Stock markets offer one of the great paradoxes of life – that when conditions grow difficult and prices fall, opportunities for profit will appear. For investors, it’s a chance to cash in – after a proper look into the nuts and bolts behind a market decline. As always with stocks, informed decisions are the most likely to pan out.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

To jumpstart that due diligence, we can check in with Wall Street’s analysts. These are the pros, the equity experts who’ve built their reputations learning and analyzing the inner workings of the trading environment, and their published notes and recommendations give the investing public a sound guide to worthwhile investments.

Using their insights and the TipRanks database, we have identified several stocks that are primed for gains – but are priced low for now. These are Buy-rated equities that have fallen on hard times – with over 60% losses in the past year – but according to the analysts, they still offer triple-digit upside potential. Let’s take a closer look.

Plug Power (PLUG)

First on our list is Plug Power, a ‘green power’ player designing and manufacturing zero-emission hydrogen fuel cell systems, including the production, storage, and delivery infrastructure needed to build out this new technology to industrial or utility scales. Hydrogen fuel cells use electrochemical reactions to generate usable electric power. The result is a cleaner power source, based on clean, renewable hydrogen – the most common element in the universe.

Plug Power’s hydrogen fuel cell battery products have found uses in both motive and stationary applications, including backup power generation and in warehousing. The fuel cells are growing in popularity with data centers, and have been found to be cost-effective in warehousing, where they are used to power pallet jacks and fork lifts. Other applications include home heating systems and portable electronics. To date, Plug has deployed more than 60,000 power cells for e-mobility, and has become the largest buyer of liquid hydrogen in North America. The company’s customer base includes names such as Amazon, Walmart, and BMW.

The long-term prospects for Plug look good. In today’s cultural environment, which places a premium on both clean and renewable energy sources, Plug can be sure of finding both political and social support. Short-term, however, the picture is less rosy, and PLUG shares are down 67% over the last 12 months.

At least part of the reason can be seen in Plug’s recent quarterly earnings reports. The company is simply not hitting the revenue expectations. In the last report, from 4Q22, Plug reported a top line of $221 million – that was up 36% year-over-year, but it missed the $277.3 million forecast by a 20% margin. Worse, the company’s annual net diluted EPS loss worsened y/y, from -$0.82 cents to -$1.25.

On a positive note, Plug does have plenty of business lined up going forward. The company came out of 2022 with a solid backlog of work, in both the hydrogen production electrolyzer business and in hydrogen liquefaction orders.

The backlog and the prospect for continued orders building up momentum going forward form the base for Wolfe analyst Steve Fleishman’s positive view of this stock.

“Plug closed 2022 with a miss on revenue but saw its backlog jump 27% in the quarter on increasing demand for electrolyzers, fuel cells, and liquefiers. We see a lot of positive momentum to come over 2023 for PLUG as hydrogen investment rises and there is more clarity on the IRA incentives and hydrogen hubs, though execution will be key this year,” Fleishman opined.

Anticipating that Plug will be able to execute, Fleishman rates the shares as Outperform (i.e. Buy) and sets a price target of $25, suggesting a one-year upside of ~138%. (To watch Fleishman’s track record, click here)

Overall, Plug has been generating plenty of buzz, and has 22 reviews from the Street’s analysts. These include 16 Buy recommendations and 6 Holds, for a Moderate Buy consensus rating. Overall, the Street sees an impressive 138% upside potential here, based on the average price target of $25.14. (See PLUG stock forecast)

Adicet Bio (ACET)

Next on our list is Adicet Bio, a small-cap firm in the biopharmaceutical sector. Adicet is working on a new line of ‘off the shelf’ T cell therapies for cancer treatment, based on allogenic gamma delta T cells. These represent a new generation of T cells, when compared to the current alpha beta T cell immunotherapies, and offer the promise of greater efficacy in antitumor activity against both solid tumors and hematological cancers. The company is producing its line of gamma delta T cell drug candidates through a proprietary cell platform.

Adicet is currently in the transition from the pre-clinical stage to the human clinical trial stage. The company’s pipeline has multiple research tracks ongoing, including 5 currently in discovery/preclinical testing, two at the IND-enabling regulatory stage, and one in a Phase 1 human clinical trial.

