Equinix (NASDAQ: EQIX) and Digital Realty Trust (NYSE: DLR) are the two largest U.S. data center REITs, boasting market caps of ~$48.3 billion and $28.2 billion, respectively. REITs in the space, like EQIX and DLR, have an advantage in the current market environment due to the unique qualities that come with the critical nature of data centers. However, both stocks don’t appear particularly attractive at their current price levels, despite their recent violent correction. Accordingly, I am neutral on both stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Why Data Centers are Attractive in the Current Environment

Data centers appear to be favorable investments in the current market environment, as the rest of the real estate sector is a mess.

Residential properties are cooling off post-COVID-19 following the frenzy that persisted in 2020-21. Commercial properties are struggling as hybrid working (remote & physical) conditions have become the norm. Retail properties continue to face occupancy struggles as the possibility of consumers’ discretionary income declining in an upcoming recession keeps rents compressed. Rising rates/mortgages further pressure the sector.

However, there are some niche real estate areas whose essential nature places them in a better position. One such area, for instance, includes telecom tower REITs. I recently wrote about why SBA Communications (NASDAQ: SBAC) and Crown Castle (NYSE: CCI) are two solid REITs in the field.

Another niche area in the real estate sector includes data centers. Data centers appear to offer a wider margin of safety in the current environment due to their mission-critical nature. Enterprises have their whole operations running plugged into these servers.

Thus, Infrastructure-as-a-Service (IaaS) data centers deliver a critical component for many businesses. For this reason, data centers are usually leased under triple net leases over extended periods of time, providing REITs in the space with reliable and predictable cash flows.

This can also result in these REITs attracting cheaper financing rates as creditors have fewer demands than, say, mall REITs. That can be a great advantage with rates on the rise.

How Fast are EQIX & DLR Growing?

Revenue and FFO Growth

EQIX and DLR rode the favorable tailwinds the data centers industry enjoyed over the past decade quite successfully. Specifically, revenue growth over the past decade has averaged around 15% for both companies during this period.

However, remember that REITs primarily expand through the issuance of debt and equity. Thus, top-line growth is not that meaningful unless the expansion is accretive on a per-share basis. EQIX’s and DLR’s FFO/share grew by a CAGR of 10.2% and 4.3% during this period, respectively.

EQIX has outperformed, as its global, much more scalable platform unlocked multiple synergies on the way up while the company managed to complete key interconnections and other data services.

Dividend Growth

Regarding dividend growth, EQIX has increased its dividend every year since initiating it in 2014. Its five-year dividend growth CAGR stands at 10.4%. The latest dividend increase in February was also by a pleasant rate of 8%, with the company appearing comfortable to afford strong dividend hikes.

For Fiscal 2022, management expects AFFO/share to land between $28.77 and $29.10, implying growth of around 6% to 7% compared to last year and a comfortable payout ratio of 43% at the midpoint.

DLR’s dividend growth over the past has been quite slower, averaging 5.5%. However, compared to EQIX’s rather short dividend-growth track record, DLR has increased its quarterly dividend every year for 17 consecutive years.

As far as I can tell, this is the longest dividend-growth track record among all companies in the space. Management’s core FFO per share outlook of $6.75 to $6.85 for Fiscal 2022 implies a payout ratio of 68% at the midpoint. This explains why DLR has been more prudent with dividend increases over EQIX as well.

Moving forward, I expect both companies to experience a slowdown in growth. The space has become overcrowded, and the industry has grown quite mature. With rates on the rise, expansion should be more expensive in the coming years as well.

What are the Price Targets for EQIX and DLR Shares?

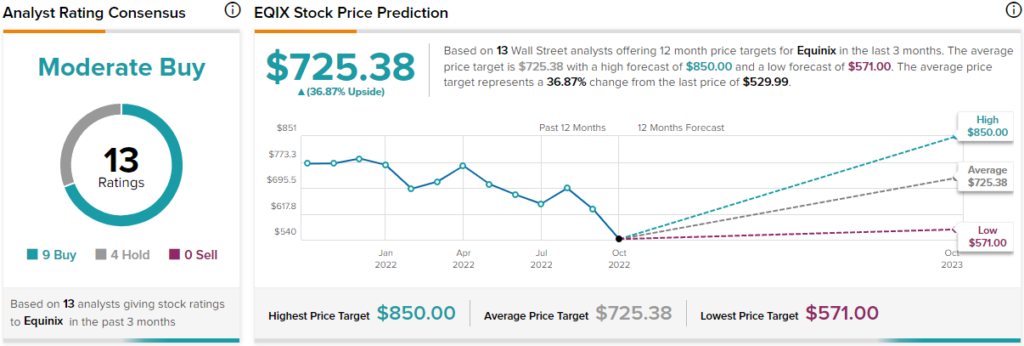

Turning to Wall Street, Equinix has a Moderate Buy consensus rating based on nine Buys and four Holds assigned in the past three months. At $725.38, the average Equinix stock forecast suggests 36.9% upside potential.

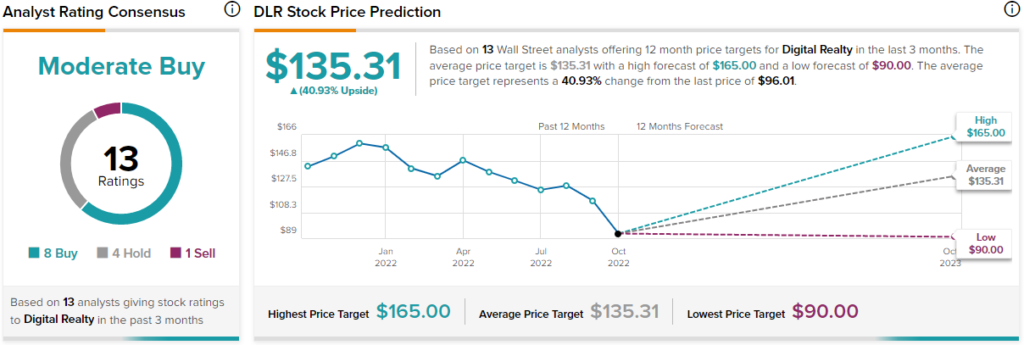

Analysts are rather bullish on Digital Realty as well. The stock has a Moderate Buy consensus rating based on eight Buys, four Holds, and one Sell assigned in the past three months. At $135.38, the average Digital Realty stock forecast implies 40.9% upside potential.

Takeaway: Valuations Could Still be Elevated

While analysts are bullish on both stocks, and while both stocks have corrected significantly lately, I believe they could still be overvalued, especially EQIX. Basically, growth rates should slow down in a rather saturated industry and a tough macro environment. EQIX trades at around 27x its forward FFO, which is a steep multiple to have these days, even if its double-digit growth were to be sustained (and it likely won’t).

DLR appears cheaper, at ~14x its forward FFOs, while the stock has a juicy yield of 5.1%. The multiple appears quite reasonable here, but it also reflects the rather miniature growth prospects of the company. I can hardly see the company growing its FFO/share north of the low single digits. Thus, future total returns may not necessarily be that attractive just because of the lower multiple (i.e., below the double-digits).

I would definitely not touch EQIX anywhere near its current levels, and while I would consider DLR here, I wouldn’t have extraordinary total return expectations ahead. Still, due to its lower valuation and higher yield, DLR should offer an investment case with a much wider margin of safety versus EQIX.