Watching a stock you own slip and slide to the bottom is no fun. Even worse, watching it fall as the markets are up doubles the pain. Having said that, the ‘buy low, sell high’ maxim is not the worn-out cliché it is for nothing. The savvy investor knows that the best time to pick up shares is when they are lying in the doldrums in anticipation of a turnaround.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But how to find the right names that are only temporarily down and due a bounce back? Enter the Wall Street pros.

We opened the TipRanks database and homed in on two equities that have been excluded from this year’s rally but are about to rebound – or so say the Street’s stock experts. The pair are both down by a large amount year-to-date – by over 40% – but are rated as Strong Buys by the analyst consensus, with some forecasting huge gains ahead. Let’s see why you might want to pick up shares of these beaten-down stocks before they hit the comeback trail.

Alignment Healthcare (ALHC)

The first beaten-down stock we’ll look into is Alignment Healthcare, a company focused on delivering personalized and comprehensive care to Medicare beneficiaries. Alignment’s patient-centered approach aims to improve the health outcomes and overall experience for seniors and those most in need of customized health care solutions. The company offers a range of services, including Medicare Advantage plans, care coordination, and chronic condition management.

The tech-enabled Medicare advantage firm provides over 40 rich-in-benefits plans across 52 counties, spanning six states, all contributing to a strong performance in its latest quarterly readout, for 1Q23. Revenue rose by 27.1% year-over-year to reach $439.16 million, at the same time beating the consensus estimate by $7.78 million. While the company regularly operates at a loss, the Q1 EPS of -$0.20 fared better than the -$0.26 anticipated by the analysts. However, for the outlook, the company expects Q2 revenue in the range between $433 million and $438 million, amounting to a sequential drop.

Furthermore, recent concerns about broad industry medical costs for outpatient care amongst seniors in addition to a disappointing Q4 print in early March have helped put pressure on the shares. Hence, the stock is down by 49% year-to-date.

That said, assessing the company’s prospects, Morgan Stanley analyst Michael Ha sees a lot to like here.

“Looking ahead,” said Ha, “we believe Alignment’s 2Q23 earnings guidance is conservative and well positioned for upside driven by a likely benefit from mid-year payment sweep true-ups. Regarding 2024, we grow increasingly optimistic on Alignment’s potential to achieve their +20% membership growth target as we believe the company has a significant relative competitive advantage from superior Star ratings providing them with a golden opportunity to take market share and drive outsized membership growth.”

These comments form the basis for Ha’s Overweight (i.e., Buy) rating while his $19 price target suggests shares will post strong growth of 209% in the year ahead. (To watch Ha’s track record, click here)

In general, other analysts echo Ha’s sentiment. 3 Buys and 1 Hold add up to a Strong Buy consensus rating. Based on the average price target of $10.25, the upside potential comes in at 71%.(See ALHC stock forecast)

Castle Biosciences (CSTL)

For our next doldrum languishing name, we’ll stay in healthcare but look at a firm with a different value proposition.

Castle Biosciences is a leading diagnostic firm dedicated to transforming patient care by providing innovative diagnostic tests. These enable physicians to make more informed treatment decisions. The firm’s proprietary molecular testing platforms utilize advanced genomic and bioinformatics technologies to analyze tumor samples and provide accurate prognostic and predictive information.

Presently, Castle Biosciences offers six distinct proprietary tests specifically tailored for dermatologic cancers, uveal melanoma, Barrett’s esophagus, and mental health disorders.

The products have been gaining traction as evident in the revenue haul consistently rising for the past couple of years. The recent Q1 earnings showed a top-line of $42.04 million, amounting to a 56.5% year-over-year increase and coming in ahead of the consensus estimate by $4.66 million. In the quarter, the company delivered 14,916 total test reports, a 73% improvement on the 8,627 delivered in the same period last year.

However, the shares have shed 45% year-to-date and that is entirely down to the stock cratering by 49% in one session earlier this month. That evisceration came after Novitas (a Medicare Administrative Contractor [MAC]) announced its future effective Local Coverage Determination (LCD). According to the LCD, two of Castle’s products – DecisionDx-SCC (DD-SCC) and DecisionDx-Melanoma (DD-Mel) – do not meet the criteria required for coverage.

That is obviously not great news, notes Canaccord analyst Kyle Mikson, although given the company’s positioning – and the lowered share price – Mikson thinks the stock is ripe for the picking.

“We recognize that the Novitas coverage decisions regarding DDSCC and DecisionDx-Melanoma are not positive outcomes and appear alarming on the surface. This result will likely significantly impact DD-SCC revenue in the near term. That said, the governing LCD for Castle’s most important revenue driver, DecisionDx-Melanoma, remains unchanged… We believe Castle remains well-positioned to achieve solid revenue growth in 2023 and beyond (as well as positive cash flows over time). At this point, we remain bullish on the shares and recommend buying on the recent weakness,” Mikson opined.

To this end, Mikson sticks with a Buy rating, backed by a $40 price target. Should the figure be met, a year from now, investors will be sitting on returns of 202%. (To watch Mikson’s track record, click here)

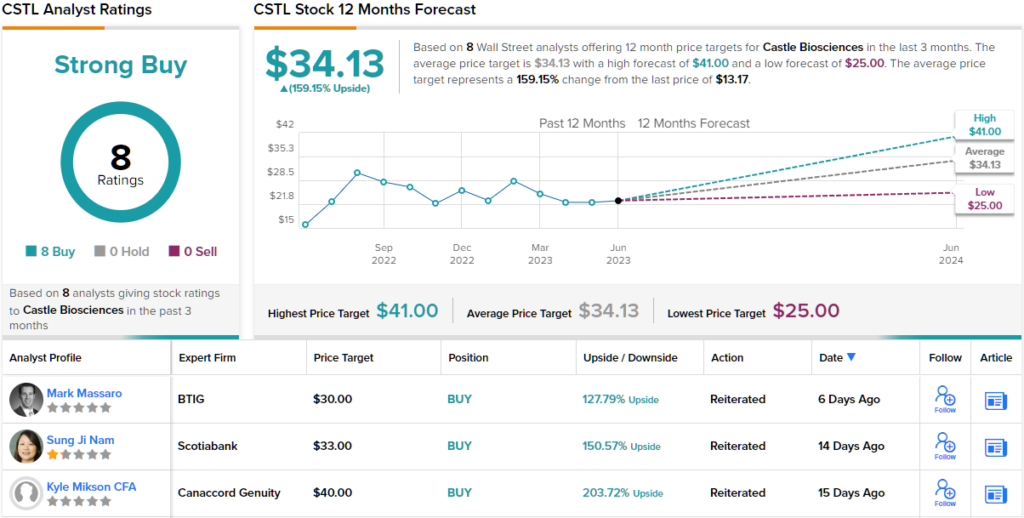

Overall, there is total agreement on Wall Street that these shares are going for cheap. Not only does the stock boast a Strong Buy consensus rating – based on a unanimous 8 Buys – but the $34.13 average target makes room for 12-month upside of 159%. (See CSTL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.