The streaming industry has become increasingly saturated and, at the same time, speculative over the past few years. A decade ago, Netflix was the only game in town. Now, other giants, along with their streaming initiatives like Amazon’s (NASDAQ: AMZN) Prime Video, Disney’s (NYSE: DIS) Disney+ platform, and AT&T’s (NYSE: T) HBO, are all striving to capture market share. What these platforms lack, though, are high-quality sports and educational content. That’s where fuboTV (NYSE: FUBO) and CuriosityStream (NASDAQ: CURI) come in, as they exclusively focus on each one of these two categories.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, do they have a place in the market with such a niche focus? Well, if one were to answer solely by seeing their stock price charts, they would rightfully believe that the two companies have been failing dramatically. Over the past year, shares of fuboTV have declined by roughly 85%, while shares of CuriosityStream have lost almost 87% of their value over the same period.

On the one hand, both companies have been growing their revenues quite rapidly and feature competitive advantages, while they are not that far away from achieving sustainable profit generation. On the other hand, this is a very tough environment for money-losing companies. Thus, I am neutral on both stocks.

What are fuboTV’s and CuriosityStream’s Competitive Advantages?

As I mentioned, the streaming industry is highly saturated. For a company to survive in the space, in my view, it has to offer a unique value proposition and differentiate itself. Due to both fuboTV and CuriosityStream focusing on a very specific niche, they have already distinguished their platforms in the market. However, what competitive advantages can distinguish them as an attractive investment?

fuboTV

Regarding fuboTV, the platform allows its subscribers to stream up to four sporting events and related news channels at the same time. This is a one-of-a-kind viewing experience for fans of multiple sports who like to pay attention to multiple matches and match stats in one place through a seamless experience.

Additionally, fuboTV is about to unlock massive potential through the betting integrations the company is incorporating into its platform. In early September, for instance, the company launched Sportsbook in New Jersey, enabling people to begin placing bets presently.

In my view, this is a game changer, especially considering that fuboTV is currently the only platform in the world that offers access to a massive live sports catalog along with the possibility for fans to place bets. The potential of betting through streaming is tremendous in particular, as fuboTV plans to introduce real-time, custom bets based on the underlying state of the match. This should not only form a highly interactive and fun experience but also a very profitable operation for fuboTV.

CuriosityStream

When it comes to CuriosityStream’s competitive advantage, again, one major aspect is that the company focuses on a very niche content category that is typically underserved. Not one of the prevalent platforms offers a thorough documentary-oriented, “food-for-hungry-brains”-type content library.

Due to the company’s award-winning video content library, which contains thousands of non-fiction episodes, fans of the genre have essentially only one platform to turn to, and that’s CuriosityStream. Just like fuboTV when it comes to a massive sports library.

I also think that CuriosityStream is building a strong brand, which should also evolve into a great competitive advantage in such a saturated industry. This is because the company has employed a credibility-building strategy via producing factual content, with its programs being hosted by scientists and specialists in each field. Examples include the much adored Sir David Attenborough, Patrick Aryee, and even Stephen Hawking, among other respectable figures.

In a world where many people are sick of misinformation and hungry for interesting and factual content, CuriosityStream has a clear edge.

Are FUBO & CURI Going to Make Money Anytime Soon?

The most significant factor that has led to fuboTV and CuriosityStream shares declining by this much over the past year despite their competitive advantages is that both companies remain unprofitable. The stock that will start producing profits the fastest will be the one investors start to reevaluate first in the current macroeconomic landscape.

In its latest shareholder letter, fuboTV announced that the company targets positive cash flow and adjusted EBITDA in 2025. When it comes to CuriosityStream, the company hasn’t shared any such tangible target, but management expects to deliver an EBITDA loss within the range of $(11) – $(9) million this year.

This is much better than last year’s EBITDA loss of $(51.9) million. With additional revenue growth expected in Fiscal 2022, helping the company achieve further economies of scale, positive EBITDA is not unlikely by 2023.

With FUBO and CURI shares trading at a forward P/S of 0.8x each, any advancement of positive EBITDA in the coming years should lead to a P/S expansion and, thus, a stock price recovery. Still, to say by how much and by when is utterly speculative.

What are the Price Targets for FUBO and CURI Shares?

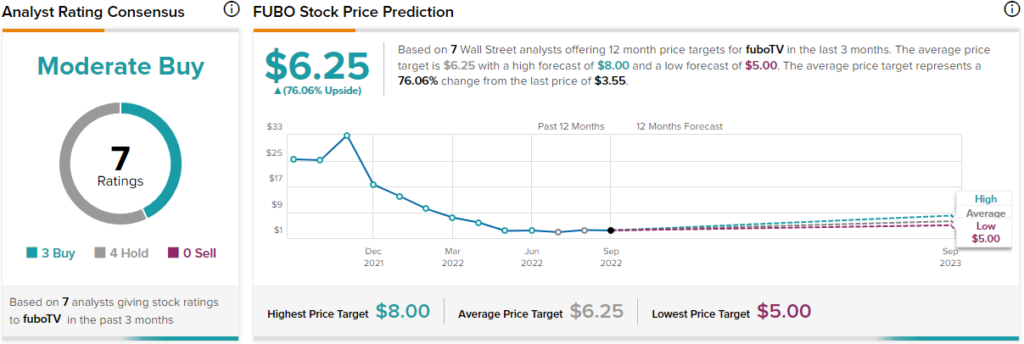

Turning to Wall Street, FuboTV has a Moderate Buy consensus rating based on three Buys and four Holds assigned in the past three months. At $6.25, the average FUBO stock forecast implies 76.1% upside potential.

CuriosityStream also features a Moderate Buy consensus rating, this time based on three Buys and two Holds assigned in the past three months. At $4.20, the average CuriosityStream stock forecast implies a much more gigantic 187.7% upside potential.

Conclusion: Compelling Ideas with Uncertianities Attached

Both FUBO and CURI feature quite interesting investment cases, as they specialize in niche streaming areas, appear to have unique competitive advantages, and trade at very cheap P/S multiples. As soon as profitability starts to kick in in the coming years, both stocks could produce massive returns, as projected by Wall Street analysts. Still, this is not a favorable environment for money-losing companies, while various factors, including dilution, could easily set back their price targets and future returns.