Tennessee-based FedEx (FDX) provides prompt package delivery services to businesses and residences. I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Throughout 2022’s first half, inflation and supply-chain bottlenecks have been frequent topics of conversation in the financial media. For both essential and discretionary items, many people count on FedEx to get orders fulfilled in a timely manner.

Given the aforementioned macro-level challenges, prospective investors might assume that FedEx’s financial data would be disappointing this year. Yet, FedEx might surprise you with its resilience and with the company’s optimistic outlook for an admittedly difficult year.

All in all, informed investors should find that FedEx offers a decent yield and compelling value with its shares. The shipping industry might continue to come under pressure for a while, but FedEx should be able to manage its issues and produce results for the company’s stakeholders.

Stuck in Neutral

If there’s any term that can describe FedEx stock, it’s “range-bound.” Throughout 2022 so far, the stock can’t seem to break above $250, but it also refuses to stay below $200.

Even if share-price appreciation is elusive with FedEx stock, at least the company’s long-term investors can collect some decent dividend payments. Currently, FedEx offers a forward annual dividend yield of 2%. Knowing this, income-focused investors can consider reinvesting the dividends in order to leverage the principle of compounding.

Prior to a recent earnings event, FedEx had a trailing 12-month P/E ratio of around 12, which is quite reasonable. That number might change if FedEx stock increases in value over the coming days, but even if the P/E ratio reaches the high teens or low 20s, the stock should still offer a good value.

Still, it would be nice to see FedEx stock finally break above its range. If anything could make this happen, it would be a strong fiscal report. So, let’s check and see how FedEx fared during the fourth fiscal quarter of 2022.

The Freight Was Great

Make no mistake about it: FedEx is fully aware of its problems. The company specifically cited some familiar issues that many businesses are facing today, including “lower shipment demand due to slower economic growth and supply-chain disruptions, as well as higher purchased transportation and wage rates.”

Thus, any quarterly results should be understood within that problematic context. In other words, investors shouldn’t expect FedEx to knock it out of the park with the company’s quarterly data.

The first piece of good news is that FedEx managed to demonstrate moderate revenue growth. Specifically, the company posted Q4 FY-2022 revenue of $24.4 billion, versus $22.6 billion from the year-earlier quarter. Analysts polled by FactSet had modeled $24.5 billion in revenue, so we can call the actual result in-line with expectations.

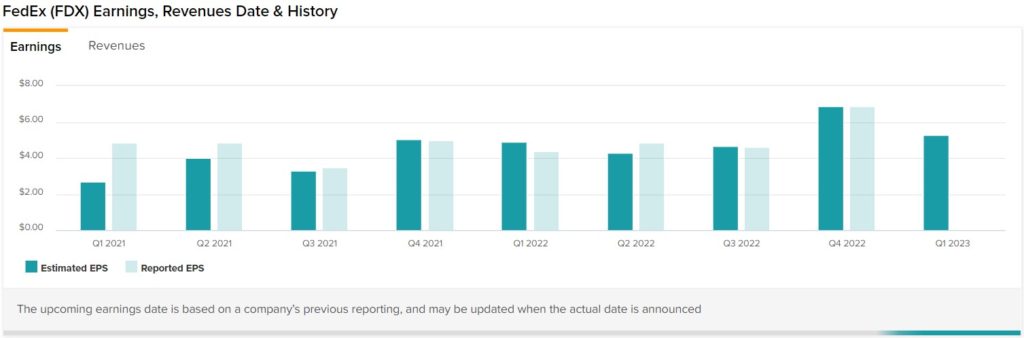

Turning to the bottom-line results, FedEx posted diluted/adjusted GAAP earnings of $6.87 per share. This result was roughly in-line with the analysts’ estimate of $6.88 per share, and it showed improvement over the prior year’s result of $5.01 per share.

Perhaps the most notable result for the quarter was FedEx Freight’s operating margin improvement of 570 basis points to 21.8%. According to the company, “The improved results were driven by a 28% increase in revenue per shipment from the continued focus on revenue quality and profitable growth.”

Teed Up for a Good Year

While FedEx’s Freight segment certainly performed well, the real star of the show might have been FedEx’s guidance for Fiscal Year 2023. To quote Argus Research President John Eade, “Their guidance is aggressive, much higher than Street anticipations for next year. So they’re teed up to have a good year in their Fiscal 2023.”

Before various adjustments, FedEx anticipates full-year diluted EPS of $22.45 to $24.45. That’s above what the analysts had expected, as they were preparing for Fiscal 2023 EPS of roughly $22.21. The company’s optimistic outlook may be the catalyst that caused a pop in the FedEx share price in after-hours trading following the earnings release.

Clearly, FedEx Executive Vice President and CFO Michael C. Lenz is preparing for a strong finish to the fiscal year. “We expect further momentum in Fiscal 2023 and beyond as we execute on our initiatives to drive increased profitability and returns,” Lenz assured.

On top of all that, FedEx is engaged in an aggressive share buyback program. During Fiscal 2022, FedEx repurchased $2.2 billion of the company’s common stock. Moreover, in Fiscal 2023’s first half, FedEx expects to repurchase $1.5 billion worth of its common stock.

Wall Street’s Take

Turning to Wall Street, FDX comes in as a Strong Buy, based on 12 Buy and three Hold ratings. The average FedEx price target is $293.86, implying 20.8% upside potential.

The Takeaway

There are plenty of reasons to like FedEx now. The company is buying back its own shares, which is a sign of self-confidence. Plus, the shares are trading at a low valuation, and investors can expect to receive consistent dividend payments over the long term.

So, don’t worry if FedEx’s results were only “in line.” The company’s ambitious forward guidance – and its ability to produce decent results under difficult conditions – should offer plenty of encouragement for FedEx stockholders today.