Investors are caught between stubbornly high inflation and the growing possibility of a recession. Amid these uncertain times, stocks generating high dividend yields that are backed by solid cash could be a great addition to investors’ portfolios.Using TipRanks’ Stock Comparison Tool, we pitted Energy Transfer (NYSE:ET), Enterprise Products (NYSE:EPD), and Enbridge (NYSE:ENB) (TSE:ENB) against each other to pick the dividend stock that will deliver the best returns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Energy Transfer LP (ET)

Energy Transfer, a master limited partnership (MLP), is one of the most diversified midstream energy companies in the U.S., with an extensive presence across 41 states and in all of the major production basins.

The company slashed its dividend (or cash distribution) by half in October 2020 amid the slump in energy prices during the pandemic. Over the past few quarters, Energy Transfer has been increasing its dividends. In October 2022, it announced a dividend per share of $0.265 for Q3 2022 (paid on November 21), reflecting a 15% increase from Q2 2022.

The company intends to return to its previous quarterly dividend per share of $0.305, while balancing its targeted leverage levels, buybacks, and growth investments. Based on the dividends paid over the trailing 12 months, Energy Transfer’s dividend yield stands at 7.1%.

Energy Transfer’s attractive dividends are backed by its stable cash flows, with about 85% to 90% of its 2022 estimated adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) coming from fee-based contracts with low commodity price sensitivity. In Q3 2022, the company’s adjusted distributable cash flow (DCF) increased 21% to $1.58 billion. Energy Transfer had an excess cash flow of about $760 million after distributions.

The company’s future growth looks promising as it continues to enhance its existing asset base and invest in growth projects, primarily in the midstream, intrastate, and natural gas liquids (NGL) refined products segments.

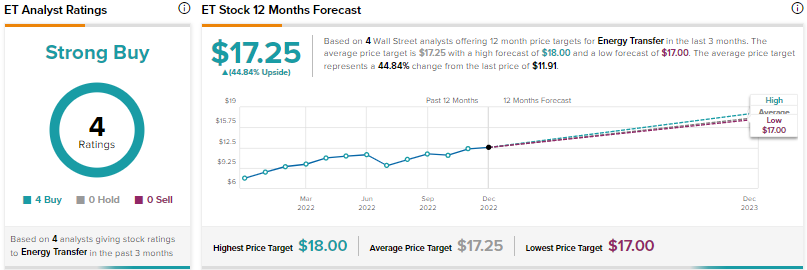

Is Energy Transfer a Buy or Sell?

Energy Transfer scores a Strong Buy consensus rating based on four unanimous Buys. The average ET stock price target of $17.25 implies 44.8% upside potential. ET stock has rallied by an impressive 45% so far this year.

Enterprise Products Partner L.P. (EPD)

Another MLP, Enterprise Products is one of the leading North American providers of midstream energy services. It has a diversified asset base that includes pipelines, storage terminals, and processing facilities.

Enterprise Products pays a quarterly dividend of nearly $0.475 (annualized dividend per share of $1.90), reflecting a significant dividend yield of 7.7%. This year is the 24th consecutive year of dividend or cash distribution hike for the company. EPD has a diversified revenue base, with the top 200 customers accounting for 98.6% of 2021 revenues. Furthermore, the partnership’s cash flows are predictable as it relies on long-term contracts.

In the third quarter, Enterprise Products paid 56% of its distributable cash flow (DCF) of $1.87 billion as dividends (Note that in the case of MLPs, dividends are often measured against DCF rather than free cash flows). This payout ratio leaves enough scope for the partnership to invest in its expansion and increase its dividends further.

Enterprise Products continues to invest in traditional midstream services and lower carbon projects to support growth in the years ahead.

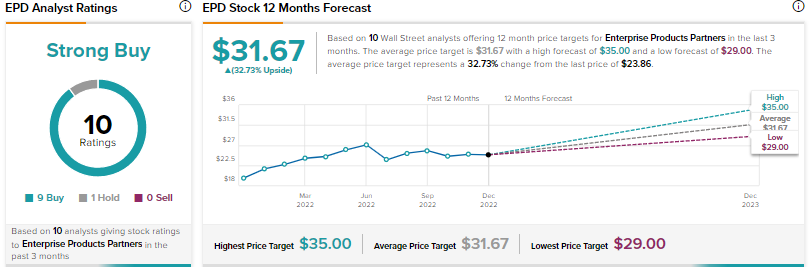

Is EPD a Good Stock to Buy?

Wall Street’s Strong Buy consensus rating for Enterprise Products stock is based on nine Buys and one Hold rating. At $31.67, the average Enterprise Products stock price prediction suggests 32.7% upside potential. EPD stock has advanced nearly 9% this year.

Enbridge (ENB)

Canada-based Enbridge is one of the largest energy infrastructure companies in North America. It transports crude oil and natural gas, and has an expanding renewable portfolio.

Enbridge recently announced a 3.2% hike in its quarterly dividend per share to C$0.8875 (annualized dividend per share of C$3.55), effective March 1, 2023. This hike marks the 28th consecutive annual dividend increase for the company. ENB’s dividend yield stands at 6.6%. Enbridge intends to keep its dividend payout ratio in the range of 60% to 70% of its DCF. It expects 2023 DCF per share in the range of C$5.25-C$5.65, which is enough to cover the annualized dividend per share of C$3.55.

Enbridge’s cash flows are derived from more than 40 sources, making them highly diversified in nature. Also, 98% of the company’s cash flows are backed by long-term contracts. With a strong backlog of C$17 billion of secured projects and continued investments in conventional as well as low-carbon businesses, the company seems well-positioned to grow its dividends further.

What is the Target Price for Enbridge Stock?

Wall Street is cautiously optimistic about Enbridge stock, with a Moderate Buy consensus rating based on five Buys and five Holds. The average ENB stock price target of $43.02 implies 9.6% upside potential. ENB’s U.S.-listed shares are flat on a year-to-date basis.

Conclusion

The dividend yields of the aforementioned companies are not significantly different from one another. However, with a solid dividend yield and splendid year-to-date rise in the stock, Energy Transfer has rewarded investors with higher total returns (dividends plus capital gains) than Enterprise Products and Enbridge.

If we consider total returns, then based on Wall Street’s price target estimates, Energy Transfer is poised to deliver better returns than the other two stocks in the year ahead. The company continues to reduce its debt, strengthen its balance sheet, and invest in growth projects to ensure steady cash flows that will support its high dividends.