While the mood on Wall Street has significantly improved over the past several weeks, investors still concerned about market ambiguities may want to consider reinsurance giant Everest Group (NYSE:EG). Though not the most riveting idea, Everest offers superior financial performances, along with an economic backdrop that could be favorable for the business. Not too many investors are paying attention to EG stock, which I’d like to change because it offers a quietly bullish prospect.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

EG Stock Weathered the Storm Well

At its core, the reinsurance business essentially provides insurance protection for insurance companies. So, an individual driver has a primary relationship with his or her auto insurance firm. However, the auto insurance firm, in turn, protects against catastrophic risks through a risk-management policy with a reinsurance specialist like Everest Group.

Generally speaking, entities such as the one undergirding EG stock are dependable investments because of their risk-sharing profiles. By working with primary insurance companies, they collectively dilute exposure to financial losses from large or unexpected claims. In addition, insurance firms typically feature diverse portfolios – especially government-issued bonds – to bolster their overall returns.

However, the economic and monetary policy environment of 2022 and 2023 threw a monkey wrench into the narrative. With the benchmark interest rate jumping higher, the value of the bonds that Everest and its peers held declined. That’s because investors prefer newer bonds with higher yields rather than older ones with fixed (lower) rates.

Further, EG stock faced two years of catastrophic events. First, in early 2022, Russia invaded Ukraine, forcing many industries to reassess their risk exposure. Second, in October of last year, Hamas launched a surprise attack against Israel, again forcing many enterprises to re-evaluate their risk management strategies. Between these events, several other incidents occurred, impacting market and economic cycles.

Despite a chaotic environment, EG stock managed to perform reasonably well. Granted, the 6% return for 2023 isn’t exactly something to write home about, especially with the benchmark S&P 500 Index (SPX) gaining nearly 25%. Still, for all the variables that Everest had to manage, not losing represented a solid victory.

Even better, circumstances may improve in 2024. For one thing, the major geopolitical catalysts – Russian aggression and Hamas’ belligerence – are now known factors, facilitating potentially more accurate risk modeling. Second, the Federal Reserve may throw a bone to EG stock.

Lower Rates Could Boost Everest

A few weeks ago, Federal Reserve Chair Jerome Powell hinted at the possibility of three interest rate cuts to take place in 2024. To be clear, nothing is set in stone. However, policymakers have stated that they saw encouraging disinflationary data. Since they’re also eager to avoid a harsh recession, reduced borrowing costs represent a non-zero probability.

Should lower rates materialize, EG stock may enjoy a sentiment lift. Effectively, Everest would likely see the reverse of what initially challenged the reinsurance specialist. Under a dovish monetary policy, Everest’s bond holdings should rise in value since newly-issued bonds will feature lower yields.

More broadly, reduced borrowing costs should make premiums more affordable for both individuals and businesses. Therefore, the realistically addressable market for Everest should expand, potentially leading to higher returns for EG stock.

In addition, if the Fed succeeds in engineering a soft landing for the economy, the dynamic should deliver increased confidence for risk-taking. Here, it’s not just a matter of investors buying risk-on assets, though that could be the case. Rather, more individuals may decide to take the entrepreneurial route. Certainly, lower borrowing costs would entice such a thought process. Subsequently, Everest’s market could increase as demand for new risk-management products rises.

Ultimately, the biggest sense of relief centers on avoiding a much-dreaded recession. It’s possible that because so many people and institutions feared a downturn, they decided to batten down the hatches. Notably, the personal saving rate between November 2022 and November 2023 increased from 3.3% to 4.1%.

However, with the disaster apparently averted, risk-on sentiment may return. And that, again, could benefit EG stock.

Financials Point to Everest’s Resilience

For the final bullish argument for EG stock, investors should consider the underlying company’s return on equity (ROE). In 2022, this metric dipped as the Fed raised interest rates rather aggressively. However, as Everest acclimated to the brave new world, its ROE started to improve.

At the end of the third quarter, this metric stood at 22.31%. in contrast, the sector median for the insurance industry sat at 13.71% during the same period.

Is Everest Group Stock a Buy, According to Analysts?

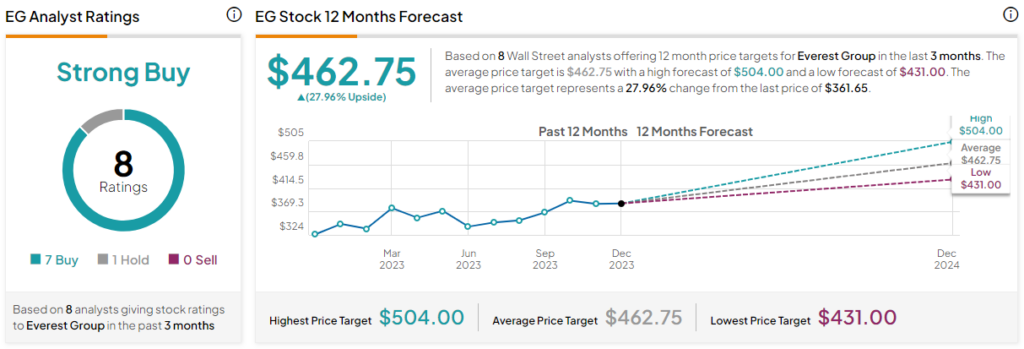

Turning to Wall Street, EG stock has a Strong Buy consensus rating based on seven Buys, one Hold, and zero Sell ratings. The average EG stock price target is $462.75, implying 27.96% upside potential.

The Takeaway: EG Stock is Ready for a Favorable Environment

Even when Everest Group was facing tough circumstances for the insurance industry (military conflicts and monetary policy pivots) it managed to steady the ship. Further, its ROE ended up significantly outpacing its sector peers. With the possibility of enjoying broader tailwinds this time, EG stock appears to be a sensible investment opportunity.