The stock market remains volatile amid high inflation and rising interest rates. However, investors can still earn a steady income from stocks with a solid history of dividend payments and growth. Among the reliable dividend stocks, investors could consider investing in TC Energy’s (NYSE:TRP)(TSE:TRP) stock. This energy infrastructure company has a long track record of dividend growth. Moreover, it offers a high dividend yield.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s Why TC Energy is a Dependable Income Stock

TC Energy transports and stores natural gas and crude oil. It also owns power generation assets to produce electricity. Thanks to its high-quality asset base and focus on optimizing the utilization of its assets, TC Energy has paid and increased its dividend since 2000 (for 22 years). Furthermore, its dividends have grown at a CAGR of 7% since then.

The company is confident of growing its earnings, which would support future payouts. For instance, TC Energy expects about C$33 billion of projects to enter service in the coming years, which will drive its earnings and cash flows, and in turn, its dividend payments. Also, its assets maintain high utilization levels, which is positive.

Given its growing earnings and cash flows, TC Energy expects to increase its dividend by 3-5% annually in the future. In addition, as most of its EBITDA (about 95%) comes from regulated and long-term contracted assets, its payouts are well covered.

TC Energy stock has remained resilient in 2022. Further, it offers a high dividend yield of 6.3%.

Is TC Energy a Buy?

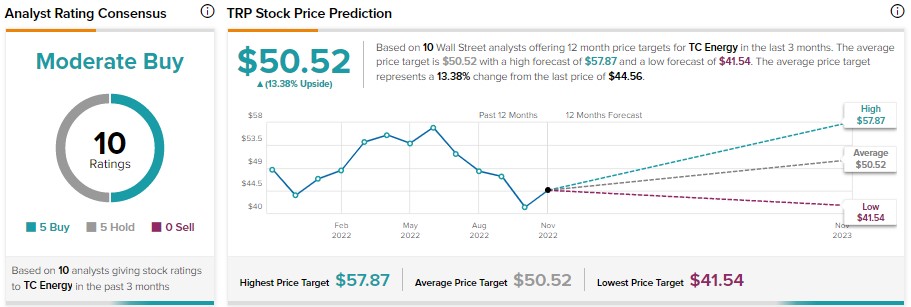

On TipRanks, TC Energy stock has received five Buy and five Hold recommendations, translating into a Moderate Buy consensus rating. Meanwhile, the analysts’ average price target of $50.52 indicates 13.4% upside potential.

TipRanks’ data shows insiders bought $1.8M worth of TRP stock last quarter. However, the hedge funds sold 156.3K TRP stock. Overall, TRP stock has a Smart Score of eight on 10 on TipRanks, implying an Outperform outlook.

Bottom Line

TC Energy’s solid dividend payment history, high asset utilization, resilient EBITDA, and visibility over future dividend growth make it an attractive stock to earn a steady income amid all market conditions.