Picking the stocks that are recommended by the top analysts in the market can be a shortcut to great returns – and TipRanks makes it easy to pinpoint the stocks that are frequently rated by the analysts who get good returns.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

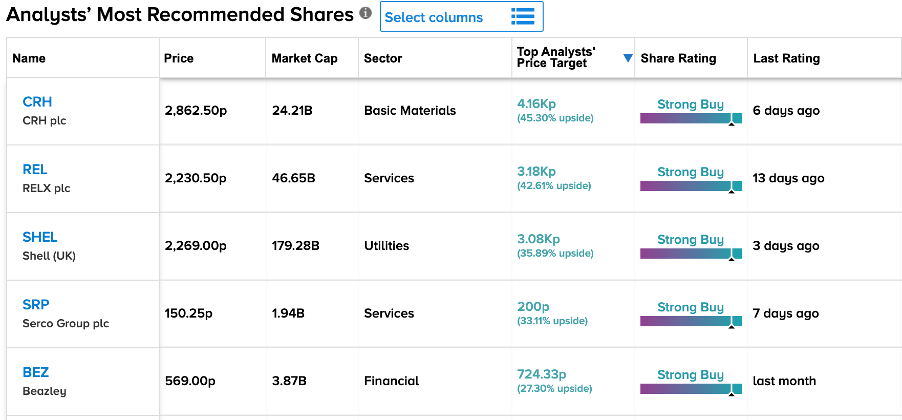

Today, we have shortlisted manufacturer CRH Plc (GB:CRH), analytics solution provider RELX Plc (GB:REL), mining giant Shell (GB:SHEL), government contractor Serco Group (GB:SRP), and insurance company Beazley (GB:BEZ).

We have used the TipRanks Analysts’ Top Shares tool to find out the list of stocks that are frequently recommended by best-performing analysts.

Let’s see these stocks in detail.

CRH Plc

CRH manufactures and sells a wide range of building products and materials used by the construction industry.

The company’s leading position gives it an edge in its pricing power during inflationary pressures. Driven by higher demand and price hikes, the company posted an increase of 14% in its sales and 29% in profits after tax in its interim results for 2022.

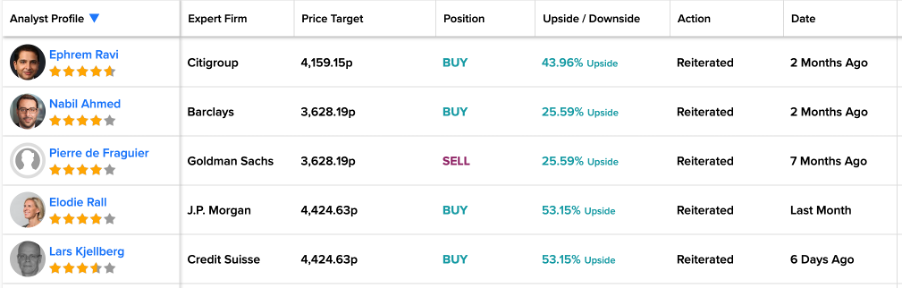

The stock has backing from 11 high-rated analysts on TipRanks. Last week, Lars Kjellberg from Credit Suisse reiterated his Buy rating on the stock. According to him, the stock has scope to grow by another 53.15%.

Overall, the stock has a Moderate Buy rating, based on 10 Buy and one Hold recommendations. The average target price is 4,143p, which has an upside potential of 47%.

RELX Plc

RELX is a global company providing information and analytics solutions in more than 180 countries.

The company’s overall prospects are positive, owing to its strong top-line growth and faster-than-expected improvement in profit margins. In the first-half results for 2022, all its business segments performed well with positive revenue as well as operating profit growth.

Recently, the company got a lot of traction from analysts who reiterated their ratings. Five-star-rate analyst Lisa Yang from Goldman Sachs has the highest price target of 2,986 with an upside potential of 36%.

Yang mainly covers the stock from the European internet and media sector. She commented,“ the sector will be defined by the acceleration of the digital economy in 2022 and beyond, with an increased focus on growth, reinvestment, and repositioning businesses for a post-pandemic world.”

According to analyst consensus on TipRanks, RELX stock has a moderate Buy rating with an average target price of 2,952.3p.

Shell (UK)

Shell is a UK-based exploration company dealing in energy products such as fuels, oils, LPG, lubricants, etc.

The company’s stock has grown by almost 40% in the last three years. Shell’s performance in recent times has benefitted from higher energy prices. It reported two back-to-back quarters of record profits.

Even though oil prices have started to decline, analysts are looking at long-term prospects and the stock has a Buy rating from 11 analysts.

Jefferies analyst Giacomo Romeo covers energy stocks from the UK, the U.S., and German markets and has around 14 years of experience in this sector.

He remains highly bullish on Shell stock and has a target price of 3,300 with an upside potential of 44.3%. He has a success rate of 85% on the stock, which means 11 out of 13 ratings were profitable.

Serco Group Plc

Serco Group is a UK-based contractor dealing in a wide range of public services in healthcare, transport, defence, and more.

The company has some big and long-term contracts under its umbrella. The company’s top-line growth has been stable in the last few years. In its recent trading update, the company has increased its full-year guidance numbers, based on a ‘positive outlook’.

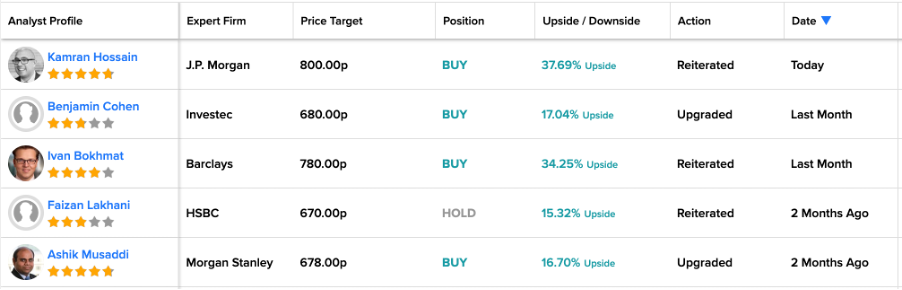

According to TipRanks, Serco stock has a Strong Buy rating, based on 7 Buy recommendations.

Four-star-rated analyst Andrew Brooke from RBC Capital has been covering the stock since 2018 at a success rate of 68%. He has a Buy rating on the stock at a target price of 210p, which is 38% higher than the current price level.

Beazley

Beazley is a British insurance company with operations worldwide.

The company’s stock has outperformed the market in the last year with 55% returns. The company’s diversification of services helps it manage overall business growth. The company’s outlook remains strong, as the insurance sector is considered to be stable even during the slowdown.

J.P. Morgan analyst Kamran Hossain is a five-star-rated analyst on TipRanks and mainly covers financial stocks. He has covered Beazley’s stock since 2018 and has always remained bullish. He has an average return of 12.6% on the stock.

Overall, the stock has a Strong Buy rating on TipRanks, at an average target price of 678.67p.

Conclusion

These five companies are tipped by top analysts, and look likely to weather the current economic storms.