Solar power is a growth industry for 2023, and Enphase Energy (NASDAQ:ENPH) is a superstar you can stand by throughout the year. The company consistently beats EPS forecasts and is heavily favored by experts on Wall Street, so I am bullish on ENPH stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

California-based Enphase Energy sells microinverters for solar energy storage systems to residential and commercial customers. Sure, there are bigger companies out there that offer indirect solar power exposure, but ENPH is a pure-play asset that should grow with the industry this year.

President Biden reminded the market of his administration’s commitment to clean energy, including solar power, during his most recent State of the Union address. It almost felt as if he gave an executive order for smart investors to hold ENPH stock. So, let’s shine a light on one of my favorite picks right now, Enphase Energy.

Enphase Energy is a Global Solar Business

The solar market isn’t limited to just one country or even one continent. It’s truly global in scope. Likewise, Enphase Energy is attractive since it has both domestic and international operations.

On the home front, Enphase Energy is teaming up with renewable energy company Lumio to “significantly expand its offering” in the U.S. of Enphase’s IQ8 Microinverters and IQ Batteries. The IQ8 Microinverters are Enphase Energy’s most revolutionary product, as they represent the “industry’s first microgrid-forming microinverters.”

However, Enphase is also making waves abroad. In Brazil, the company reported a “significant increase in deployments of residential solar energy systems powered by” Enphase Energy’s microinverters. Additionally, Enphase is expanding its product offerings in Europe, especially in Germany and Austria, through a team-up with decentralized energy systems specialist Enerix.

Get Ready for Enphase Energy’s Bidirectional Charger

While Enphase Energy crosses international boundaries, the company is also pushing the envelope with a potentially transformational device. It’s a bidirectional charger, which Enphase hopes to bring to market in 2024.

There are plenty of electric vehicle (EV) chargers out there, but imagine a device that enables an EV battery to “provide uninterrupted power to a home during a power outage” and to “share energy with the grid to help relieve the strain on electric utilities during times of peak energy demand.”

Enphase Energy’s bidirectional charger will be able to do all of that, as well as send “clean solar energy directly to the EV battery.” All in all, this device could become the world’s go-to, all-in-one charger for vehicles, homes, and businesses. Importantly, it could be a major revenue generator for Enphase Energy.

Enphase Energy Sold Many Microinverters Despite High Inflation

Speaking of generating revenue, Enphase Energy demonstrated its ability to sell its products in late 2022, even while inflation was elevated. During last year’s fourth quarter, Enphase shipped a mind-blowing 4,873,702 microinverters and took in record quarterly revenue of $724.7 million.

That result exceeded analysts’ consensus estimate of $704 million and indicated a huge improvement over the year-earlier quarter’s revenue of $412.7 million. Clearly, Enphase Energy had no trouble selling its microinverters even though macroeconomic conditions weren’t ideal.

For the current quarter, Enphase Energy expects to generate $700 million to $740 million in revenue, so don’t be surprised if the company maintains its impressive momentum.

Furthermore, Enphase beat Wall Street’s Q4-2022 consensus EPS estimate of $1.27 per share by delivering $1.51 per share. Moreover, take a glance at Enphase Energy’s EPS history, and you’ll see that the company has achieved estimate-beating results quarter after quarter since 2019. There aren’t too many businesses, solar or otherwise, that can claim a track record like this.

Is ENPH Stock a Buy, According to Analysts?

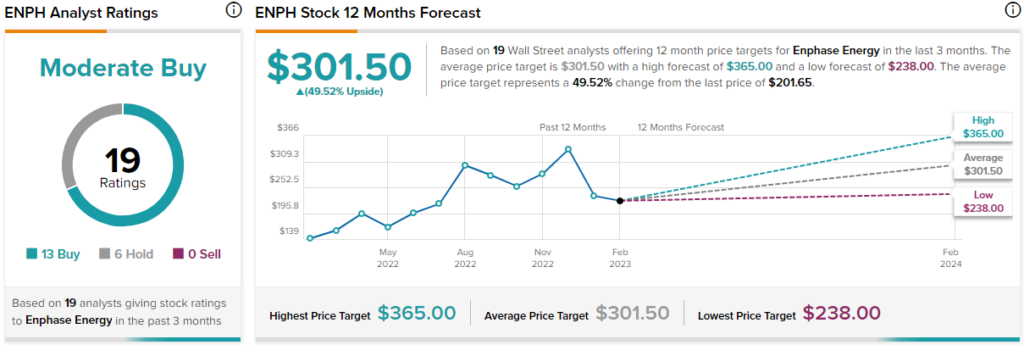

Turning to Wall Street, ENPH stock is a Moderate Buy based on 13 Buys and six Hold ratings. The average Enphase Energy stock price target is $301.50, implying 49.5% upside potential.

Conclusion: Should You Consider ENPH Stock?

Enphase Energy’s microinverters are quite popular already in the U.S. and could become big sellers in multiple regions of the world. Also, the company’s bidirectional charger might actually transform the way people power their vehicles and homes.

Moreover, Enphase Energy is heavily favored by analysts, and it managed to ship out plenty of products even while inflation was running hot. Therefore, anyone who envisions a bright future for solar power in 2023 and beyond should seriously consider a position in ENPH stock.