Li Lu’s most recent 13F filing reveals that he picked up some 480,000 shares in East West Bancorp (NASDAQ:EWBC), now accounting for over 8% of his portfolio. EWBC is a bank that operates in the U.S. and Greater China. It services people and businesses in both countries synergistically and offers various services, such as loans, deposits, payments, and investments. EWBC is unique in that it bridges the gap between the U.S. and China and offers Asian-American citizens a tailored banking solution.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

EWBC stock has been lagging behind the S&P 500 (SPX) and the KBW Bank Index this year despite delivering strong earnings and revenue growth in the past quarters. Therefore, as the year comes to a close, many investors are seeking ways to minimize their tax liabilities by selling off stocks that have performed poorly. This leads to a situation commonly referred to as tax-loss selling, where the prices of beaten-down stocks may experience more pressure.

Therefore, in this article, we will take a closer look at why Li Lu, also referred to as the “Chinese Warren Buffett,” decided to invest in EWBC and what makes it a compelling investment. I am bullish on EWBC stock for October and beyond, as it offers a combination of value, growth, and income at a steep tax-loss-selling discount. Investors who are willing to look past the short-term volatility and take a long-term view could be rewarded with attractive returns.

Victim of Tax Loss Harvesting

According to Morgan Stanley (NYSE:MS), there are 81 companies that will have technical pressures due to tax loss selling in Q4 of 2023, and EWBC is among those named. However, this could be a great opportunity for savvy investors who are looking for a bargain.

EWBC is trading at a low valuation compared to its past, with a P/E ratio of 5.8 compared to its 10-year median P/E of 13.8, as well as a price-to-book ratio of 1.13, lower than its 10-year median multiple of 1.83. It also pays a healthy dividend of 3.7%, which is well covered by its earnings. EWBC is at its lowest price since June and has demonstrated that it’s not a regional bank to be worried about.

EWBC is Unrivaled in Deposit Management

EWBC’s Consumer and Business Banking division is the core of the bank’s deposit-gathering activities. It holds an impressive total average of $33 billion in deposits, with about one-third of them being non-interest-bearing demand deposits. This division provides the vital fuel for EWBC’s operations.

What makes EWBC stand out is its skillful use of these deposits. Instead of lending out all of its funds, the bank only lends out half of them and still maintains a high net interest margin. The leftover funds are smartly deployed in commercial lending activities and securities investments. This unique strategy allows EWBC to optimize the value of its deposit base and generate superior returns.

The Chinese Warren Buffett Appears Bullish

Li Lu is a big deal for EWBC. He is one of the best investors in the world and a close friend of Warren Buffett. He was even in discussion to be the successor of Buffett in leading Berkshire Hathaway. Li Lu likes EWBC and according to the most recent 13F filing, he bought some shares. This means he sees something good in the bank, and he might help it grow more.

EWBC is lucky to have Li Lu on its side. He knows how to make money and he has a lot of connections. The insiders share his faith in EWBC. They have bought nearly $2 million worth of shares in the last six months. They know the bank better than anyone and they believe in its future.

This investment has all the hallmarks of a Warren-Buffett-style investment. Luckily for investors, Li Lu has much less capital than Buffett and thus invests in companies Buffett simply can’t. Li likely identified EWBC for its undervaluation after the Silicon Valley Bank crisis, its moat among Asian-American citizens, its unrivaled deposit management, and its stable dividend. Now, investors can acquire shares at a similar price per share thanks to tax-loss selling headwinds.

Warren Buffett once advised investors, “Be fearful when others are greedy and to be greedy only when others are fearful.” Li Lu is doing just that here, capitalizing on the regional banking crisis fears at the time he initiated a position. Lucky for us investors, EWBC now trades at around the prices he likely scooped it up for.

Is EWBC Stock a Buy, According to Analysts?

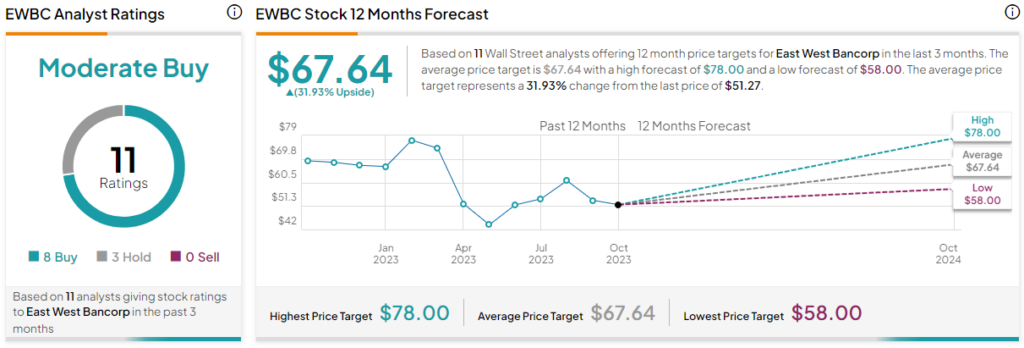

Turning to Wall Street, EWBC has a Moderate Buy consensus rating based on eight Buys and three Holds assigned in the past three months. At $67.64, the average EWBC stock forecast implies 31.9% upside potential.

The Takeaway

EWBC is a bank that has a lot of potential to grow and make money. It has a unique advantage in serving the Asian-American community and doing business with China. It also has a low valuation, a sustainable dividend, and a smart deposit management strategy. These are likely some of the reasons why Li Lu, the Chinese Warren Buffett, is buying this regional bank and why investors may want to consider following his lead and buying EWBC at a steep tax-loss-selling discount right now.