In this piece, I evaluated two e-commerce stocks, Etsy (NASDAQ:ETSY) and eBay (NASDAQ:EBAY), using TipRanks’ comparison tool to determine which is better.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Etsy is an e-commerce company focused on handmade and vintage items from individual sellers, including jewelry, bags, furniture, art, home décor, and clothing. eBay is an e-commerce site primarily focused on online auctions that facilitates consumer-to-consumer and business-to-consumer sales.

Shares of Etsy have gained 27.7% over the last year, but they’re down 16.6% year-to-date, eating into last year’s enormous gain. eBay shares are up 8% over the last year and year to date.

The U.S. e-commerce industry is trading at a price-to-sales (P/S) ratio of 3.9, slightly ahead of its three-year average of 3.3. The pandemic matured the industry much faster than would have occurred otherwise, but as shopping habits normalize, some companies are struggling.

Etsy (NASDAQ:ETSY)

At a P/S multiple of 4.4, Etsy immediately looks expensive relative to its industry, although its five-year mean P/S is 10.2. A deeper dive into the company’s financials reveals a worrisome balance sheet as the company swung to a loss in 2022 and remains unprofitable on a 12-month basis. Thus, a bearish view seems appropriate.

Etsy enjoyed explosive growth in 2020, more than doubling its sales from 2019. However, its sales growth fell to 35% in 2021 and then 10% in 2022, causing the company to swing to a loss last year. The most recent quarter wasn’t great either, so Etsy remains unprofitable for the last 12 months.

The good news is that Etsy is free-cash-flow positive, generating $664 million over the last 12 months. However, its balance sheet is a bit concerning. Etsy had $1 billion in cash and short-term investments over the last 12 months, but its total assets are worth $2.5 billion versus its total liabilities of $3 billion. The result is a negative debt/equity ratio, which is bad news because it suggests significant risk, especially considering the lack of net income.

In short, investors might want to ask themselves whether an unprofitable company with concerning financial trends deserves a market capitalization of almost $11.4 billion.

What is the Price Target for ETSY Stock?

Etsy has a Moderate Buy consensus rating based on 12 Buys, five Holds, and two Sell ratings assigned over the last three months. At $118.78, the average Etsy stock price target implies upside potential of 28.6%.

eBay (NASDAQ:EBAY)

At a P/S of 2.4, eBay is cheap relative to its industry, although it’s trading near Amazon’s (NASDAQ:AMZN) P/S of 2.5. eBay is also slightly discounted from its five-year mean P/S of 3.1, and the stock remains well below its 52-week high of $52.23, having been punished for its lack of full-year guidance despite its robust fourth-quarter earnings and solid first-quarter sales guidance. Thus, a bullish view seems appropriate.

Over the last three years, eBay has consistently traded slightly below its industry, but currently, it’s trading at a deep discount to the industry. This is particularly true when looking at the company’s long-term stock chart.

eBay shares are up more than 13,000% since 1998 and 18% over the last five years. In fact, when eBay was trading around its recent peak in late 2021, its P/S was still only in the 4-4.5 range, suggesting this stock may avoid some of the euphoria that surrounds other e-commerce names.

From a financial standpoint, eBay did swing to a loss in 2022 after solid sales growth of 17% to 20% in 2020 and 2021. However, the company recovered in its latest quarter and is back in the green for the last 12 months, demonstrating staying power and solid execution.

eBay’s balance sheet is in decent shape, with $6.9 billion in cash and short-term investments, total assets of $20 billion, and $14.6 billion in total liabilities for the last 12 months. It’s also generating plenty of cash, recording free cash flow of $2 billion for the last 12 months.

Finally, eBay has a dividend yield of 2.1%, which is a nice bonus, given that most tech and e-commerce companies don’t pay dividends.

What is the Price Target for EBAY Stock?

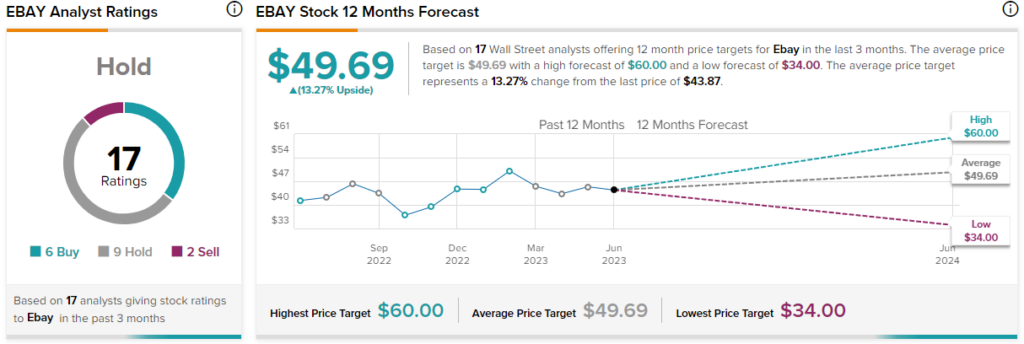

eBay has a Hold consensus rating based on six Buys, nine Holds, and two Sell ratings assigned over the last three months. At $49.69, the average eBay stock price target implies upside potential of 13.3%.

Conclusion: Bearish on ETSY, Bullish on EBAY

E-commerce companies received a giant push forward during the pandemic when consumers were forced to stay home and shop online. However, some of that online demand is starting to shift back to brick-and-mortar retail.

Etsy looks troublesome due to its lack of profits and weak balance sheet. However, eBay has demonstrated staying power during economic turmoil, recording revenue growth of 11% and 2% in 2008 and 2009, respectively, despite tumbling consumer spending.