It should be a golden age for network technology producers like Ericsson (ERIC). With 5G starting to ramp up and potentially offering an end to the digital divide and a post-smartphone world starting to take shape, opportunities abound.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, Ericsson’s recent earnings report suggested the company might be getting left behind, as it is currently down over 9% today.

The company posted earnings of $0.14 per share, which faltered against estimates calling for $0.18 per share. The company’s revenue of $6.36 billion also came in under expectations.

The reasons behind the misses were common enough; a combination of supply-chain issues and surging inflation sent the company’s costs skyrocketing, and that cut into both earnings and revenue.

Despite the stock falling, I’m bullish on Ericsson right now. There are some great opportunities afoot here, and with a very attractive price point for entry, the company has quite a bit of upward potential.

It’s been a very up-and-down year for Ericsson but within a fairly tight range. The company saw share prices clear the $13 per share mark this time last year but slide down to around $10 going into the close of 2021. A brief surge sent the company back over $12, but that surge didn’t hold, and now the company is down under $7 per share.

Wall Street’s Take on Ericsson

Turning to Wall Street, Ericsson has a Moderate Buy consensus rating. That’s based on just one Buy assigned in the past three months. The average Ericsson price target of $15 implies 121.6% upside potential.

Investor Sentiment is on a Razor’s Edge

While the last earnings report didn’t exactly bode well, there’s still plenty of confidence out there that Ericsson can achieve. In fact, Ericsson has a Smart Score of 7 out of 10 on TipRanks, the highest level of “neutral.”

That makes it somewhat more likely than not that the company will outperform the broader market. It’s not a full “outperform,” but it’s very close.

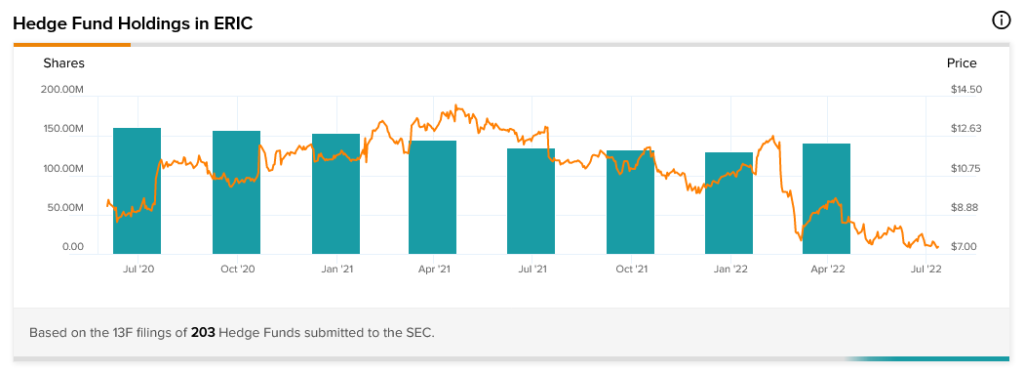

Hedge fund involvement demonstrates the confidence the market has in Ericsson rather nicely, based on the results of TipRanks’ 13-F Tracker. Hedge funds added a combined 10.4 million shares to their portfolios in the last quarter.

This actually breaks a downward trend that stretches back almost two years. Hedge funds haven’t owned this much Ericsson stock since March of 2021. That suggests growing confidence in Ericsson’s ability to succeed in the market.

However, insider trading is something of a different picture. There is currently no data available on the levels of insider trading seen at Ericsson.

As for retail investors who hold portfolios on TipRanks, they’re increasingly getting out of the company. In the last seven days, the number of TipRanks portfolios that hold Ericsson stock was down 0.7%. Over the last 30 days, this number was also down 0.7%.

Finally, there’s the matter of Ericsson’s dividend history. It’s irregular, to say the least, but it did manage to keep up with the worst of the pandemic. The company went from an annual dividend to a bi-annual dividend starting in 2020, oddly enough. While the amount has been cut over the years, the multiple payouts likely make this a bit more attractive for income investors.

A Larger Master Plan Emerges

Ericsson has been a quiet leader in communications systems for years. Taking a look at some of what it’s got coming up makes it worth considering.

About two weeks ago, for example, the company offered up an update on its planned acquisition of Vonage (VG), which was a leader in voice over Internet protocol (VoIP) service.

So far, it seems to be moving smoothly. The proposal has “cleared all other requisite foreign and U.S. regulatory approval requirements.” The deal is set to close by the end of this month if all goes as planned.

Such a move would give Ericsson access to an end-to-end option for mobile telephony; it would be working on the communications media—5G connectivity—and on the voice platform required to operate it as well.

Meanwhile, Ericsson’s Radio Dot System is working to provide better access to 5G wireless connectivity indoors. Indoor wireless connections have always been difficult, especially with some buildings that depend heavily on steel and concrete. It’s also a big help in terms of getting VoIP service into these buildings; you can’t send voice over internet protocol without internet access, after all.

Finally, Ericsson has also been working with Digital Nasional Berhad in Malaysia to send voice traffic over the nation’s 5G network. Dubbed Voice over New Radio (VoNR), it’s similar to VoIP, except it works over 5G operations.

Take these three points together, and a larger master plan begins to emerge. It’s almost as though Ericsson is rapidly working toward being a major new force in voice service provision.

Ericsson offering voice service is a terrific complementary good to its work in 5G service. Not only will Ericsson have a hand in the growing 5G market, but it will also be able to offer a service on 5G. That combination allows the company to make revenue coming and going. That, in turn, will certainly help earnings figures regardless of supply-chain issues.

Ericsson may not be the first thing people think of when they think of mobile communications. However, they probably should be thinking of it a lot more than they do.

Conclusion – Low Price Tag, Master Plan, Recession Resistant

The combination of Ericsson’s low price tag and potentially very real larger master plan suggests that there’s much reason to Buy in on Ericsson right now. That’s the biggest reason why I’m bullish on the company.

Throw in the growing support of hedge funds, and that only makes a good thing even better. The macroeconomic conditions won’t hurt the company much, either.

Internet service is one of the last things to go in a recessionary economy. People need internet connections for job hunting and cheap entertainment. Since it serves multiple useful purposes, it tends to stick around.

With Ericsson actively working on a technology that may finally make high-speed internet truly ubiquitous, even in the countryside where households are few and far between, this could be what really makes the company big.