That clinical trial is the primary factor for investors to consider on this stock. The drug candidate, ADI-001, is under investigation in the treatment of relapsed or refractory B-cell non-Hodgkin’s lymphoma, in an ongoing Phase 1 study. The drug received the FDA’s Fast Track designation last year, and in Q4 Adicet released interim data on safety and efficacy.

The released data showed a ‘favorable’ safety and tolerability profile at all dose levels, as well as a 75% overall response rate (ORR) and a 69% complete response (CR) across all dose levels. The company is currently continuing enrollment in the trial, with the goal of obtaining additional data on durability of response in support of a planned Phase 2 dose. Additional updates are expected in 2Q23.

While these data were positive, the company’s stock fell sharply after the results were released. Concerns were raised over the six-month complete response rate, as the data showed a complete response rate for dose levels 2 and 3 of just 33%. The company plans to address these issues with the dose level 4 process underway. In the meantime, shares in ACET are down 74% for the past 12 months.

Despite the concerns over the durability issues of ACI-001, Wedbush analyst Robert Driscoll remains upbeat on Adicet through the rest of this year. Explaining his position, Driscoll says, “We continue to believe the data remain impressive with an ORR of 75% included a striking 5/5 CRs in LBCL patients who relapsed after prior CD19 CAR-T therapy, and expect longer-term durability data from additional dose cohorts will provide better insight into potential durability. We see ACET’s platform as significantly differentiated, and see significant upside potential for shares over the next 12–18 months as programs progress.”

This justifies the Outperform (i.e. Buy) rating, in Driscoll’s view, and the analyst’s $30 price target indicates his confidence in a hefty 482% upside for the next 12 months. (To watch Driscoll’s track record, click here)

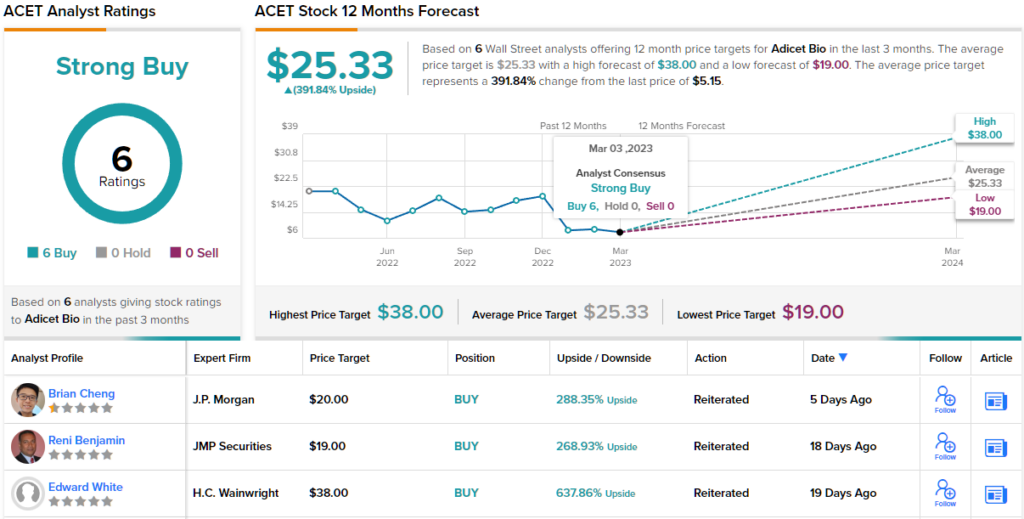

Overall, with 6 recent analyst reviews, all positive, Adicet’s stock has earned its Strong Buy consensus rating. The shares are trading for $5.21 and the average price target, which stands at $25.33, suggests an impressive gain of ~392% lying ahead. (See ACET stock forecast)

Design Therapeutics (DSGN)

For the last stock on our list, we’ll stick with the biotech sector. Design Therapeutics, another research-oriented biopharma, is focused on finding disease-modifying treatments that target underlying causes of inherited nucleotide repeat expansion conditions. In short, the company is developing new therapeutic agents for genetically-based degenerative diseases with high unmet medical needs.

