Logically, investors interested in profiting off the global electric vehicle rollout should consider focusing on the most viable EV stocks. However, a possibly safer and more reliable approach may be to consider critical infrastructure companies like Vulcan Materials (NYSE:VMC). A major producer of aggregates-based construction materials, including asphalt and ready-mixed concrete, Vulcan will likely rise in relevance. Therefore, advocates of the EV industry should strongly consider VMC stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fundamentally, Vulcan Materials stands to swing higher over the long run, irrespective of a successful EV transition. According to the company’s website, “Historically, more than half of the aggregates we produce have been used in the construction and maintenance of infrastructure—highways and roads, and other public works projects.” With natural population increases along with gains from immigration, vehicle miles traveled will likely increase, boosting VMC stock.

In addition, with the passing of the Bipartisan Infrastructure Law (Infrastructure Investment and Jobs Act), Vulcan enjoys another compelling tailwind. Specifically, the legislation states that it “will reauthorize surface transportation programs for five years and invest $110 billion in additional funding to repair our roads and bridges and support major, transformational projects.” Again, that’s a win for VMC stock.

Even workplace pivots back to a normal pre-pandemic schedule should lift demand for Vulcan. As employers recall their workers, the exemption from the dreaded morning commute will be eliminated. Naturally, this dynamic means greater vehicle usage – and greater usage leads to more breakdowns.

Therefore, VMC stock enjoys plenty of upside catalysts on its own. However, the nature of EVs could send shares flying even higher.

Interestingly, on TipRanks, VMC stock has an 8 out of 10 Smart Score rating. This indicates solid potential for the stock to outperform the broader market.

The Extra Weight of EVs Could Bolster VMC Stock

Although the general consensus appears to be that the EV platform represents a game-changer in transportation – cleaner, quieter, and in many cases quicker – the transition away from combustion-powered vehicles isn’t without concern. Primarily, a major impediment to broader integration centers on electric vehicles being relatively heavy.

According to Fast Company, EVs indeed carry a weight problem. For example, the electric version of an F-150 truck weighs 35% more. When the framework focuses on segments such as heavy-duty trucks, the added load may impose significant challenges and risks.

For instance, the total net carbon footprint of unnecessarily heavier EVs pollute more than they need to. Further, survivable accidents can turn into deadly ones. However, as it relates to VMC stock, the tremendous bulk of EVs may be a cynical upside catalyst.

According to researchers at the Delft University of Technology, the EV platform’s heavier weight (due to the underlying robust battery) doesn’t just cause tires to wear out faster. Rather, the top layer of asphalt will wear down quicker due to EVs commanding higher acceleration capacity.

“Asphalt is an extraordinary material. The faster you accelerate, the harder it gets and the more counter-pressure it gives,” explained Sandra Erkens, professor of applied civil engineering at the TU Delft.

From a societal point of view, the extra wear and tear presents an additional environmental impact. However, for Vulcan, this dynamic translates to more business, and that should bode well for VMC stock.

Is VMC a Good Stock to Buy?

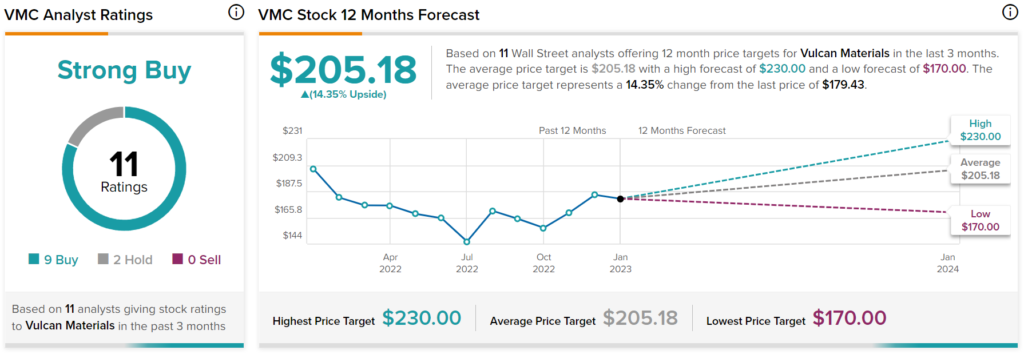

Turning to Wall Street, VMC stock has a Strong Buy consensus rating based on nine Buys, two Holds, and zero Sell ratings. The average VMC price target is $205.18, implying 14.35% upside potential.

Vulcan Requires a Patient Hand

While the fundamentals seemingly facilitate an upside pathway for VMC stock, investors should note that this thesis requires patience, and that’s because the financial picture doesn’t offer the most welcoming angle.

For instance, Vulcan’s balance sheet features decent stability – not terrible, but not great. Most notably, the company’s Altman Z-Score stands at 3.05, somewhere in the “gray zone” of fiscal resilience. In other words, Vulcan doesn’t have a high risk of bankruptcy, but management can’t relax for too long.

In terms of value, objectively speaking, VMC stock rates as overvalued. For instance, shares trade hands at 25.1 times forward earnings, well above the industry median of 9.6 times.

However, on the positive side, Vulcan features a return on equity of about 9%, beating out 62% of its peers. Further, its net income margin of 8.3% exceeds more than 64% of the competition.

Perhaps the final word should come from smart money. Currently, sentiment among hedge funds rates as positive for VMC stock. For anyone looking for a creative approach to EVs, Vulcan may be your ticket.