Let’s admit it, stock picking isn’t for everyone.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Many investors have no time or willingness to sift through countless articles, opinions, analyst recommendations, and financial data points to choose a stock or two. It’s difficult, time-consuming, and in many cases frustrating, as the results don’t always justify the efforts. That’s why so many individual investors prefer ETFs – a cheap, effortless tool allowing them to get exposure to a large number of stocks.

There is a myriad of ETFs on the market, ranging from the huge, highly liquid, total-index SPDR S&P 500 ETF Trust (SPY) and iShares Russell 1000 ETF (IWB), through the more expensive proprietary index and actively managed ETFs, and all the way to very specific niche ETFs, such as, for example, Invesco S&P SmallCap Consumer Discretionary ETF (PSCD). There are also many esoteric ETFs, which target non-common investment themes, from entrepreneurship to marijuana (such as BOSS or MSOS).

The smaller, concentrated, and less liquid investment vehicles are, of course, more dangerous: their concentration means that a large move in one stock can have an outsized impact on the whole fund, while their low liquidity can impact the ability to redeem units of the fund and can lead to higher trading costs. Even more dangerous are inverse and leveraged ETFs: they can double or triple investors’ return, but also losses; they are definitely not for novices or gentle-hearted investors.

Should investors stick only to the good old, plain-vanilla, broad-index ETFs? Not necessarily. Investors can diversify their holdings within the ETF sphere and add to their returns above the general markets with some winning themes or strategies, but they should be carefully choosing their bets.

One of the less-known large, diversified, and liquid ETFs is the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL). OMFL tracks an index of US large-cap stocks selected by a combination of five investment factors, which are weighted based on current macroeconomic conditions.

The index followed by the ETF, the Russell 1000 Invesco Dynamic Multifactor Index, re-weights large-cap securities of the Russell 1000 Index according to the U.S. economic cycle stage (expansion, slowdown, contraction, or recovery) and market conditions. Companies are then scored based on the factors that are most relevant given the overall outlook: during recovery or expansion, the emphasis is placed on the company size and value, while during a slowdown or contraction, stocks with healthier balance sheets and reduced susceptibility to market swings move into focus. As a result of this active, multi-factor-based approach, the underlying index, as well as the ETF itself, may significantly diverge from the Russell 1000 Index. The index and the ETF are rebalanced monthly according to changes in the economy and markets, as well as the stock factor scores.

OMFL’s assets under management (AUM) are $3.8 billion; the fund holds above 300 shares of companies from all sectors. It must be said, though, that the ETF is quite top-heavy, with the ten largest holdings comprising almost 40% of the fund. Its top holdings, as of June 1st, are Apple (AAPL), Microsoft(MSFT), Berkshire Hathaway (BRK.B), Exxon Mobil (XOM), Johnson & Johnson (JNJ), Chevron (CVX), Visa (V), Eli Lilly (LLY), UnitedHealth Group (UNH), and Costco (COST).

OMFL’s total expense ratio (total fees) of 0.29% is higher than that of the plain-vanilla ETFs but is lower than the costs of many other actively managed or proprietary-index exchange-traded funds. Besides, despite the higher fees, OMFL has had significant periods of net outperformance compared to ETFs following the S&P 500 and Russell 1000 indices – SPDR S&P 500 ETF Trust (SPY) and iShares Russell 1000 ETF (IWB).

OMFL, like SPY and IWB, pays quarterly dividends. The dividend yields are as follows: OMFL – 1.63%, SPY – 1.55%, and IWB – 1.46%. The difference might not seem significant, but it has to be noted.

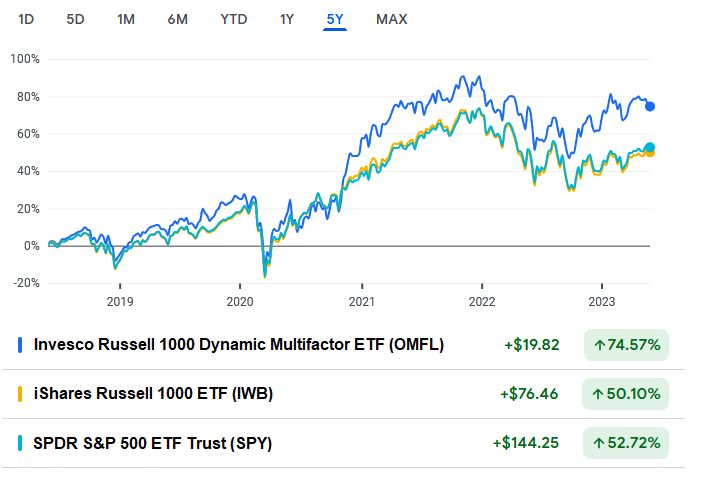

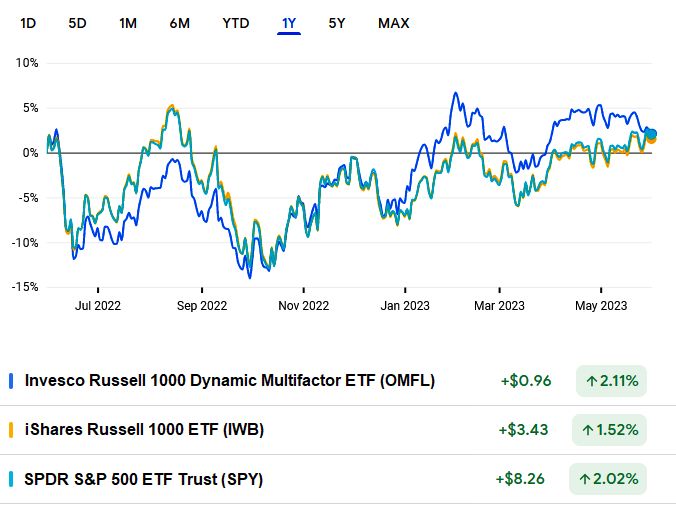

Let’s have a look at the performance of the ETFs following the large-cap indexes: OMFL, IWB, and SPY in the 5-year and 12-month periods.

As can be seen, OMFL’s short-term performance is very similar to that of the S&P 500-following ETF but better than that of the Russell 1000-following one; while in the long term, OMFL beats both SPY and IWB by a wide margin.

Furthermore, OMFL carries an 8/10 (“Outperform”) Smart Score rating on TipRanks, with a “Moderate Buy” analyst recommendation:

To sum it all up, OMFL presents a great opportunity to diversify an investment portfolio with a multi-factor index-based ETF that outperforms large-cap indexes in the long term.