Tesla (NASDAQ:TSLA) often garners attention for its potential benefits stemming from the adoption of AI technology. But apart from sounding buzzy, how does that actually manifest itself in more concrete ways?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

To shed light on this, Goldman Sachs analyst Mark Delaney asserts that Tesla is “one of the few companies in the world capable of developing leading AI training technology.” This includes its own chip (D1 made on 7 nm technology) and compute hardware (Dojo).

Furthermore, its leading position in AI technology will enable it to “expand businesses like FSD in particular for Tesla’s own fleet of vehicles,” according to the 5-star analyst.

FSD, or Full Self Driving, refers to Tesla’s automated driving assistance technology (no Tesla vehicles have ‘full self-driving’ abilities yet), and Delaney estimates it currently generates Tesla around $1-3 billion per year. This revenue is predominantly derived from upfront license sales, currently priced at $12,000 in the U.S. market, wherein the license is typically tied to the vehicle for its entire lifespan. Additionally, Tesla provides a subscription option at $199 per month.

However, that could grow much bigger. To emphasize the potential scale of a licensing business, it’s worth considering that Nvidia’s datacenter segment is projected to exceed $50 billion in revenue by 2024, while AWS is anticipated to surpass $100 billion, according to Goldman estimates.

As for Tesla’s software related revenue, by 2030, it could be tens of billions of dollars per year (the bulk generated from FSD), and more if you add in the licensing of Dojo or selling FSD to other OEMs.

Over the long-term, Delaney thinks the total addressable market (TAM) for the automotive software and services industry could surpass $1 trillion a year. This estimate takes into consideration the potential transformation of the global installed base of over 1 billion vehicles on the road, transitioning towards connectivity and software-defined capabilities over the next 10 to 20 years.

However, since this transformation is still some time away, Delaney would require compelling evidence of impending success to revise his current overall thesis. He summed up, “To the extent we thought that the company was closer to a catalyst as meaningful as the ramp of the third-generation platform, or if Tesla made faster progress with FSD/AI products than we anticipate, then we could be more positive on the stock.”

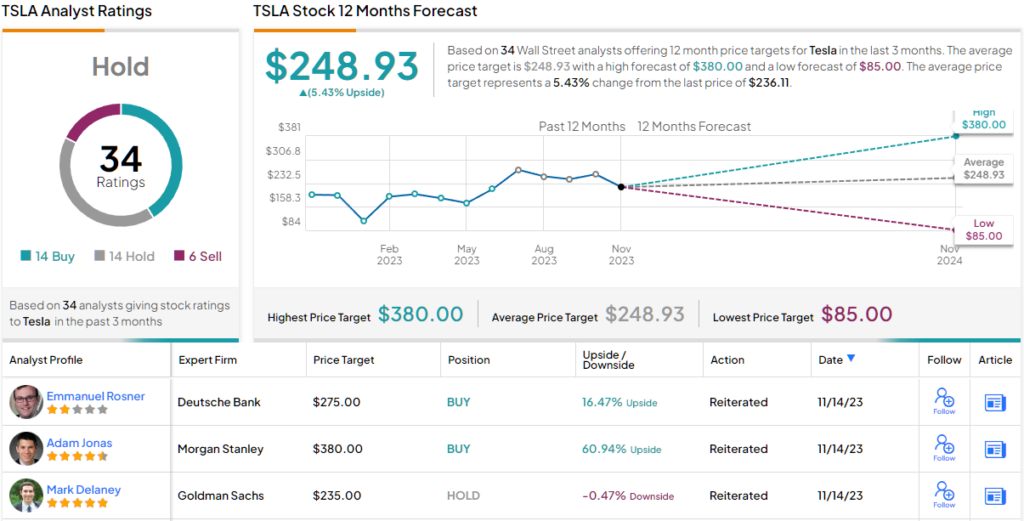

As such, Delaney maintained a Neutral rating on TSLA, along with a $235 price target, suggesting the stock is currently fully valued. (To watch Delaney’s track record, click here)

Looking at the consensus breakdown, based on a mix of 14 Buys and Holds, each, plus 6 Sells, the stock claims a Hold consensus rating. The average price target, at $248.93, is a touch higher than Delaney’s objective and makes room for modest one-year returns of 5%. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.