When the Biden administration announced its infrastructure bill, which earmarked $5 billion over five years to build a national electric vehicle charging network, it was a major milestone for the industry. Investors quickly sent every stock related to EVs through the roof, but not all of them are created equal. In this piece, we used TipRanks’ Comparison Tool to evaluate two EV charging stocks — EVgo (NASDAQ:EVGO) and Blink Charging (NASDAQ:BLNK) — to see which one has the most potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A review of EVgo and Blink Charging business models reveals reasons to be long-term bullish on EVgo but bearish on Blink.

There are Many Players in the EV Market

Perhaps the most important takeaway investors should understand from any article about EV charging is that there are many business models — and not all of them are attractive. Some are far more profitable than others, so investors would do well to learn about those employed by the companies whose stocks they want to buy.

For example, EVgo provides electric vehicle charging to individual drivers, commercial customers, and fleet owners via its owned infrastructure and collects revenue from users when they charge their electric vehicles. This business model brings in revenue from charging in a variety of situations, and by monetizing regulatory credits generated by its charging activities.

On the other hand, Blink Charging offers a variety of different plans to those that host its charging plugs — some of which bring very little revenue to Blink at all. ChargePoint (NYSE:CHPT), the biggest player in the space including all types of charging plugs, makes money by selling charging stations.

Aside from the many business models, the other big story in the world of EV charging is the Biden administration’s infrastructure bill. It will pay almost $5 billion over five years to help states build an EV charging network along designated Alternative Fuel Corridors, especially U.S. interstates.

To be eligible for those federal funds, the EV charging stations must have at least four fast-speed plugs and non-proprietary chargers, meaning they work for vehicles from multiple automakers. The bill requires level three direct-current fast chargers, which can charge a vehicle almost to fill in 15 to 45 minutes, depending on the vehicle.

EVgo

EVgo owns and operates the largest public DC fast-charging EV network in the U.S. and is the first charging network in the U.S. powered 100% by renewable energy. For these reasons, along with the path to profitability set out by management, and the attractive business model used, a bullish view of EVgo seems appropriate. However, the company is not profitable and probably won’t be until EV adoption is at a more mature stage, so this is certainly a long-term play.

EVgo’s business model involves building infrastructure in high-traffic, high-density areas to provide easy access to high-speed charging. Without an adaptor, the company’s DC fast-charging stations can charge all models of electric vehicles utilizing all charging standards available in the U.S.

EVgo earns charging revenue through multiple streams, including retail charging revenue, automaker revenue, and commercial charging revenue for high-volume fleets. Since the company owns the nation’s largest DC fast-charging network, it stands to benefit greatly from the infrastructure bill. Of course, we can’t know for sure which companies will capture the lion’s share of those funds. However, state agencies in Pennsylvania and California built DC fast-charging stations in those states, so it has captured government grant monies before.

Unfortunately, EVgo is unprofitable, as are other EV charging companies, but there are reasons to like this company over its competitors. Analysts generally expect EVgo to near profitability by 2025, with the long-term plan from management calling for more than $5 billion in revenue with an EBITDA margin of 35% to 40% — when EV penetration hits 15% in the U.S.

For now, EVgo brought in only $9.1 million in revenue for the second quarter of 2022, although that’s a 90% year-over-year increase. It’s showing signs of growth, adding 170 new stalls and about 67,000 new customer accounts during the quarter.

With a forward price/sales multiple of around 5.6 times, EVgo’s valuation has plummeted, which could mean an attractive entry point has been reached. It peaked at a 32 times price/sales multiple in November 2021, although that valuation seems too high in the current stage. EVgo’s closest peer is ChargePoint, which has fallen to a price/sales multiple of about 8.5 times.

Is EVGO Stock a Buy, Sell, or Hold?

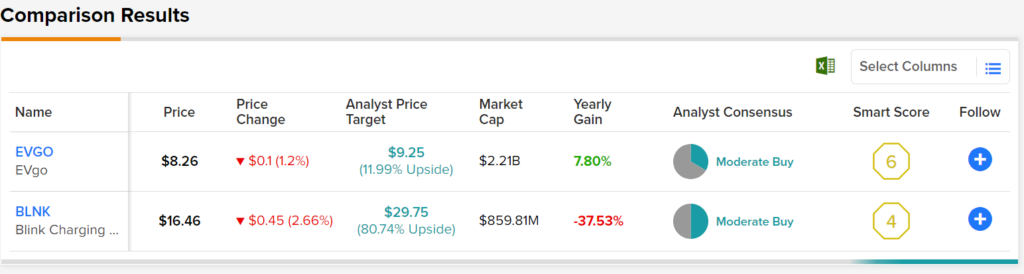

EVgo has a Moderate Buy consensus rating based on one Buy and two Holds assigned over the last three months. At $9.25, the average price target for EVgo implies upside potential of 12.4%.

Blink Charging

Blink Charging makes money through a variety of revenue streams, although the more attractive subscription and charging revenues made up only 18.6% and 13% of its second-quarter revenue, respectively. With a forward price/sales multiple of about 11 times, Blink Charging looks blatantly overvalued, especially when considering its unattractive business model. As a result, a bearish view appears appropriate for the company.

A review of Blink’s various revenue streams includes options like the “Blink-as-a-service plan,” under which it makes money by charging low monthly fees to host companies after paying for its own equipment and installation at their locations. The property owner keeps all the charging revenue for themselves.

The company’s second-quarter earnings report reveals that product sales, which cover charger installations with one-time fees, accounted for the lion’s share of Blink Charging’s revenue. The greater profit potential lies in service revenues, which include charging, network fees, and ride-sharing revenues. However, Blink’s service revenues amounted to only $2.2 million in the second quarter.

Of course, things aren’t all bad for Blink, so it may be worth monitoring at some point. The company’s total revenues rose 164% year-over-year in the second quarter of 2022, including a 170% increase in product sales and a 154% increase in service revenues.

What is the Price Target for BLNK Stock?

Blink Charging has a Moderate Buy consensus rating based on two Buys, two Holds, and zero Sells assigned over the last three months. At $29.75, the average price target for Blink Charging implies upside potential of 80.6%.

Conclusion: Long-Term Bullish on EVGO, Bearish on Blink

It’s doubtful that any EV charging company will be profitable until EV adoption picks up, but the industry is in a chicken-and-egg situation. Drivers need more stations before they will buy EVs, but those stations will continue to lose money until there is sufficient adoption. However, EVgo looks more attractive than Blink right now.

EVgo runs the nation’s largest public DC fast-charging infrastructure, but Blink focuses more on levels one and two chargers, although it does have some level three DC fast-charging stations. To benefit from the infrastructure bill, Blink will have to build more level three stations.

Finally, EVgo’s use of sustainable energy for its charging stations also suggests a highly profitable future down the line. Unfortunately, the downside is that investors will be waiting a while for this one to play out.