The Q1 earnings season is about to commence, and as is traditional, banking stocks will get first dibs on reporting the quarter’s shenanigans. And what shenanigans they have been for the banking industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

2023’s opening salvo has been characterized by multiple bank collapses; Silvergate Bank, Signature Bank, Silicon Valley Bank and Credit Suisse have all hit the self-destruct button, causing investors to seriously question the health of the industry.

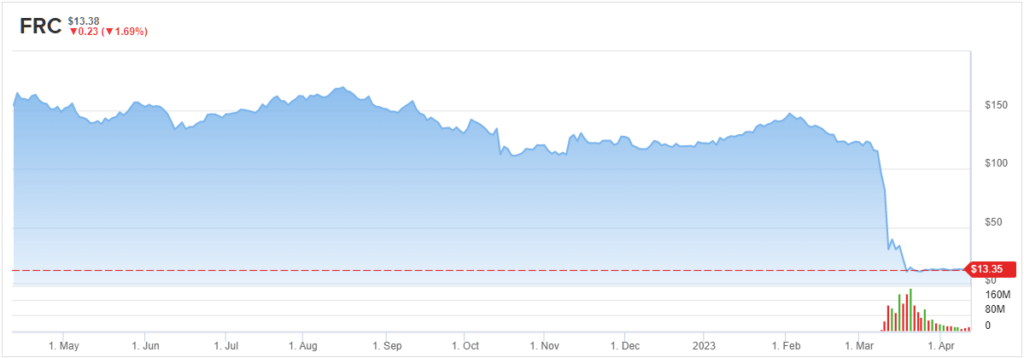

In trying to assess which bank might be the next to collapse, going by its recent share price performance, many appear to think First Republic Bank (NYSE:FRC) is one likely candidate. Since the beginning of March, shares of the private lender and wealth management firm have shaved off almost 89% of their value as the bank reportedly experienced over $70 billion or more of deposit outflows in the wake of SVB’s collapse.

Meanwhile, in an effort to boost confidence in the industry, the US’s four biggest banks (JPMorgan, Wells Fargo, Citigroup and BofA) deposited $5 billion each in uninsured deposits into First Republic in March and were amongst a cohort of 11 lenders that strengthened the bank’s position.

However, as Barclays analyst Jason Goldberg notes, the outlook for the bank remains “uncertain.”

As such, ahead of FRC’s Q1 earnings report – which was originally slated to take place on Friday (April) but which has now been pushed back to April 24 – Goldberg has reduced his 2023 EPS estimate from $6.00 to break-even and his 2024 EPS estimate from $8.80 to -$1.50.

Goldberg notes that proceedings were rather normal during the quarter until SVB’s meltdown. Since then, he believes FRC experienced a “significant decline in no/low-cost deposits resulting in an increase in much more expensive borrowings.”

“While FRC appears to be managing short-term liquidity and deposit outflows may have slowed, a jump in its funding costs coupled with fixed rate assets will likely weigh heavily on its NIM. In addition, it’s losing FAs. Plus, unrealized securities losses and long duration loans make balance sheet restructuring difficult,” Goldberg wrote.

Based on the above, then, Goldberg reiterates an Equal Weight (i.e., Neutral) rating on FRC shares, along with a $17 price target. Still, there’s potential upside of 23% from current levels. (To watch Goldberg’s track record, click here)

Most on the Street agree; FRC’s Hold consensus rating is based on a total of 11 Holds, 5 Buys and 1 Sell. (See FRC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.