Joining 2021’s extensive list of IPOs, Expensify (EXFY) went public a month ago and has already attracted notable analyst coverage. J.P. Morgan’s Sterling Auty has also been taking notes.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

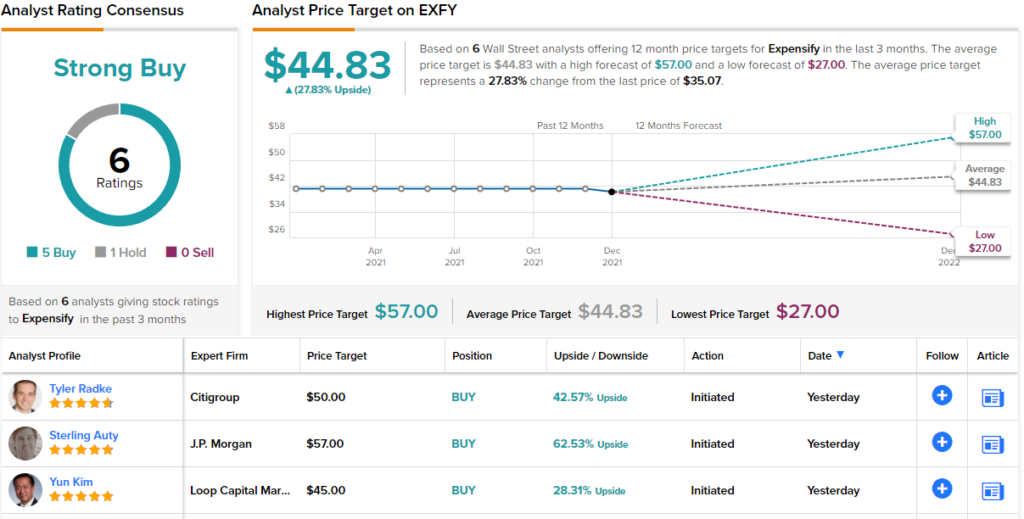

The analyst initiated coverage with an Overweight (i.e., Buy) rating and $57 price target, suggesting shares have room for 62% growth over the next year. (To watch Auty’s track record, click here)

So, what has piqued Auty’s interest? Well as the name implies, the company provides an online tool for companies to record expenses. On the surface, this does not appear such a novel idea, as expense management software has been around for ages and used by enterprises. However, the problem is that vendors have yet to find a “profitable and effective” way of catering to the SMB (small- and medium-sized businesses) market. Auty believes Expensify has rectified this problem.

“Expensify, with its AI-base expense management cloud software and unique user adoption model, has cracked the code, leading to best-in-class profitability at its revenue scale,” the analyst said.

The company might be addressing the issues of smaller businesses, but this is a sizeable market. Auty believes that across the globe there are more than 100 million employees at companies with a head count below 500, indicating there’s potentially a TAM (total addressable market) over $21 billion.

Another factor which has impressed Auty is that in contrast to many high-growth software IPO companies which operate at a loss, Expensify shows that it is possible to grow and at the same time turn a profit. Revenue increased by ~88% in the last quarter, with operating margins coming in above 40%. “This is particularly impressive for a company that we anticipate will generate ~$140 million in revenue this year,” the analyst added.

The company also has a differentiated tech approach. Instead of using the public cloud, Expensify uses its own cloud infrastructure and has based the core of the platform on blockchain technology. This way the company retains control of security and redundancy while also enabling it to “scale up to multiples of the current usage without needing to add additional infrastructure capacity.” Auty believes this will serve to create “unique opportunities to become both a B2B and B2C vendor in the future.”

Most of Auty’s colleagues agree Expensify’s prospects are sound. Looking at the consensus breakdown, barring 1 Hold, all 5 other reviews are positive, providing this stock with a Strong Buy consensus rating. The forecast calls for 12-month upside of 28%, given the average price target currently stands at $44.83. (See Expensify stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.