There are conflicting signals coming from the markets lately.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

We all know the accumulated headwinds; rising interest rates, the banking failures, and the Fed, in the minutes from its last FOMC meeting, indicated that a ‘mild’ recession is highly likely in the second half of this year.

Yet, the markets have seen sound gains year-to-date, with the S&P 500 up 7.5% and the NASDAQ an even better 15%.

Looking at the current market conditions, Jeremy Siegel, a Wharton economic professor and a long-time stock bull, acknowledges that the likelihood of a recession has increased. However, Siegel believes that recessions present excellent buying opportunities.

“I always think recessions are great buying opportunities. I don’t sell in anticipation of [a recession], but I know a lot of other people do which could lead to softness, not crash. I think the October lows are holding,” Siegel opined.

Against this backdrop, we identified two stocks that have fallen over 50% from their recent peaks – but that Wall Street analysts believe are gearing up for a rebound. In fact, according to TipRanks, the world’s biggest database of analysts and research, the two tickers have scored enough praise from the Street to earn a “Strong Buy” consensus rating.

Akoya Biosciences (AKYA)

We’ll start in the med-tech sector with Akoya Biosciences. This research firm focuses on spatial phenotyping, a form of tissue imaging study at the cellular level that keeps the individual cells of the sample in their original spatial context. It’s a type of visualization that gives researchers greater insight into how cells are organized in respect to one another, how they interact with one another, and importantly, how they impact or are impacted by the progression of disease conditions.

Akoya’s technology allows clinicians to achieve a higher level of resolution when examining samples, a development that brings with it the promise of improved treatment responses. The company currently has several main platforms to offer, the PhenoCycler and two versions of the PhenoImager, which between them provide a complementary solution for fast, unbiased data on scores of protein and RNA biomarkers.

Last month, Akoya released financial data for Q4 and full year 2022. The company had a quarterly top line of $21.2 million, up 31% year-over-year and approximately $760K above expectations. At the bottom line, the GAAP EPS of 50 cents missed the forecast by 6 cents – although it was 3 cents better than the year-ago quarter’s result. The Q4 revenue was a company quarterly record, and the full-year top line, of $74.9 million, was up 36% y/y.

Shares in AKYA peaked this past August, at well over $15 each; since then, the stock is down 55%. However, Canaccord analyst Kyle Mikson thinks this lower stock price could offer new investors an opportunity to get into AKYA on the cheap.

“We think the share weakness is overdone but can be explained by a few factors (which are not new to the AKYA story). First, the stock has relatively unfavorable trading liquidity. Second, Akoya’s consumables revenue per instrument (i.e., pull-through) remains relatively modest. Third (finally), most investors expect AKYA to conduct a financing in the near term. We believe concerns related to these factors are overblown,” Mikson opined.

“Overall, we view the recent weakness in AKYA shares as a compelling buying opportunity for investors given the company’s attractive growth potential as a differentiated leader in the emerging, yet potentially lucrative, spatial biology market,” the analyst added.

In Mikson’s view, that potential market justifies a Buy rating and a price target of $25, to imply a one-year gain of 257%. (To watch Mikson’s track record, click here)

Mikson is hardly the only bull; AKYA’s Strong Buy consensus rating is unanimous, based on 5 recent reviews from the Street. The shares are currently trading at $7.01 and their $15.60 average price target implies an upside of ~122% from that level. (See AKYA stock forecast)

CommScope Holding (COMM)

Next up, we’ll explore CommScope, a networking technology company. This is a provider and distributor, through its subsidiaries, of network infrastructure for building and cell tower installations, for transmitter base stations, and for outdoor wireless power supplies, among other things. CommScope, due its scale, is well-positioned to participate in the ongoing buildouts of new technology and new wireless networks.

To that end, the company announced that it ended last year with a total of 1 million shipments of radio frequency amplifiers during the whole of 2022. The shipments were made to top cable operators. In addition to hitting that milestone, CommScope also announced an increase in its US production of fiber optic cables, move that will make it possible to accelerate the rollout of broadband services in underserved communities. The company’s expansion of fiber optic cables will also feed into overall job creation.

Wrapping up 4Q22, CommScope reported top line revenues of $2.32 billion, up 4.5% year-over-year, but missing the forecast by $20 million. The non-GAAP EPS at the bottom line came in at 49 cents. This was up 18 cents y/y, and a single penny under the forecast. These numbers came along with a non-GAAP adjusted free cash flow of $402.8 billion.

Looking at the full year, the company’s net sales hit $9.23 billion, while the free for the year came in at $197.5 million – indicating that the FCF accelerated in Q4.

With the stock plummeting by 60% from its peak of over $177 last October, is it a good time to take action? Deutsche Bank analyst Matthew Niknam certainly thinks so.

“We believe COMM’s underlying exposure to secular tailwinds (ie: service provider investment in fiber and 5G, enterprise connectivity) and the resulting ramp in FCF create an attractive de-leveraging and equity value creation story over time… We believe 2Q23 should yield a step in the right direction, with a modest qoq improvement in both revenues and FCF. That said, we ultimately see greater tailwinds surfacing in 2H23, as order trends improve (off of easier comps) and revenue/FCF see a more meaningful ramp,” Niknam opined.

Quantifying this, Nikman rates COMM s a Buy, with a $9 price target to suggest it has room for a 63% upside in the coming year. (To watch Nikman’s track record, click here)

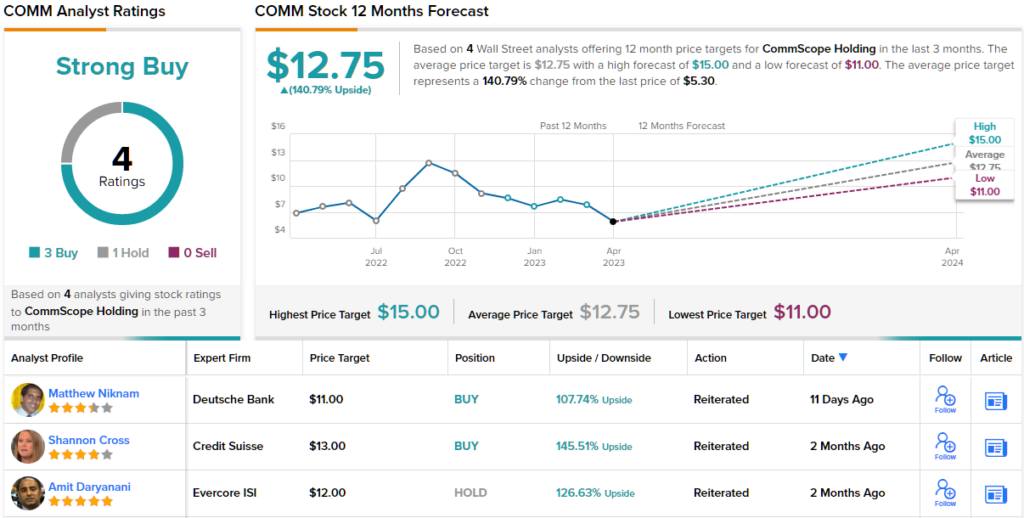

Overall, there are 4 recent analyst reviews here, and their breakdown of 3 Buys and 1 Hold give the stock its Strong Buy consensus rating. Shares in COMM are selling for $5.31 and the $12.75 average price target indicates room for 140% growth going forward. (See COMM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.