It’s been a rude awakening for beginner investors who failed to put in the homework before hitting the buy button on a stock. The valuation process should never be passed up. In the case of fast-flying growth stocks of 2021, it was tough to value companies that lacked on the cash flow front. Indeed, growth was what everyone seemed to care about, and some of the growth stories that investors were telling themselves were pretty far-fetched.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The party is over, with higher interest rates and calls for real profits over “sexy” growth stories. Some of the biggest winners of last year’s historic run are now among the biggest losers, with many such names down 80%-95% from their highs, such as Beyond Meat (NASDAQ:BYND) and Unity Software (NYSE:U).

More Weekend Edition Pieces:

Finding Value Among the Ruins: Will Growth Stocks Shine Again

Palantir’s Bullish Case Remains Compelling after Big Drop

Here are 2 Stocks to Consider for a Rebound

80%-95% Drops: When All Others Give Up Hope

Whenever you have an 80%-95% drop, the hopes of a swift recovery are essentially reduced to near zero. Indeed, euphoria and difficulty evaluating high-growth companies caused many to be lazy and buy stocks based on their past momentum.

Now that momentum has reversed course and things are starting to show early signs of bottoming out, it may be time to have a second look at the fallen stars of 2020 and 2021. Sure, such names may not hit new highs this decade or even the next 30 years, but that doesn’t mean they’re not capable of delivering handsome returns as managers look to continue business as usual through an ugly macro environment.

Without clarity on where rates are headed next, growth remains tough to value, even at these depths. That’s no excuse to be lazy, though. Investors looking to buy should still attempt to formulate a list of reasons (and catalysts) why they want to own a stock and try to value a firm based on its peers or relative to its normalized (after the recession) growth rate.

It’s not easy to go bottom-fishing for freshly crashed growth stocks. If you have an investment horizon of five-to-10 years, the rewards could be tremendous, making such imploded stocks worthy of a small part of your portfolio.

Many folks who bid up the hot momentum stocks “to the moon” last year are unlikely to be willing to wait for years at a time. For us long-term thinkers, that’s a plus as we look for contrarian picks among the tech wreckage.

What Types of Crashed Stocks are Worth Your Attention?

After large plunges, you’d think the bottom is in. That’s just simply not the case, though. Many zombie companies lived on until their demise from the dot-com bubble. The same could be in the cards for many low-quality growth firms that fail to adapt to the new era of higher rates. The key to finding imploded names worth owning is whether or not the firm in question has a strong product, management, and moat.

It’s hard to value a firm based on just price-to-sales (P/S) — a multiple that could just expand anyway as sales dry up in a recession year — so it’s critical to put more emphasis on a firm’s product to gain a more realistic idea of how it can power higher amid profound headwinds. Simply put, you want more than just a survivor in your portfolio; you want a misunderstood company that will rise again.

Looking Beyond the Faded Growth Hopes

Beyond Meat is one battered company whose shares are down around 93% from their all-time highs. That’s a severe drop and one that may not be over until the company can limit its cash bleed and regain the luster it had before it went public.

Not only is Beyond suffering from cash bleed, but consumers have also curbed their appetite for alternative meats. Due to cooling demand for the plant-based meat market, Beyond hasn’t had the type of pricing power as traditional meats. If anything, market dynamics may require Beyond to lower prices to bring up demand in a recession year.

Fortunately, Beyond has options to ride out a rough patch in alternative meats. The company has been trimming away at its c-suite, also cutting around 19% of its workforce. Such moves should help Beyond cope with such a hostile environment. Still, questions linger about the fate of the alternative meat market and whether Beyond can thrive without leaning heavily on big fast-food chains.

In any case, Beyond is taking steps to bring fundamentals back in order. With such a compelling product and new innovations that could re-ignite demand in a post-recession environment, BYND stock stands out as one crashed stock worthy of a second look.

Beyond’s new plant-based steak tips are intriguing. Though it’s hard to get taste and texture right, I view Beyond as an innovative company with a great product that will help the stock regain footing.

Further, concerns about the growth story seem overdone. Alternative meats have lost their novel appeal, but they’re more than just a fad. As Beyond improves its recipes while controlling costs, the stock could have significant room to run.

Is BYND Stock a Buy or Sell, According to Analysts?

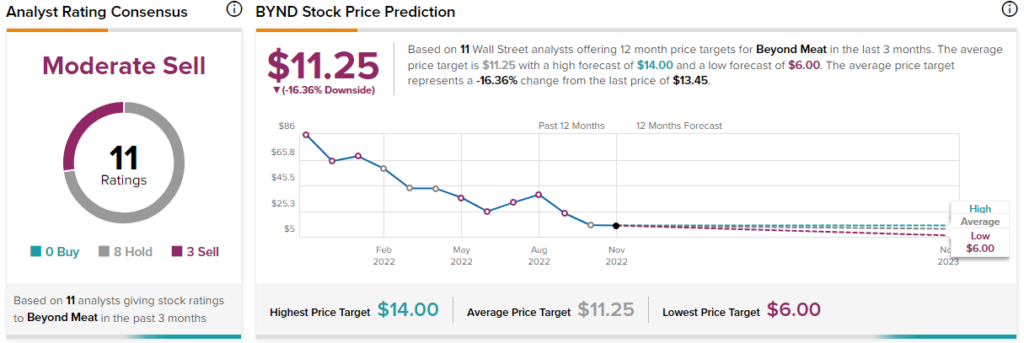

Turning to Wall Street, BYND stock has a Moderate Sell consensus rating based on eight Holds and three Sells assigned in the past three months. The average BYND stock price target of $11.25 implies 16.36% upside potential.

Another Opportunity Among the Tech Wreckage

Unity Software is another intriguing company with a moat wide enough to help it power through this turbulent time. The stock is currently down around 84% from its all-time high. As the company doesn’t just power many of the video games we know and love, it’s a potential metaverse infrastructure play. Further, the push into the ad business may still be underrated by Wall Street analysts.

Unity isn’t just a gaming firm; it has the tools to improve its growth and profitability prospects through the next decade. If anything, Unity’s many growth levers make it one of the most compelling fallen growth stocks of the year.

At 8.3x sales, U stock seems misunderstood amid tech’s march lower. Losses may be swelling, but in terms of growth via innovation, it’s tough to find a better deal than Unity if you’re looking to brave the market decline.

Is Unity Software Stock a Buy, According to Analysts?

Turning to Wall Street, U stock has a Moderate Buy consensus rating based on eight Buys and three Holds assigned in the past three months. The average Unity Software stock price target of $39.45 implies 13.75% upside potential.