Amongst the new EV companies staking their claim as genuine contenders in this rising industry, Lucid Group (NASDAQ:LCID) has plenty going for it.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Helmed by former Vice President of Vehicle Engineering at Tesla and Chief Engineer of the Model S, Peter Rawlinson, the company makes luxury EVs with best-in-class tech that allows for longer range and improved efficiency. Its highly regarded Lucid Air has been the recipient of several awards since entering the market toward the end of 2021, while the company’s second offering, the Lucid Gravity SUV, is scheduled for a public unveiling in November with production on course for 2024.

Moreover, in June, the company disclosed that it had formed a long-term strategic partnership with Aston Martin, for whom it will provide powertrain and battery systems worth upwards of $450 million. On top of phased cash payments that Lucid will receive over the duration of the deal, it will also be due a technology access fee and become an Aston Martin shareholder.

Baird analyst Ben Kallo expects there will be more agreements like that one on the way. “We speculate that this partnership may be the first of many for LCID given its differentiated performance capabilities and believe that partnerships will reduce the cash burden of scaling up LCID’s manufacturing footprint,” Kallo opined.

In fact, all the details noted above are ones Kallo highlights as strong selling points for Lucid. However, Kallo also has some misgivings.

For example, in 1Q23 and 2Q23, total deliveries reached 1,406 and 1,404, respectively, amounting to 60.8% and 64.6% of total vehicles produced during those periods. “While some gap is expected due to vehicles in transit and other logistical hurdles,” says Kallo, “the large difference and growing inventory has raised concerns about demand.”

That said, in anticipation of consumer health improving, the entrance to new markets and getting more exposure of the Lucid brand, over time, Kallo expects the gap to narrow.

Nevertheless, before that happens there are other issues to contend with. While Kallo believes Lucid’s performance is “among the best,” given its models’ high starting prices and a niche market segment, he sees a “challenging near-term setup.” As such, before becoming “more constructive” on the shares, he is looking for “improved consumer health and progress in LCID’s volume ramp.”

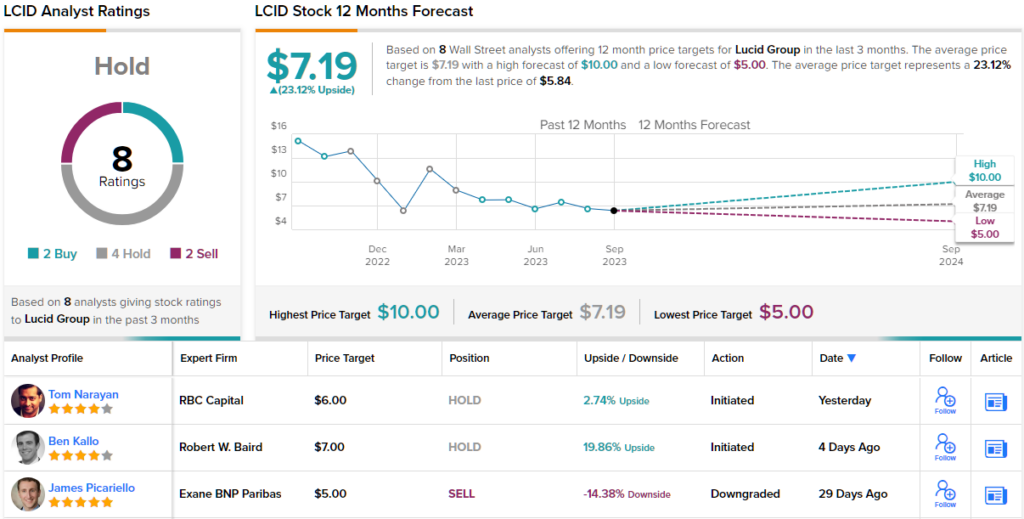

Considering all the above, then, Kallo rates LCID stock a Neutral along with a $7 price target. The figure suggests upside of ~20% for the year ahead. (To watch Kallo’s track record, click here)

Overall, Lucid shares have a Hold rating from the analyst consensus based on 8 recent analyst reviews, including 2 Buys, 4 Holds, and 2 Sells. Lucid shares sell for $5.84 and the average price target indicates an upside of ~23% from that level. (See Lucid stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.