Over the years, we’ve seen solar energy companies come and go, with many folding under the pressure of trying to turn their revenue into profits. However, we’re starting to see the wheat being separated from the chaff, with several attractive solar companies becoming profitable. In this piece, we compared two solar stocks. First Solar (NASDAQ: FSLR) and SunPower (NASDAQ: SPWR) appear to have staying power. However, the market has treated these two as total opposites, with First Solar up about 14% in the past year and SunPower down 48.5% in the same period. At first glance, it’s not clear why, but a deeper dive reveals why FSLR is better.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Solar Energy and the Inflation Reduction Act

It’s no secret that solar energy companies generally face attractive opportunities. In 2022, IBISWorld estimated that the U.S. solar power market was worth $16.9 billion and that it would grow by 27%. It also estimated that the U.S. solar power market has grown by an average of 21.7% annually since 2017. A statement from the White House recently claimed that the U.S. is on track to triple domestic solar manufacturing capacity by 2024.

The widely-publicized Inflation Reduction Act had further benefits for the solar power market in the U.S. The bill extended the 30% Residential Clean Energy Credit, better known as the solar investment tax credit, to 2024. The incentive had previously been set to step down from 26% in 2022 to 22% next year before disappearing entirely in 2024.

The Inflation Reduction Act also gave solar panel makers production tax credits they can deduct against their corporate income tax, a perk First Solar is already taking advantage of by expanding production in Ohio and building a new factory in the southeastern U.S.

Of course, not all solar power companies are created equal, particularly due to the various business models that exist. For example, some solar companies make money by leasing out the solar panels they install on their customers’ buildings, while others, like First Solar and SunPower, make money by selling solar panels and systems.

The primary difference between First Solar and SunPower is that they address two parallel but different markets. First Solar’s panels and systems are designed solely for large-scale utility or megawatt-size power plants, while SunPower addresses the residential solar market.

Additionally, SunPower stopped manufacturing its own solar panels in 2022. It split into two separate companies, leaving its manufacturing to Maxeon Solar Technologies (NASDAQ: MAXN), while First Solar continues to both design and manufacture its solar panels and systems.

First Solar (FSLR)

First Solar is the largest solar manufacturer in the U.S., making it a key beneficiary of the Inflation Reduction Act. First Solar is undeniably expensive, with a P/E ratio of 69.5x and a P/S ratio of ~5.5x, compared to the average P/S for renewable energy stocks of ~1.9x. However, a bullish view seems appropriate for First Solar with this caveat—the high valuation makes it a risky choice, requiring a long-term buy-and-hold strategy.

First Solar is unique, as it is the only one of the largest solar manufacturers that builds its panels in the U.S. rather than China. As stated above, it also differs from SunPower in that it addresses the utility-scale end of the solar market rather than the residential one.

Unfortunately, utility-scale solar projects have seen the largest inflationary price increases compared to residential projects. Due to these price increases, one-third of utility-scale solar projects set for completion toward the end of 2021 were delayed by at least one quarter, according to a report from research firms Wood Mackenzie and SEIA.

The report also said that 13% of this year’s installations were put off for a year or more. On the other hand, Wood Mackenzie also expects that extending the investment tax credit for solar will increase utility-scale solar deployment by 86%.

Of note, First Solar boosted its 2022 net sales guidance in its second-quarter earnings release but dramatically slashed its profitability and related metrics. The company does have a healthy balance sheet with $7.4 billion in assets, $1.8 billion in cash and equivalents, and $1.5 billion in liabilities for the last 12 months.

What is the Price Target for FSLR Stock?

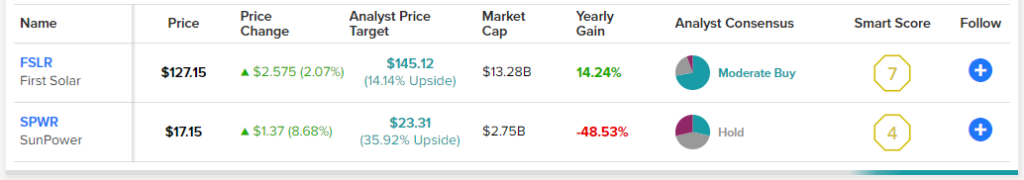

First Solar has a Moderate Buy consensus rating based on 13 Buys, four Holds, and one Sell rating assigned over the last three months. At $145.12, the average price target for First Solar implies upside potential of 14.1%.

SunPower (SPWR)

Although it addresses the residential rather than utility-scale end of the solar market, SunPower enjoys many of the same benefits as First Solar. However, it started having difficulties turning a profit during the pandemic, and insiders have been selling shares, suggesting that they question SunPower’s near future. Thus, a neutral view appears appropriate for SunPower despite its healthy balance sheet and low valuation.

While First Solar’s revenue growth has been choppy, SunPower’s has been steady. However, despite that steady revenue growth, SunPower failed to turn a profit in the last fiscal year, losing money in the year that ended in January 2022. It was profitable in the years ending in January 2021 and December 2019.

In terms of secular trends, SunPower should also benefit from the extension of the investment tax credit for Solar, which is expected to boost residential installations by 20%. However, the possibility of a recession and soaring interest rates suggest homeowners might put off installing solar panels due to the high upfront cost.

On the plus side, SunPower has an attractive balance sheet with $1.54 billion in assets, $500 million in cash and short-term investments, and $1.1 billion in liabilities. Its valuation at 1.9x sales is attractive, but the stock is risky in light of the company’s financial struggles. However, SunPower is worth watching to see if it can turn things around. The separation from its manufacturing arm could be creating some temporary hiccups in its fundamentals.

What is the Price Target for SPWR Stock?

SunPower has a Hold consensus rating based on four Buys, six Holds, and four Sell ratings assigned over the last three months. At $23.31, the average price target for SunPower implies upside potential of 35.9%.

Conclusion: Both are Risky, but FSLR May be Better

A deep dive into the fundamentals of SunPower and First Solar shows why the market hates SunPower so much while adoring First Solar. One critical difference is that insiders bought shares of First Solar while SunPower insiders unloaded shares in the last quarter. Additionally, First Solar hung on to its profitability during the pandemic while SunPower struggled.

On the one hand, the wide valuation difference makes SunPower look more attractive than First Solar, but on the other, First Solar looks more stable from a profitability standpoint. Unfortunately, First Solar’s high valuation makes it look risky and could mean it will take a while for investors to see a return on their investment, but the many question marks for SunPower around its manufacturing split call for a wait-and-see approach.