Etsy stock (NASDAQ:ETSY) has seen a 47% drop in the past year, resulting in its valuation being near an all-time low. Nevertheless, managing a family of online marketplaces like Etsy, Reverb, and Depop, the company continues to show strength with rising profits. Leveraging its enhanced profitability, the firm now strategically engages in substantial bulk repurchases of its undervalued stock, hinting at promising upside potential. As a result, my stance on the stock remains bullish.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Results Remain Strong Despite Market’s Pessimism

Despite Mr. Market’s evident pessimism toward Etsy stock, the company continues to perform well, defying the prevailing negative sentiment in the market over recent months. In particular, in its most recent Q3 results, the company posted consolidated gross merchandise sales (GMS) of $3.0 billion, up 1.2% year-over-year.

While this might appear as a modest uptick, it’s crucial to acknowledge the impact of a challenging macroeconomic landscape on consumer spending for discretionary products. Additionally, the mid-quarter divestiture of Elo7 contributed to a slight setback in GMS growth. Despite these challenges, Etsy’s revenues recorded a 7% increase, reaching $636 million for the quarter.

The accelerated growth in Etsy’s payment speed fueled the revenue boost, primarily propelled by a shift toward more international transactions with higher fees. Subsidiary payment fees and increased revenue from offsite ads also played a role in boosting overall results. Notably, the Services segment was the standout performer in driving top-line growth, experiencing a substantial 16% year-over-year increase.

Etsy Ads emerged as the chief catalyst for this strength, as the company optimized its functionality to better evaluate potential listing conversion and pricing within its ad ranking system. This optimization allowed Etsy to display more ads in search results without adversely affecting its conversion rate. In fact, the company maintained a consolidated take rate of 20.9%, aligning with the previous quarter and slightly surpassing the take rate implied at the midpoint of its prior quarterly guidance.

In summary, it’s evident that Etsy’s marketplaces remain highly active despite the current macroeconomic environment. Management’s strategic decisions, particularly in optimizing monetization while fostering a flourishing marketplace, are paying off. Its Q3 results underscore this success, with a 3.4% and 19% year-over-year increase in the number of active buyers and sellers, respectively. An increasing number of buyers gives a strong incentive to sellers to list on Etsy’s platform.

Earnings Growth, Stock Price Decline Create Low Valuation

Etsy’s robust revenue growth, coupled with enhanced profit margins resulting from divesting the less lucrative Elo7, drove impressive earnings growth in Q3. The notable growth in earnings, combined with shares plummeting in the past two years, has led to Etsy’s valuation being near an all-time low.

Specifically, in Q3, Etsy achieved a remarkable 40 basis point year-over-year expansion in its EBITDA margin, reaching an impressive 28.6%. This surpassed management’s initial guidance and marked the company’s highest adjusted EBITDA margin since Q4 2021, when a surge in consumer spending during the pandemic boosted sales. As a result, adjusted EBITDA increased by 8.6% to $182.2 million, with EPS reaching $0.64 for the quarter, setting Wall Street expectations for FY2023 at $4.73.

This forecast indicates 2.6% year-over-year EPS growth and a forward P/E of 14.8. Etsy’s forward P/E for the next 12 months also stands at a humble 14.6, right around the lowest forward valuation the stock has ever had. Seizing this opportunity, management capitalized on the undervalued shares, repurchasing about $297 million worth of stock in Q3 alone and a total of $723.6 million in the last 12 months. This is equivalent to nearly 10% of the current market cap.

In my view, Etsy’s strategic stock repurchases at these levels are poised to significantly enhance EPS over time and foster heightened investor interest. The company’s ability to swiftly reduce its share count, particularly if share prices remain stagnant, is likely to result in substantial shareholder value creation in the long run.

Is ETSY Stock a Buy, According to Analysts?

Regarding Wall Street’s sentiment on Etsy, the stock features a Moderate Buy consensus rating based on 12 Buys, nine Holds, and two Sells assigned in the past three months. At $74.39, the average Etsy stock price target implies 6% upside potential.

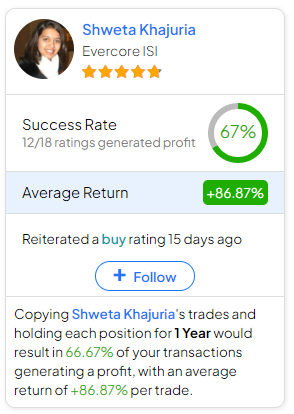

If you’re wondering which analyst you should follow if you want to buy and sell ETSY stock, the most profitable analyst covering the stock (on a one-year timeframe) is Shweta Khajuria from Evercore ISI, with an average return of 86.87% per rating and a 67% success rate. Click on the image below to learn more.

The Takeaway

In conclusion, while Etsy stock has faced a substantial decline in the past year, the company’s resilient performance and strategic decisions showcase a promising future. Despite market pessimism, Etsy’s Q3 results reveal strong revenue growth, impressive earnings, and a strategic focus on optimizing monetization.

In the meantime, the stock’s near-all-time low valuation, coupled with substantial stock repurchases, positions Etsy for potential upside. Therefore, I believe that the company’s ability to navigate challenges and drive shareholder value makes it an optimistic choice for investors in the evolving e-commerce landscape.