There were definitely dark clouds hanging over First Solar (NASDAQ:FSLR) after the company released its quarterly results. However, don’t let the market’s initial response cloud your judgment. I am bullish on FSLR stock because First Solar anticipates a strong year of profits with the help of the Inflation Reduction Act (IRA).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

First Solar is a solar panel manufacturer that’s based in Arizona but has international operations. Naturally, First Solar has to deal with high inflation, recession worries, and other issues that are beyond the company’s control.

On the other hand, First Solar’s management has high hopes for 2023. As the company swings to profitability and continues to tap into the growing U.S. renewables market, First Solar deserves a second look amid the share-price drawdown.

Legislation Will Provide a Tailwind for First Solar

Make no mistake about it: the IRA will give First Solar a financial boost this year and in the coming years. Indeed, five-star Oppenheimer analyst Colin Rusch cited First Solar’s “domestic manufacturing capacity” that’s “positioned to maximize the IRA opportunity” when he issued an Outperform rating and a $222 price target on FSLR stock.

How vast is First Solar’s “domestic manufacturing capacity”? As the company explains, First Solar’s U.S. manufacturing footprint comprises roughly 6 gigawatts of annual nameplate capacity from the company’s three Ohio-based operating factories. Furthermore, the company expects its annual nameplate capacity in the U.S. to exceed 10 gigawatts by 2025.

Most likely, the IRA contributed to FSLR stock’s astounding run-up since the summer of 2022. It’s a clear sign that the market is bullish on the domestic renewables industry in general and on First Solar as a leader in that market.

If you anticipate that the IRA and other legislation will continue to incentivize purchases of solar panels, FSLR stock is an easy way to potentially profit from this trend. First Solar reportedly anticipates that the IRA will continue to boost the company’s sales, and I tend to agree with that prediction.

First Solar Disappoints Investors but Still Pivots to a Profit

Since FSLR stock rallied so sharply during the past year, Wall Street’s expectations may have been too high for First Solar’s first-quarter earnings results. What’s really impressive, though, is that First Solar swung to a profit after two quarters of negative EPS. It’s notable that this occurred despite the aforementioned macroeconomic headwinds.

However, investors weren’t impressed with First Solar’s pivot to profitability. In Q1 2023, First Solar delivered EPS of $0.40, while analysts called for $0.99. That’s a lot of improvement to ask for, though, since First Solar posted a net loss in the previous quarter.

Financial traders also didn’t like First Solar’s quarterly net sales, which totaled $548 million, missing the consensus estimate of $713.8 million. The company’s quarter-over-quarter sales decline is, according to First Solar CFO Alexander Bradley, attributable to “an expected shift in the timing of module sales as we increased shipments to our distribution centers, both to mitigate logistics costs, as well as to align future shipments to customers with contractual delivery schedules.”

That’s a long-winded explanation, but it sounds like Bradley expects the disruption in shipping timing to be a temporary issue. Thus, the current sense of disappointment could be a setup for a relief rally after First Solar’s next quarterly earnings event.

Besides, First Solar’s management remains confident in the company’s future prospects. First Solar chose not to alter its full-year 2023 guidance, which specifies net sales of $3.4 billion to $3.6 billion as well as EPS of $7 to $8. Hence, if First Solar’s first-quarter EPS was only $0.40, then the company’s management clearly envisions powerful EPS growth for the remainder of the year.

Is FSLR Stock a Buy, According to Analysts?

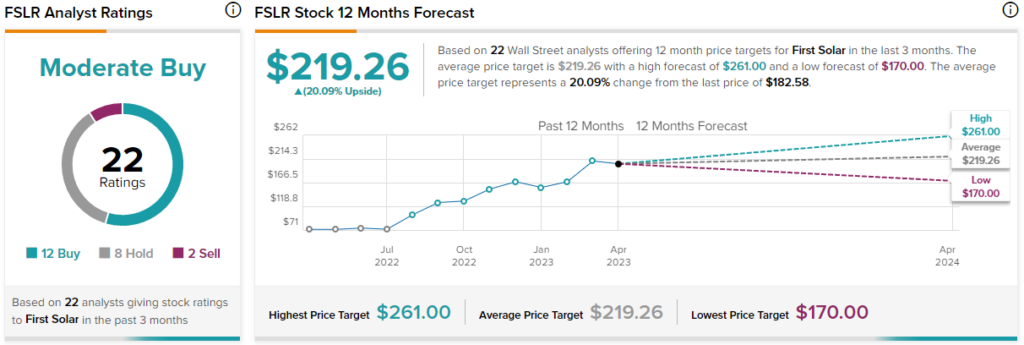

Turning to Wall Street, FSLR is a Moderate Buy based on 12 Buys, eight Holds, and two Sell ratings. The average First Solar stock price target is $219.26, implying 20.1% upside potential.

Conclusion: Should You Consider First Solar Stock?

First Solar stock fell by 9.1% today after the company released its earnings report. This seems overdone, as First Solar still expects to report strong sales and earnings in 2023.

There’s no need to let short-term traders dissuade you from investing in First Solar. If FSLR stock is trading at a reduced price, that’s just a signal to consider hitting the “buy” button if you still believe in the future growth of the domestic solar-panel market.