As Europe once again descended into armed conflict, Exxon Mobil (XOM) and the rest of the oil and gas sector enjoyed a cynical boost as U.S.-led sanctions against Russia effectively shelved a large portion of hydrocarbon energy supplies. More recently, though, rising recession fears have cut into Exxon Mobil’s previously bullish narrative. Nevertheless, fundamental catalysts may not be denied. Due to this, I am bullish on XOM stock.

Peaking on June 8 of this year, XOM stock closed the session at $104.59. Had the calendar finished out 2022 at that point, Exxon Mobil would have returned shareholders a profit of nearly 65% over the past 365 days. After struggling amid the catastrophic impact of the COVID-19 pandemic, Russia’s invasion of Ukraine essentially bailed out the company and its rivals.

However, in the month-long period between June 13 and July 8, XOM stock suffered a 10% loss. Two main factors contributed to the sudden shift in sentiment.

First, the crude oil sector suffered a demand problem as soaring inflation eroded the purchasing power of the U.S. dollar, in turn imposing a tax on real household earnings. Second, the segment incurred a supply shift as the Biden administration released crude oil from the Strategic Petroleum Reserve (SPR). More supply and less demand logically translated to reduced appetite for XOM stock and its ilk.

Nevertheless, it might be premature to exit out of the Exxon Mobil trade. Indeed, some speculators might be intrigued about its fundamental catalysts.

On TipRanks, XOM scores an 8 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to outperform the broader market.

Reality is a Friend for XOM Stock

On Friday, July 8, The Wall Street Journal noted that the price of gasoline in the U.S. had fallen for 24 straight days. As stated earlier, inflation began taking its toll on consumer sentiment. On a related matter, the rapid decline in purchasing power contributed to overall concerns that the economy may dip into a recession.

Based on the immediate evidence, going long on XOM stock seems risky. However, the reality of the broader energy paradigm bodes well for Exxon Mobil and the rest of the hydrocarbon complex.

First, the summer travel season is in full bloom. Indeed, prior to the Fourth of July weekend, travel experts forecasted that 47.9 million people would travel during the holiday, setting a new record despite soaring gasoline prices. Therefore, the respite at the pump would likely be temporary.

Second, no real transportation alternatives to fossil fuels exist. Before anyone yells out electric vehicles, investors must remind themselves that the average transaction price for a new EV hit slightly over $60,000 in February of this year. It’s very possible that this metric is even higher today.

Further, against a U.S. median household income – that is, income that every person within the same home contributes in total – of approximately $70,000, paying 86% of annual earnings toward a vehicle makes little financial sense.

Like it or not, most consumers are dependent on hydrocarbons, thus supporting the cynically bullish case for XOM stock.

Even Solutions are Actually Problems

While the matter is indelicate, it’s unavoidable that economics often mix with politics. For XOM stock, the Biden administration is almost certainly looking at its eroding approval rating and waning support for the ruling Democrats. Such dynamics likely factored into the decision to tap into the SPR to help alleviate pain at the pump.

On paper, the basic economic equation – higher supply, lower demand (prices) – inherent in the release of crude from the SPR implies a headwind against XOM stock. However, this is a bearish factor in the most temporary sense. Longer term, Mother Nature may become the ultimate arbiter.

While loosening the SPR’s spigot may score points with the electorate right now, it’s important to realize that this resource doesn’t merely serve an economic purpose. Rather, it serves a structural one, particularly if the country suffers a rough hurricane season. Without adequate levels in the SPR, the Biden administration may end up trading temporary relief for devastating longer-term consequences.

At some point, President Biden’s Cabinet may warn him against depleting the SPR, perhaps even going so far as to suggest increasing its reserve levels. Under that scenario, XOM stock would likely resume its bullish trajectory.

Wall Street’s Take

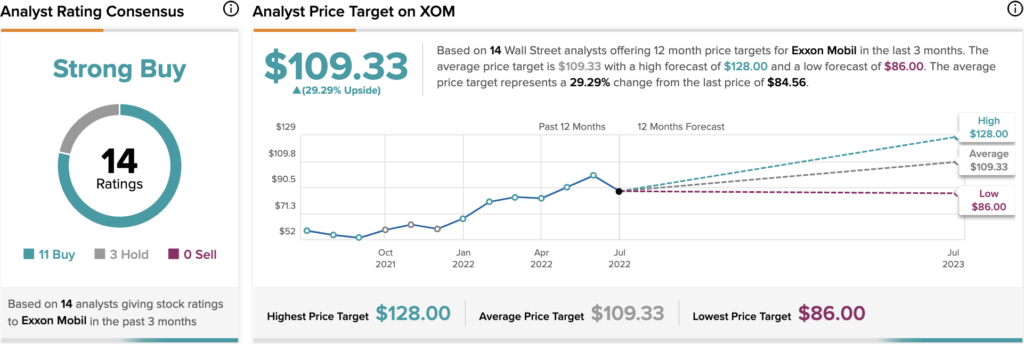

According to TipRanks’ analyst rating consensus, XOM is a Strong Buy, based on 11 Buys, three holds and no sell ratings. The average Exxon Mobil price target is $109.33, implying 29.29% upside potential.

A Discount with a Limited Time Window

Some discounted trades in the market are simply stocks tied to fundamentally unsound businesses. With XOM stock, however, investors have a legitimate opportunity. Exxon Mobil features both strengths in its balance sheet along with solid profitability metrics. In particular, the company’s net margin of 8.4% is conspicuously higher than the median for the oil and gas industry, which sits at 3.29%.

Moreover, the volatility in XOM stock is largely connected to immediate headwinds, such as the release of crude from the SPR. However, such dynamics are unlikely to continue manifesting in the future, therefore making Exxon Mobil an interesting idea to consider.

Read full Disclosure