Enterprise Products Partners (NYSE:EPD) stock likely presents one of the best high-yield opportunities (7.4% yield) in midstream. Operating over 50,000 miles of gas, oil, and product pipelines, 30 natural gas processing plants, 260 MMBbls of liquids storage, and 20 deepwater docks, the partnership owns highly critical infrastructure in the U.S. Due to the essential nature of these assets, EPD supports a business model that ensures sustained income growth for shareholders. Accordingly, I am bullish on the stock.

Breaking Down EPD’s Dividend

Before we break down EPD’s dividend and go on to explain what makes the stock a great high-yield opportunity, I should mention that EPD doesn’t technically pay a dividend. Instead, it pays out distributions, which are taxed differently. This is because it’s a partnership and not a corporation.

Nevertheless, what truly sets EPD apart as an exceptional income stock is its unparalleled track record of dividend growth within the industry. Among its American midstream counterparts, the partnership proudly holds the record for the longest streak of consecutive annual distribution increases, marking an impressive 25 years of consistent hikes. While its remarkable track record would classify it as a Dividend Aristocrat, its partnership status prevents it from meeting the formal criteria for such a status.

Nevertheless, management asserts that EPD beats numerous existing Dividend Aristocrats across various metrics. Notably, EPD stands as the sole entity boasting a 25+ year dividend growth track record while holding an “A” rating from S&P Global (NYSE:SPGI) and delivering a yield exceeding 7%. This serves as a testament to both EPD’s ability to generate robust cash flows from its mission-critical assets across diverse market cycles, as well as management’s dexterity in growing the company while maintaining a strong balance sheet.

Healthy Balance Sheet to Sustain Growth

Demonstrated by its impressive “A” rating from S&P, EPD boasts a robust balance sheet that positions it favorably for sustained dividend growth. Its total debt of $29.05 billion might appear problematic during a rising-rates landscape. However, EPD owns hard assets that generate strong enough cash flows to sufficiently service its obligations. Notably, its leverage ratio of 3x is relatively healthy, especially within the capital-intensive industry where most participants contend with substantial indebtedness.

EPD’s tendency to maintain a healthy balance sheet, combined with the highly stable nature of its assets, has resulted in EPD sustaining resilient operational cash flow per unit (OCFU) generation even during adverse conditions in the midstream industry. For context, EPD’s OCFU increased both during the Great Financial Crisis and during the COVID-19 pandemic. Even during the oil price collapse in 2015-16, when most midstream partnerships saw their equivalent metrics collapse, EPD’s OCFU barely declined.

Given that the qualities that have sustained EPD’s exceptional performance during both good and bad times remain in place, I believe that the partnership is well-positioned to sustain its dividend growth track record.

High Yield Counterbalances Slower Dividend Growth

While EPD’s dividend growth prospects remain robust, as I just mentioned, the partnership has resorted to slower dividend growth in recent years. The most recent hike to the quarterly dividend was by just 2%, or a single cent, to a rate of $0.50. I believe this is attributable to management wanting to retain a healthy payout ratio during a rising-rates environment despite its healthy balance sheet.

EPD doesn’t provide specific guidance. However, based on its performance during the first half of 2023 and the current outlook in the midstream industry, I would expect its distributable cash flow per share to land close to $3.50. This implies a stable result compared to last year and a payout ratio of 57%. Thus, even though the company could easily afford bolder dividend hikes, it makes sense to see management being prudent in the current market environment.

In the meantime, the stock’s 7.4% dividend yield should counterbalance the slower dividend growth, as it already provides a hefty, tangible return to shareholders.

Is EPD Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, EPD has a Strong Buy consensus rating based on 10 Buys and two Holds assigned in the past three months. At $31.92, the average Enterprise Products Partners stock forecast implies 17.8% upside potential.

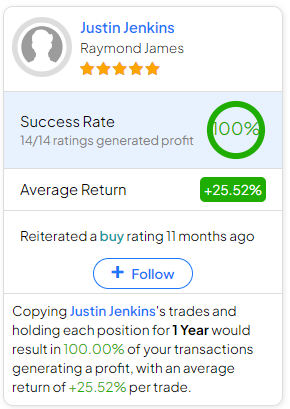

If you’re wondering which analyst you should follow if you want to buy and sell EPD stock, the most accurate analyst covering the stock (on a one-year timeframe) is Justin Jenkin from Raymond James, with an average return of 25.52% per rating and a 100% success rate.

The Takeaway

In conclusion, Enterprise Products Partners stands out as a compelling high-yield opportunity in the midstream sector. Boasting an extensive network of critical infrastructure, EPD has demonstrated a remarkable 25-year track record of consecutive annual distribution increases, a feat unmatched in the industry.

The partnership’s strategic assets, coupled with a robust balance sheet and an “A” rating from S&P, position it for sustained growth and resilience across market cycles. Despite a recent moderation in dividend growth, the 7.4% yield serves as an attractive offset. Consequently, I see EPD as a compelling pick for high-yield investors looking for reliable income within the energy sector.