guarantee that GTA VI will be a success. That said, the company’s track record of delivering high-rated hits speaks for itself. So, if a 2024 launch of the hit game is in the cards, TTWO stock may finally be ready for its much-awaited next leg higher.

Of course, it would have been nicer to hear management give some firm deadlines. Given how many video games have been delayed, though, Take-Two may be wise to minimize the time pressure on its software developers. The business of game development may entail high stress and time pressure, but Take-Two has a formula that’s worked out well. In that regard, investors should continue to be patient with Take-Two as it approaches the finish line with one of the most-anticipated video games of this decade.

Take-Two Looks Like a Hot Takeover Target as VR Gaming Grows in Popularity

Apple’s (NASDAQ:AAPL) Vision Pro headset reveal hogged the headlines in recent weeks, and for good reason. Virtual and augmented reality may very well be the next big medium for not just work, but play. Indeed, one can’t help but notice the emphasis Apple placed on gaming at WWDC 2023. As Apple better caters to game developers, I do think studios, Take-Two included, will be more open to making the leap into virtual-reality gaming.

Undoubtedly, a fully-immersive GTA title that’s VR-enabled may be one of the holy grails of spatial computing. Though such a title is still many years away, I view Take-Two as a powerful company that could help a company like Apple turn its VR or AR headset into a profound success.

As consolidation across the gaming industry continues, I’d not be surprised if Apple or some other big-tech firm with a foot in the door of spatial computing or “the Metaverse” doesn’t look at Take-Two as an attractive takeover target (although regulatory hurdles could block such a deal from happening). Regardless, this doesn’t change the fact that Take-Two stands out as one of the potential winners of a multi-year transition into 3D worlds.

Apple’s Vision Pro could be a great next-generation gaming device if enough developers commit over the coming years. In the meantime, Apple is laying out the red carpet for the gaming crowd to bring new releases to the Mac, with a tool to help port PC games to macOS. Mac gaming is a great start before Apple jumps into the deep end with Vision Pro gaming.

Is TTWO Stock a Buy, According to Analysts?

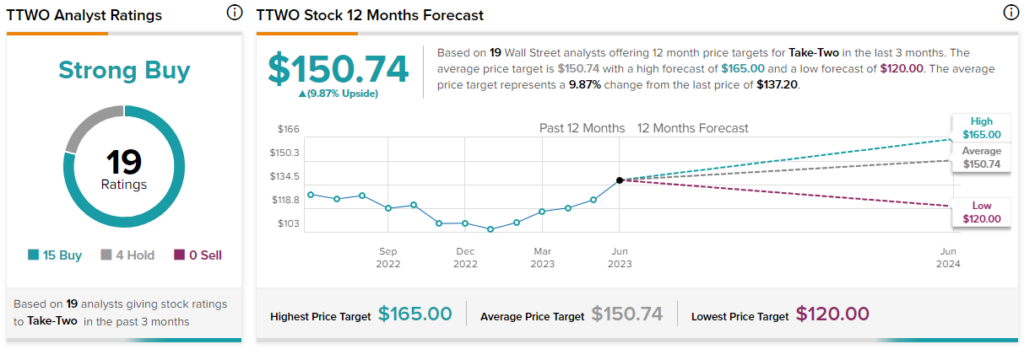

Turning to Wall Street, TTWO stock comes in as a Strong Buy. Out of 19 analyst ratings, there are 15 Buys and four Hold recommendations. The average Take-Two stock price target is $150.74, implying upside potential of 9.9%. Analyst price targets range from a low of $120.00 per share to a high of $165.00 per share.

The Bottom Line on TTWO Stock

There are a lot of things to get excited about going into 2024. GTA VI may finally launch, and as Apple Vision Pro goes on sale, the floodgates to VR gaming could open. When big developers like Take-Two are comfortable announcing big-budget VR titles, though, remains to be seen. It could take many years.

For now, TTWO stock seems attractive for a potential GTA VI launch in a year or two. Further, its attractiveness as a takeover target also can’t be ignored. At writing, the stock trades at 4.1 times price-to-sales (P/S), well below the software industry average.