Logistics giant FedEx (NYSE:FDX) is scheduled to announce its fiscal second-quarter results after the market closes on Tuesday, December 19. The company’s bottom line is expected to have benefitted from its cost-reduction strategies. Also, the bankruptcy of the rival firm Yellow may have led to increased demand for FDX’s services in the to-be-reported quarter, thereby aiding revenues. Ahead of the company’s earnings release, most Wall Street analysts are bullish on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street expects FedEx to post earnings of $4.19 per share in Q2, nearly 32% higher than the prior-year period figure of $3.18. Meanwhile, sales are projected to decline by 2% to $22.35 billion.

Q2 Earnings: Here’s What Analysts Are Saying

Ahead of the Q2 earnings release, Baird analyst Garrett Holland raised the price target on FedEx to $315 from $300 while maintaining a Buy rating. The analyst expects the company to modestly beat analysts’ expectations. Holland expects that the company’s global transformation plan will improve its long-term profitability.

In a note to investors dated December 14, Holland projected a 1% increase in Ground revenue (small-package ground delivery revenue). On the other hand, the analyst sees a 4% decline in the Express (time-critical small-package ground delivery and airfreight transportation services) segment’s revenue, reflecting sluggish demand in Asian and European markets.

Moving on, UBS analyst Thomas Wadewitz reiterated a Buy rating and a $323.00 price target on FedEx. The analyst expects the company to deliver a strong earnings report. Additionally, Wadewitz anticipates that the company’s cost-saving initiatives will improve its margins.

Is FDX a Good Buy?

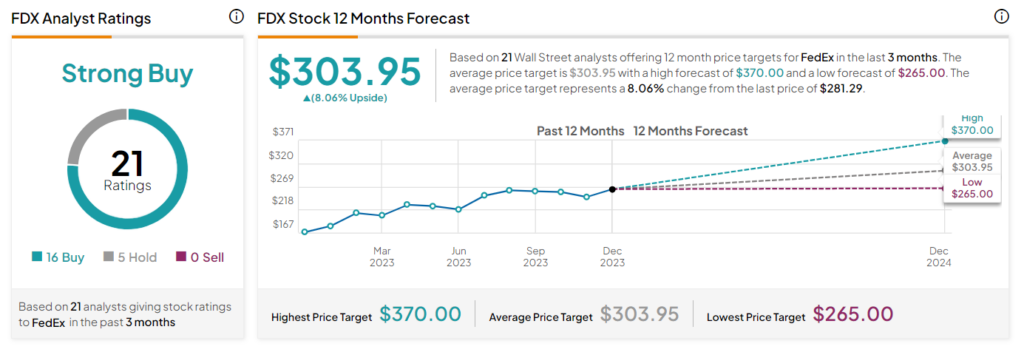

Wall Street analysts maintain an optimistic outlook about FDX stock ahead of the Q2 print. It has received 16 Buy and five Hold recommendations for a Strong Buy consensus rating. Furthermore, analysts’ average price target of $303.95 implies 8.06% upside potential.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 5.12% move on FedEx’s earnings, compared with the previous quarter’s earnings-related move of 4.52%.

Ending Note

The company’s aggressive cost-cutting measures and expected improvement in margins could support its stock price. In addition to this, Wall Street remains bullish on FedEx’s long-term growth potential.