It’s tough to be an investor as the stock market continues to feel the pressure of rising interest rates and economic pressures. The bear market has gone on for quite a while, and while FAANG stocks have seen slight cracks in their armor, I view their plunges as more of a buying opportunity than a cause for concern.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the end of the day, big tech has proved itself as a market leader through the years. One bad year for the cohort doesn’t signify the beginning of the end.

Though we’ve enjoyed some relief in the form of market rallies (or bear-market rallies), it’s tough to envision markets rallying sustainably higher from here, given the list of concerns. After a choppy year, dip-buying has definitely been tempered.

A couple of short-lived bear bounces will do that!

As investors bid 2022 farewell, market sentiment could reverse quickly as we move closer to a recession. Dip-buyers may not be so quick to chase as more doubt about a rally’s sustainability grows with every faltered bear-market bounce. Still, long-term investors need not focus on the near term.

Today, I view FAANG stocks as a great value. They’re large and profitable, making them more comfortable plays in stagflationary environments that could be life-of-death for tech unicorns with no hopes of making a profit.

FAANG and MATANA: Looking to Big-Tech Innovators for Leadership

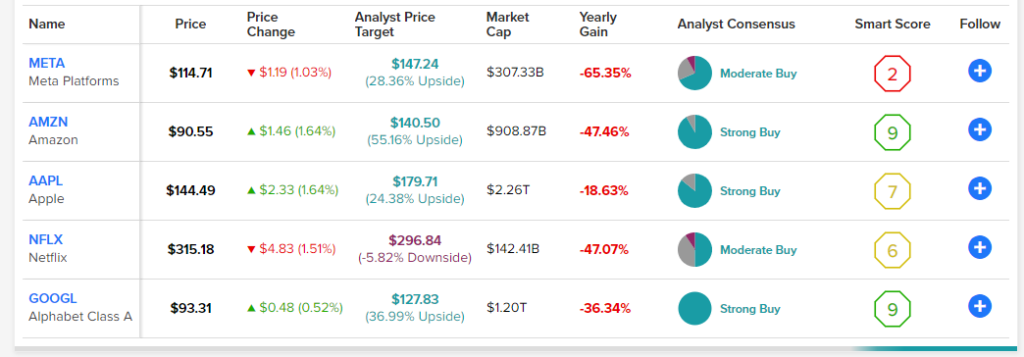

Though FAANG offers a great bang for your buck after the vicious 2022 tech-centered sell-off, it’s hard not to notice the epic decline of Meta Platforms (NASDAQ:META) and Netflix (NASDAQ:NFLX). Arguably, both tech stocks deserve “the boot” from the prestigious big-tech group, given decaying fundamentals. Meta and Netflix shares have imploded more than 70% from peak to trough, while Apple (NASDAQ:AAPL), a FAANG mainstay, fell just north of 20%.

Indeed, the FAANG group is in need of a refreshing update! Here at TipRanks, we think there’s a better way to represent innovation for the post-2022 era.

Enter “MATANA,” a group I view as a better representation of the big-tech innovators. The group consists of Microsoft (NASDAQ:MSFT), Apple, Tesla (NASDAQ:TSLA), Alphabet (NASDAQ:GOOGL), Nvidia (NASDAQ:NVDA), and Amazon (NASDAQ:AMZN).

Each tech titan has a wide moat with long-term fundamentals fully intact.

Though FAANG and MATANA will face challenges going into 2023, it all comes down to how actual results stack up against the current slate of estimates. Arguably, there’s a low bar for many companies that may be able to power through a recession year without enduring too much pain.

FAANG vs. MATANA: Value vs. Innovation

There’s no doubt that MATANA stocks deserve a better grade than FAANG for their performance through 2022. Still, valuations seem better for the FAANG group.

Undoubtedly, Meta is a deeply-discounted tech play that could help FAANG power better results in the new year.

While the MATANA group is a better representation of innovation, the average valuation is quite a bit loftier than FAANG, even after a turbulent year for the broader tech industry. For example, shares of Nvidia remain uncomfortably expensive at 15.1 times sales. If the tech wreck isn’t quite over yet, with more Fed interest rate hikes in store for 2023, Nvidia is one of the names that could weigh down the MATANA basket.

Now, Nvidia is a spicier tech name with one of the hottest long-term growth stories in the large-cap tech space. That said, questions linger as to which valuation range Nvidia stock should settle. In any case, the stock will likely be one of the bigger movers in 2023, with its high 1.74 beta.

The Bottom Line

FAANG and MATANA stocks are finishing 2022 in a tough spot. However, there have been signs of relief in recent months amid the broader market’s bounce off its bear-market lows.

Personally, I’m a bigger fan of the FAANG cohort. The growth stories of Meta and Netflix have been challenged. Nonetheless, I think the selling activity has already run its course. Further, Meta and Netflix deserve the time to turn things around. Meta’s metaverse and Netflix’s pivot into gaming could help them claw their way back in 2023.