UK-based utility companies Centrica (GB:CNA) and Drax Group (GB:DRX) are known for their steady price appreciation and regular dividends – and even in tough economic times, these two companies deliver.

For these reasons, they are analysts’ favourites and have solid backing from them.

The TipRanks Expert Center comprises a broad range of financial experts, including analysts, bloggers, and more.

These experts have solid experience in their respective sectors and generate huge returns from them. Investors can take help from such tools to choose highly rated stocks for similar returns.

Let’s have a look at these companies and the analysts backing them.

Centrica

Centrica is a leading utility company, providing energy and gas solutions in the UK and Ireland.

Centrica’s stock has been volatile in the last three months and is trading down by 18%, having gained 19% in the last year. This was mainly due to the news of temporary price capping on renewable energy, which impacted utility stocks.

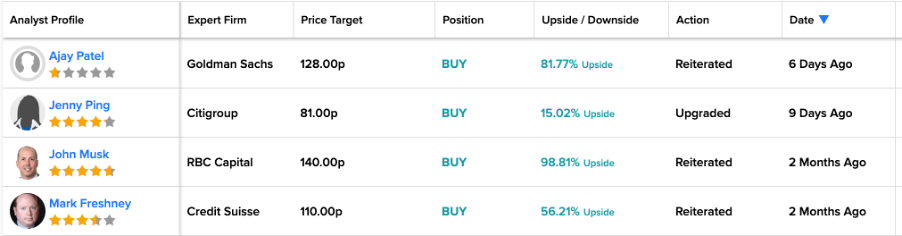

Centrica has always remained an attractive pick among investors with its regular dividend payouts. It also enjoys wide coverage from analysts, who are bullish on the stock.

John Musk from RBS Capital is highly bullish on the stock and sees upside potential of close to 100% in the share price. He has been covering the stock since 2015 and has around 23 ratings. He has a success rate of more than 50% on the stock market with an average return of 10%.

Jenny Ping from Citigroup recently lifted her rating on Centrica from Neutral to Buy at a target price of 81p. Citigroup is also bullish on dividend payments and expects a full-year dividend of 3.1p per share in 2022. In 2023, analysts expect the dividend to increase to 3.7p per share.

Is Centrica a good stock to buy?

According to TipRanks, the stock has a Strong Buy rating, based on six Buy and two Hold recommendations. The average target price is 115.75p, with an upside potential of 64%.

Drax Group Plc

Based in the UK, Drax Group is a renewable energy company with the ambition to become carbon negative by 2030.

Recently, the company’s shares tumbled after a BBC Panorama documentary said the company was cutting down environmentally important forests. The shares were also affected by news of revenue caps for power generators. Overall, after a lot of ups and downs, the stock was trading down by 5% last year.

Let’s see what analysts expect from the stock.

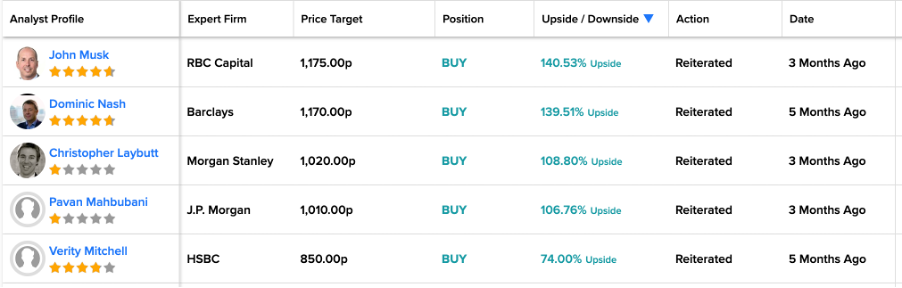

RBC analyst Musk is bullish on Drax as well and expects an upside of 140%. He has 44 ratings on the stock, with an average return of 23% per rating. Musk mainly covers the stock from the utility sector and has generated a return of 152% on Drax stock between April 2020 and April 2021.

Dominic Nash from Barclays has a Buy rating on the stock with a target price of 1,170p, with an upside potential of 137%. His success rate on the stock is 71%, with 5 out of 7 ratings being profitable. He also has a solid average return of 53% per rating.

Drax Group share price forecast

According to TipRanks consensus, Drax Group stock has a Strong Buy rating.

The DRX target price is 935.5p, which has an upside potential of 89.8%.

Conclusion

Based on these analysts’ experience, success rates, and grip on the utility sector, these stocks could be a great value addition for investors.