Dropbox Inc. (DBX) is a growing cloud computing services company, operating in the information technology sector. Since going public on March 23, 2018, the financial outlook for Dropbox has been improving ,as the company displays more and more potential for Revenue and Free Cash Flow growth, while the fundamental business idea behind the well-known brand is also evolving.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Dropbox has expanded from keeping files in sync to keeping teams in sync. Today, we are well-positioned to reimagine the way work is done.

Attractive valuation multiples, strong fundamentals, and a clear applicable vision for the future -all explored in detail throughout this analysis- establish the stock as an appealing choice for both growth and value-oriented investors.

Recent Stock Performance

While the company has been beating growth expectations, the stock has recently experienced a significant pullback, erasing the majority of 2021 gains. The current stock price of $23.9 represents a 28% drop from 52-Week highs. In fact, when considering that Dropbox has no price appreciation to show for the last three years, since its IPO, some investors/analysts might be discouraged.

Jan 2021- Stock Performance

Financial Outlook

For the last couple of years, Dropbox has solidified Revenue and Cash Flow growth while at the same time reaching profitability. Over the last five years, Total Revenue has grown at a CAGR of 26% while Cash Flow from Operations has grown, for the 2016-2021 period, at a 23% CAGR. Another highlight of financial performance is an impressive 80% Gross profit margin, significantly higher than the 2016 margin of 56%.

Even though it is known that the cloud computing industry allows for very high levels of profitability, Dropbox stands out among competitors, providing clear evidence of a smooth and effective business model. One additional area of strength for Dropbox, for the past few years, has been the zero-leverage strategy the company has employed. Management, however, in 2021 decided in favor of using debt-financing solutions and, as of the end of its third quarter in September the 30th 2021, maintains a 1.4B long-term Debt balance. According to the company’s guidance, 1.0B of Free Cash Flow is expected to be generated by 2024.

Finally, despite the tendency most young companies have to issue more shares, thereby diluting shareholders, Dropbox is actually reducing the number of shares outstanding and plans to continue doing so for the foreseeable future.

Fundamentals

While the cloud industry has attracted more and more investor attention, as the digitalization of the economy, accelerated by the COVID-19 pandemic, has established a new work environment for millions of professionals around the world. The Cloud computing services market size is forecasted to reach 1.3T by 2028, registering a CAGR of 19.1% for the coming six years, according to research from Businesswire.

The lucrative nature and growth prospects of the cloud business have enticed many big players, to fight for market share in what is forming to be a highly competitive space over the next decade. Given Apple’s (AAPL) iCloud, Microsoft’s (MSFT) Azure, Amazon’s (AMZN) AWS, and many more cloud solutions offered by different companies, a smaller player like Dropbox is going to have to differentiate, while proving that it can continue to invite new users.

To that end, Dropbox aims to become much more than a cloud storage destination. By taking strategic initiatives and improving platform capabilities, Dropbox is on pace to becoming a smart, interactive workspace for digital content collaboration. By offering cutting-edge file sync-and-share solutions like DocSend and HELLOSIGN, Dropbox Business looks to reintroduce itself as a space for remote work, where professionals/employees can collaborate on a global scale, thereby reducing costs and increasing productivity.

Today, the company counts more than 700M users and around 16.5M paying users (with 80% using the platform for work). Paying users for Dropbox have grown approximately 30% since 2018, when the company reported 12.7M subscribers.

The customer transition from registered to paying user is arguably the biggest challenge for Dropbox, as well as the most important growth catalyst. The company also intends to focus on another growth driver, the introduction of team subscription plans, suitable for work-at-scale both in small businesses and large corporations.

A Look at Valuation

The Information-Technology sector is one of aggressive growth and high valuation multiples. Even well-established, dominant companies like Microsoft or Adobe (ADBE) trade at P/E ratios over 30x and P/S ratios over 10x. While Dropbox has displayed strong growth history and future potential, it does not share elevated valuation multiples. Currently, with a market cap of 9.1B, the stock trades at a P/S ratio of 4.5x and a forward P/E ratio of 16x. The double-digit top and bottom-line growth the company is experiencing is, apparently, offered to investors at a discount.

Wall Street’s Take

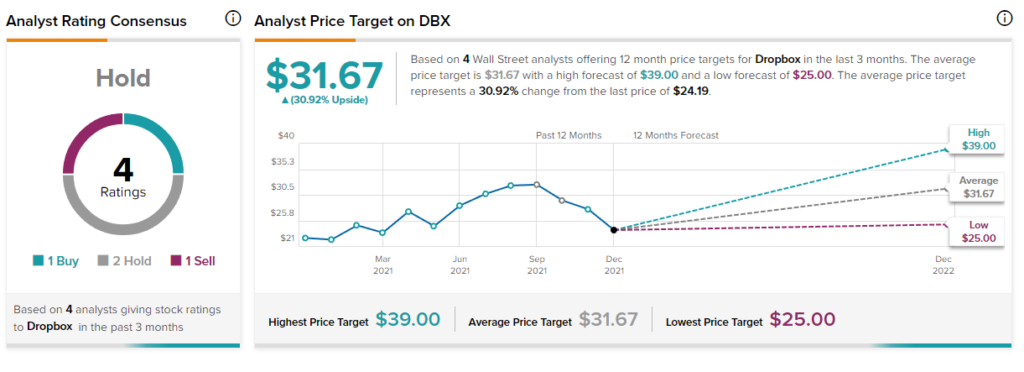

Turning to Wall Street, Dropbox has a Hold consensus

rating, based on 1 Buy, 2 Holds, and 1 Sell assigned in the last three

months. The average Dropbox price target is $31.67, representing a 30.92% upside from current price levels, with a high forecast of $39.00 and a low forecast of $25.00.

Disclosure: At the time of publication, Alex Galanis did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.