High-dividend ETFs can be a wise investment during difficult economic times, as they offer a consistent income stream regardless of market conditions. These types of ETFs usually distribute a larger portion of their profits as dividends, indicating that they have the ability to mitigate any capital losses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To help simplify your investment decision, we used the TipRanks High-Dividend-Yield ETFs tool to scan for ETFs with a high dividend yield. Here, we present five ETFs with a dividend yield of more than 7%:

Global X SuperDividend ETF (SDIV): The SDIV ETF invests in 100 of the highest-dividend-yielding equity securities in the world. SDIV has $712.4 million in assets under management (AUM), with a net asset value (NAV) of $20.69. Further, the ETF boasts a dividend yield of 13.2% over the past 12 months. Meanwhile, the expense ratio of the fund is 0.58%.

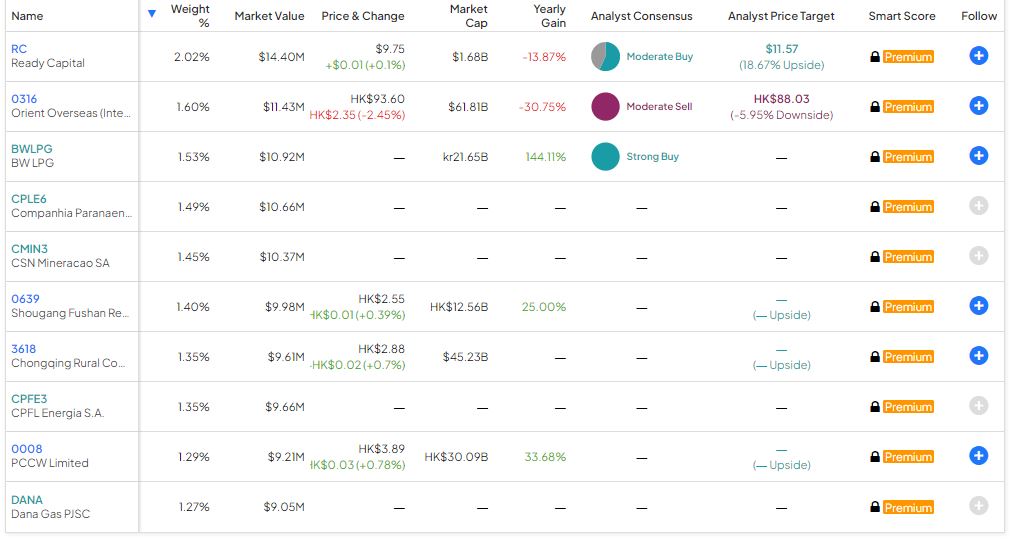

SDIV offers investors ample diversification. Its top 10 holdings make up just 14.75% of assets. Below, you can take a look at SDIV’s top 10 holdings, as displayed on TipRanks’ holdings tool.

iShares Emerging Markets Dividend ETF (DVYE): This index tracks the investment results of an index composed of relatively high-dividend-paying equities in emerging markets. DVYE has $616.4 million in AUM. The ETF’s net asset value stands at $24.5. Further, the DVYE ETF dividend yield is 10%, and the expense ratio of the fund is 0.49%.

This ETF holds 110 stocks, and its top 10 holdings make up just 20.02% of total assets. Below, you can take a look at DVYE’s top 10 holdings, as displayed on TipRanks’ holdings tool.

Global X MSCI SuperDividend Emerging Markets ETF (SDEM): SDEM ETF invests in 51 of the highest-dividend-yielding equities in the emerging markets. The ETF has $42.7 million in AUM, and its net asset NAV stands at $23.03. Further, the ETF dividend yield is 8% and the expense ratio of the fund is 0.67%.

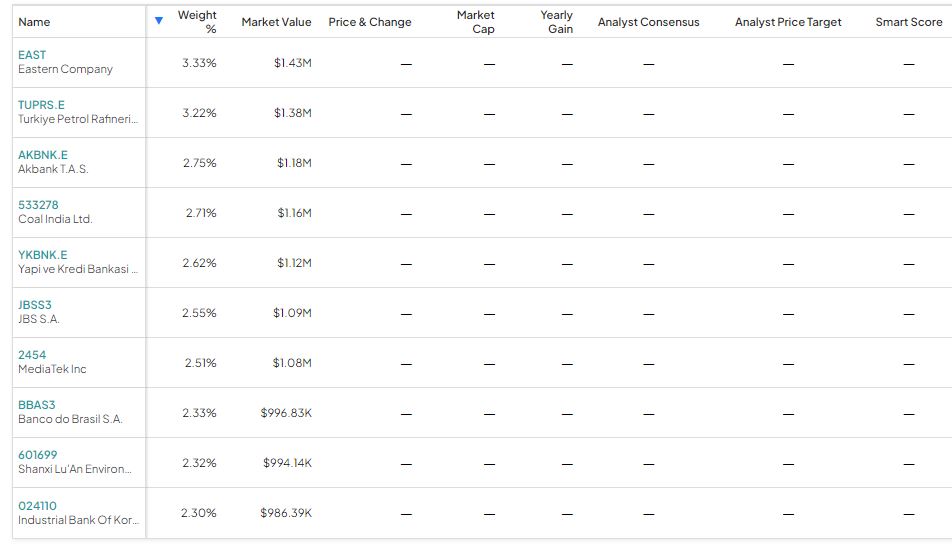

SDEM offers investors ample diversification. Its top 10 holdings make up just 26.6% of total assets. Below, you can take a look at SDEM’s top 10 holdings, as shown on TipRanks’ holdings tool.

iShares Asia/Pacific Dividend ETF (DVYA): This index tracks the results of an index composed of relatively high-dividend-paying equities in the Asia/Pacific region. DVYA has $37.75 million in AUM and boasts a net NAV of $31.68. Further, the ETF has a dividend yield of about 7% and the expense ratio of the fund is 0.49%.

This ETF holds 52 stocks, and its top 10 holdings make up just 33.01% of overall assets. Below, you can take a look at DVYA’s top 10 holdings, as seen on TipRanks’ holdings tool.

Global X SuperDividend U.S. ETF (DIV): DIV tracks an equally weighted index of 48 high-dividend, low-volatility securities. DIV has $599.1 million in AUM, and NAV stands at $15.79. Further, the ETF has a dividend yield of about 8%, and the expense ratio of the fund is 0.45%.

This ETF’s top 10 holdings make up just 26.67% of total assets. Below, you can take a look at DIV’s top 10 holdings, as shown on TipRanks’ holdings tool.

Conclusion

High-dividend ETFs exhibit reduced price volatility in the face of economic uncertainties. They provide investors with a regular stream of current income, helping them navigate losses to some extent. The aforementioned five ETFs, selected with the help of our TipRanks ETF Screener tool, could enhance investors’ total returns with their lucrative dividend yields.

Learn more about TipRanks’ forecasts and price targets for individual ETFs.