Extreme Networks (NASDAQ:EXTR) is Needham analyst Alex Henderson’s “single best idea” in networking for 2024. The analyst maintained a Buy rating and price target of $23 on EXTR stock on December 28.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

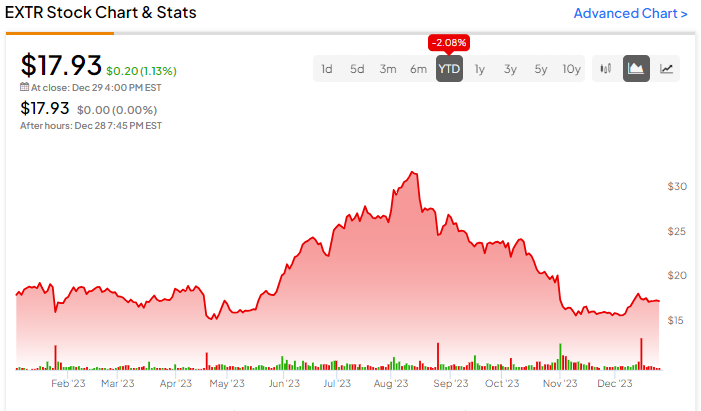

The company provides cloud-based networking solutions. It designs and manufactures wired, wireless, and SDWAN (Software-Defined Wide Area Network) infrastructure equipment. While Henderson is bullish, EXTR’s shareholders didn’t have much to cheer about in 2023 as Extreme stock underperformed the broader markets and is down about 2% year-to-date.

Nonetheless, Henderson expects EXTR to benefit from margin expansion and inventory normalization. The analyst believes “Extreme can regain double-digit growth while also having a margin expansion story.” However, he warned that the company will have a slow start to CY2024 due to the tough year-over-year comparisons.

Is EXTR Stock a Good Buy?

Extreme Networks is benefitting from its growing average deal size, new customer wins, quarter-over-quarter growth in the number of deals over $1 million, and high customer retention. Thanks to its solid operating metrics, the company’s top line increased 19% year-over-year in the first quarter of Fiscal 2024. At the same time, its EPS jumped by 75% to $0.35.

Though Extreme Networks is performing well, a challenging macro environment and an elevated interest rate environment have slowed its growth in some large markets and lengthened its sales cycles. This is why analysts are cautiously optimistic about EXTR’s prospects.

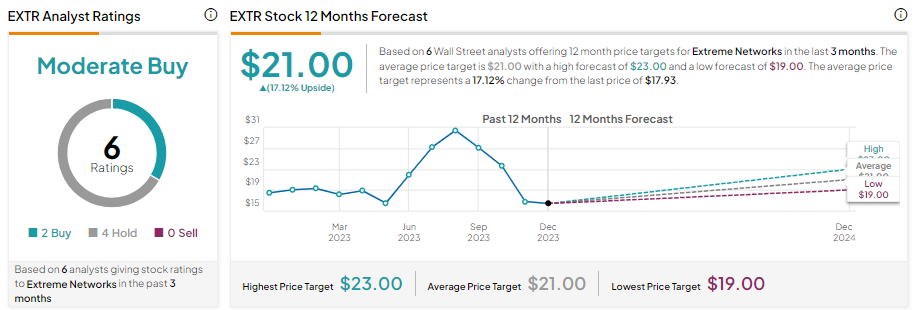

With two Buy and four Hold recommendations, EXTR stock has a Moderate Buy consensus rating. Analysts’ average price target of $21 implies 17.12% upside potential from current levels.

Bottom Line

Needham analyst Henderson expects EXTR’s growth to accelerate. Moreover, inventory normalization and expectations of margin expansion keep the analyst bullish. However, macro headwinds are taking a toll on industry-wide customer orders, posing a challenge for the companies operating in the networking space.