Design’s approach is based on gene targeted chimeras (GeneTACs), forming the base of small-molecule genomic medicinal agents. These novel drug candidates work by modifying the defective inherited nucleotides that underlie the targeted conditions.

The company’s research pipeline currently features three tracks, two of which are attracting investor attention. The most advanced, at the Phase 1/2 clinical stage, is drug candidate DT-216, a potential treatment for Friedreich Ataxia. The Phase 1 stage of the trial is ongoing, evaluating adult patients to build a profile on safety, tolerability, pharmacokinetics, biodistribution, and pharmacodynamic effects, all based on three weekly doses. Earlier results, based on the single-ascending dose (SAD) portion of the trial showed that DT-216 was generally well-tolerated; results from a multiple ascending dose (MAD) portion are expected by the middle of this year, and the Phase 2 portion of the trial is planned for initiation in 2H23.

In another development of note to investors, the company’s second drug candidate, DT-168, remains on track for a Investigational New Drug (IND) submission in 2H23. This is an important regulatory milestone, and approval will clear the way for human clinical trials. DT-168 is a potential treatment for the genetic eye disease Fuchs Endothelial Corneal Dystrophy, or FECD.

Despite the positive position of the company’s research programs, shares in DSGN are down by 68% in the past year.

That said, RBC analyst Leonid Timashev takes a bullish stance on the company and believes the shares will push ahead from here.

“The team continues to execute on DT-216, with the program still on track for data mid-year and a ph.II start in 2H23. Additionally, we note the company continues to keep costs under control while progressing lead program DT-216 through ph.I MAD work and two additional geneTACs towards the clinic. With shares having pulled back following the December SAD uptake, we believe investors are undervaluing the demonstrated proof of principle, and we look for additional validation as the program progresses through MAD and ph.II to help shares recover,” Timashev opined.

These comments back up Timashev’s Outperform (i.e. Buy) rating and he has set the one-year price target at $24, implying a gain of ~340% in that time. (To watch Timashev’s track record, click here)

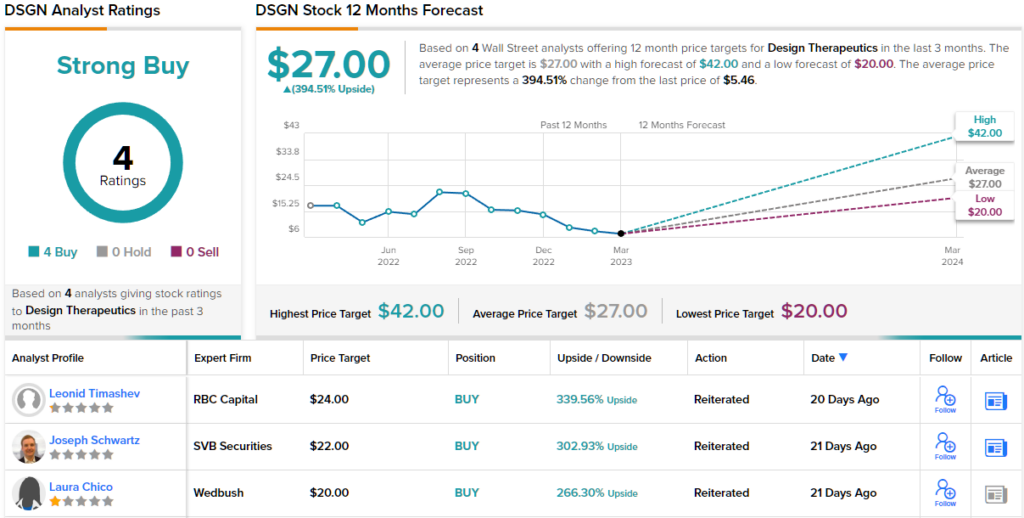

Looking at the consensus breakdown, other analysts are on the same page. With 4 Buys and no Holds or Sells, the word on the Street is that DSGN is a Strong Buy. DSGN shares are priced at $5.46 and their $27 average target implies a whopping 394% gain in the next 12 months. (See DSGN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.