U.S. inflation continues to ease (dropped to 8.2% in September from 9.1% in June) but remains high, implying that the Fed could continue to maintain a hawkish stance. High inflation and interest rates could keep the stock market volatile. However, if you are an income investor, you have plenty of options to earn a steady and fat yield. One such investment option is Enterprise Products Partners (NYSE:EPD) stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

EPD’s Stellar Dividend Payment & Growth

Enterprise Products Partners is a midstream energy services company. Its assets gather, process, transport, and store hydrocarbons, including crude oil, natural gas, and NGLs (natural gas liquids). Thanks to its geographically diversified assets and strong demand for its midstream assets, EPD has consistently delivered solid EBITDA and cash flows that support higher dividend payments.

It’s worth highlighting that EPD has uninterruptedly raised its dividends for 24 years. Moreover, EPD’s dividend increased at a CAGR of 7% during the same period.

Its solid dividend payments and growth are supported by its solid adjusted EBITDA, which has a CAGR of 9.4% since 2017. Further, its free cash flow per share grew at a CAGR of 21% during the same period.

EPD’s continued investments in infrastructure assets and steady energy demand will support its financials and dividend payouts. Meanwhile, income-seeking investors can earn an attractive and reliable dividend yield of 7.5% by investing in Enterprise Products Partners stock now.

Is EPD a Good Stock to Buy?

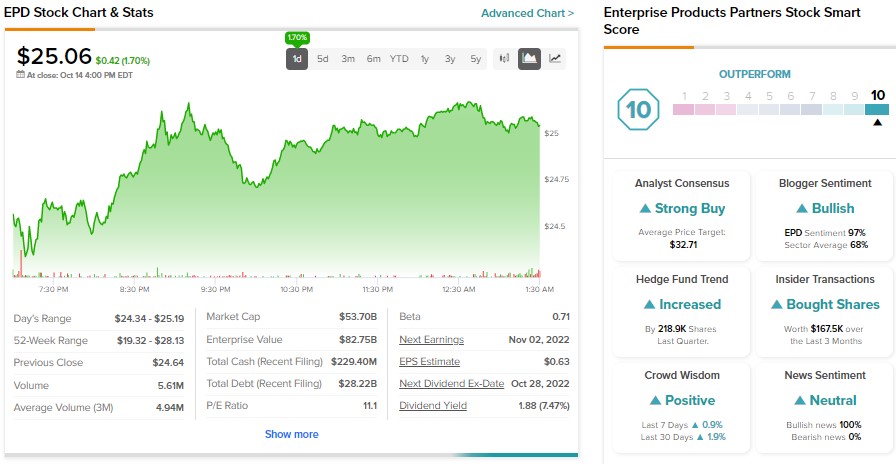

Analysts are bullish about EPD’s prospects. EPD stock sports a Strong Buy consensus rating on TipRanks based on eight unanimous Buy recommendations. Further, these analysts’ average price target of $32.71 implies 29% upside potential.

EPD stock also has positive signals from hedge funds and insiders. TipRanks’ data shows that hedge funds bought 218.9K EPD stock last quarter. Meanwhile, insiders added Enterprise Products Partners stock worth $167.5K.

With positive signals from analysts, hedge funds, and insiders, EPD Stock has a maximum Smart Score of “Perfect 10” on TipRanks.