Few things are certain in this world, but green energy seems to be a safe bet over the coming years – with increasing government funding in this sector, renewable energy companies are set to benefit from higher production output and revenues.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

So which British green energy stocks might be a good choice for your portfolio?

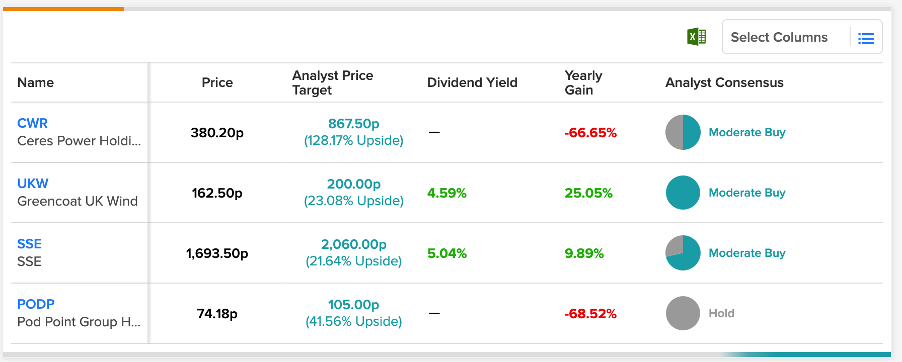

Here, we have shortlisted Ceres Power Holdings (GB:CWR), Greencoat UK Wind (GB:UKW), SSE (GB:SSE), and Pod Point Group Holdings (GB:PODP) from the renewable energy sector.

Let’s look at the stocks in detail.

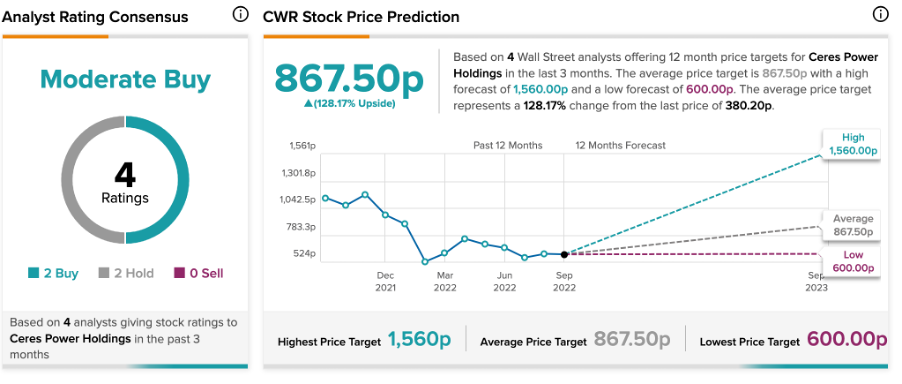

Ceres Power Holdings

Ceres Power develops technology such as fuel cells and electrolysers for clean energy generation.

Despite a market-leading position in climate technology, share prices are struggling and trading down by 60% this year.

However, analysts maintain a bullish approach based on its revenue prospects.

An eagerly awaited China joint venture is expected to be signed in the fourth quarter of 2022. With this venture, the company will be able to deploy its technology in the Chinese market. The licence fee of £30 million associated with the JV will be reflected at the beginning of 2023.

According to TipRanks, Ceres Power stock has a Moderate Buy rating. The CWR target price is 867.5p, which has a huge upside potential of 128.1%.

