We used TipRanks’ Stock Comparison Tool to stack up First Solar (NASDAQ:FSLR), SolarEdge (NASDAQ:SEDG), and Sunrun (NASDAQ:RUN) against each other to pick the most attractive solar stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

High oil prices amid supply constraints and a growing focus on climate change are pushing countries across the globe to cleaner energy sources. Several countries are introducing favorable policies to accelerate the adoption of renewable energy sources, like solar. In the U.S., the Inflation Reduction Act (IRA) includes a 10-year extension of the 30% solar investment tax credit to boost solar adoption.

First Solar (FSLR) Stock

First Solar recently reported dismal Q3 results, with the company slipping into a loss per share of $0.46 from earnings per share (EPS) of $0.42 in the prior-year quarter. Higher logistics charges and a gain related to the sale of the company’s Japan project development platform recorded in the prior-year quarter impacted the bottom line. Consequently, First Solar lowered its full-year earnings guidance.

Nevertheless, the company is optimistic about its long-term growth and highlighted that it now has a backlog of future deliveries of 58.1 gigawatts, including orders with deliveries scheduled in 2027. First Solar is investing about $1.2 billion in scaling its domestic manufacturing footprint to approximately 10.7 gigawatts in 2026.

Overall, the company is expected to be a major beneficiary of the IRA. Due to this bullish sentiment, First Solar stock has rallied by 82% year-to-date.

Is FSLR a Buy or Sell?

Following the Q3 results, Argus analyst Bill Selesky increased the price target for First Solar stock to $176 from $123 and reiterated a Buy rating. The analyst cut his 2022 EPS estimate to a loss of $0.50 from a profit of $0.08 per share based on the company’s revised guidance.

Nonetheless, Selesky raised his 2023 EPS estimate to $4.27 from $2.10 as he expects freight issues and logistics cost pressures to subside. Selesky also expects significant improvement in solar module demand due to the IRA.

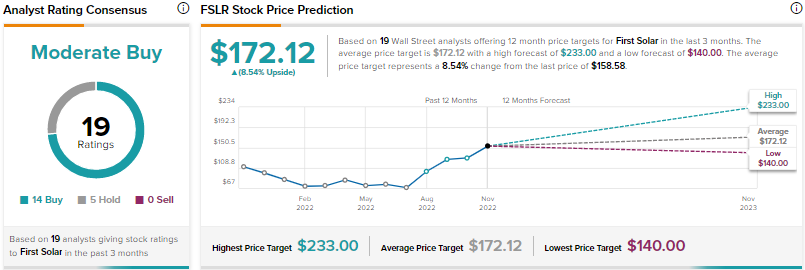

Overall, Wall Street is cautiously optimistic on First Solar stock, with a Moderate Buy consensus rating based on 14 Buys and five holds. The average FSLR stock price prediction of $172.12 implies 8.5% upside potential.

SolarEdge Technologies (SEDG) Stock

Israel-based SolarEdge is a leading provider of solar inverters for photovoltaic arrays and also offers other solar energy generation and storage solutions. The company’s Q3 revenue surged 59% year-over-year to $836.7 million. However, adjusted EPS declined considerably to $0.91 from $1.45 in the prior-year quarter due to higher taxes and forex headwinds.

It’s worth noting that SolarEdge’s revenue from Europe increased 90% in Q3 ahead of a challenging winter anticipated in the region. However, the company prioritized its supply to the European residential market due to constrained capacity, causing its U.S. revenue to decline.

Looking ahead, SolarEdge is ramping the production capacity in its new Mexico facility and other locations to address the demand-supply gap. Further, it plans to establish its manufacturing plant in the U.S. within 2023 to cater to the increased demand.

Is SolarEdge a Good Stock to Buy?

This week, Deutsche Bank analyst Corinne Blanchard initiated coverage of SolarEdge stock with a Hold rating and a price target of $260. The analyst is positive about the company’s diversified commercial product mix, but feels that cost pressures and management’s execution are responsible for the stock’s underperformance compared to peers.

That said, Blanchard believes that the stock could rebound over the next six to 12 months if management drives improved performance despite headwinds like supply chain bottlenecks and elevated costs. Blanchard also feels that the company’s efforts to set up more regional hubs to address supply chain issues could take over six months.

The Street’s Moderate Buy consensus rating for SolarEdge stock is based on nine Buys and five Holds. The average SEDG stock price target of $322.46 implies 11.3% upside potential. SolarEdge stock has risen 3.3% so far this year.

Sunrun (RUN) Stock

Sunrun is the leading residential solar company in the U.S. and has installed more than 47,000 solar and battery systems nationwide. The company ended Q3 with 759,937 customers, marking a 21% year-over-year rise.

Sunrun delivered better-than-anticipated Q3 results despite the adverse impact of hurricanes in Puerto Rico and Florida and supply constraints. Revenue grew 44% year-over-year to $631.9 million, thanks to the solid growth in the company’s customer base. Additionally, net subscriber value increased 68% to $13,259 compared to Q2, thanks to higher prices.

Solid top-line growth and higher margins helped the company deliver EPS of $0.96 in Q3 2022 compared to $0.11 in the prior-year quarter. The company increased its installed solar energy capacity by 17% to 256 megawatts in Q3 and expects to expand it by about 25% in the full year.

Is Sunrun a Good Investment?

Credit Suisse analyst Maheep Mandloi raised the price target for Sunrun stock to $66 from $58 and reiterated a Buy rating, calling RUN a top pick. The analyst noted the impressive rise in net subscriber value in Q3, fueled by the company’s pricing power and higher investment tax credits under IRA.

Overall, Sunrun stock earns a Strong Buy consensus rating based on 13 Buys and one Hold rating. The average RUN stock price target of $49.09 implies 56.7% upside potential. Shares have declined 8.6% year-to-date.

Conclusion

Among these three prominent players in the solar space, analysts are currently more bullish on Sunrun stock than First Solar and SolarEdge. While Sunrun stock has lagged the other two stocks this year, analysts see higher upside potential from current levels. A growing customer base, pricing power, and rising demand for solar energy solutions bode well for Sunrun’s long-term growth.