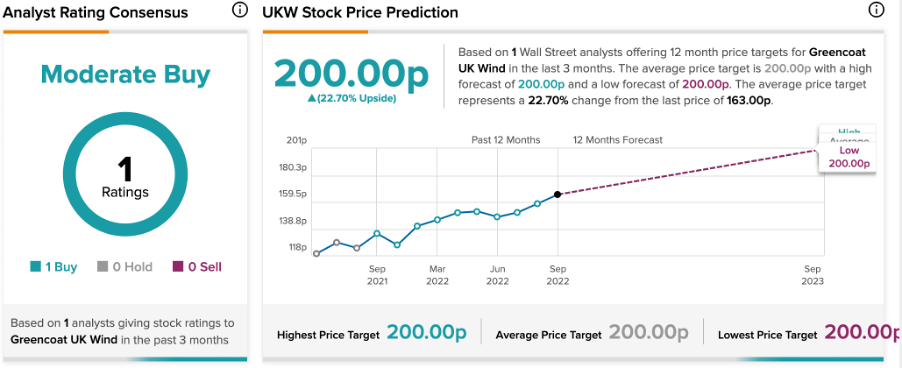

Greencoat UK Wind

Greencoat UK Wind is a renewable fund that invests in wind farms and generates income for its shareholders.

The company has a portfolio of 44 wind farms with a total capacity of 1,460 MW. In the half-year results for 2022, the company generated net cash of £328.8 million and announced a dividend of 3.86p per share.

This was just another set of solid results from the company, based on a low-risk approach which generates cash for sustainable dividends.

According to TipRanks, the stock has a Moderate Buy rating, based on a Buy rating from analyst John Musk of RBC Capital.

He is a five-star-rated analyst and has a target price of 200p, which is 22% higher than the current price.

SSE

SSE is a multinational energy company focused on generating renewable electricity. In 2020, SSE sold its retail electricity operations to develop and operate a renewable energy business.

In its recently issued trading update, the company posted 24% growth in its total renewable production output. The company is highly optimistic about its renewable projects and plans to invest around $7.5 billion up to 2025. Riding on higher production numbers, the company expects its earnings growth to be between 7 and 10% annually till 2026.

According to TipRanks, SSE stock has a Moderate Buy rating. It is based on five Buy and two Hold recommendations.

The SSE target price is 2,060p, which shows a growth of 21.6% on the current price level.

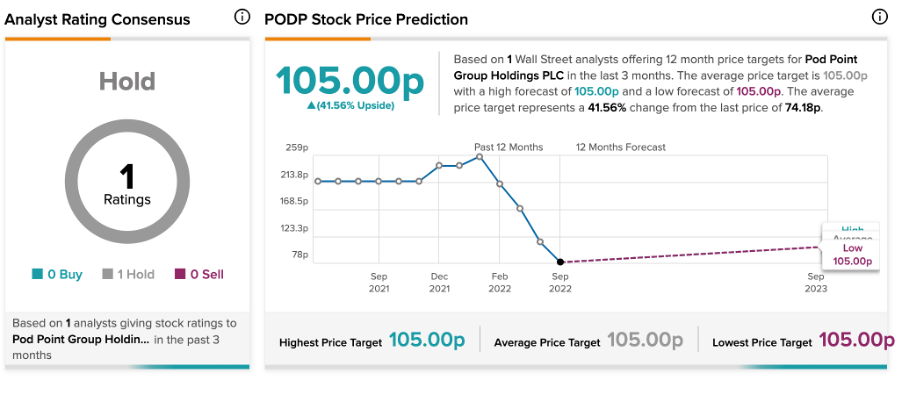

Pod Point Group Holdings

Pod Point Group is a UK-based company engaged in developing electric vehicle (EV) charging solutions for homes and businesses.

In its interim results for 2022, the company posted a jump of 57% in revenues and 48% in its gross profit.

The company recently signed a three-year agreement to be BMW’s (DE:BMW) preferred home charge supplier in the UK, for all BMW and MINI brands. With this, the company now has around 20 contracts with car OEMs (original equipment manufacturers).

Pod Point is riding on the growth wave of the electric vehicle market. The EV infrastructure is growing at a slower pace than expected. However, with improved market share and stronger partnerships, the company is well placed to benefit.

According to TipRanks, Pod Point has a Hold rating from Barclays analyst James Zaremba. He has a target price of 105p, which has an upside potential of 42%.

Conclusion

The green energy sector has witnessed huge growth over the last few years – but there is also great risk associated with these stocks, especially with the smaller players in the market.

Overall, renewable is in the growth phase and investors can make healthy returns if they pick carefully.