Among the many Warren Buffett quotes thrown around, none has caught the imagination more than his timeless, “be fearful when others are greedy, and greedy when others are fearful” nugget.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

And it looks like 2023 will be the perfect opportunity for Buffett to once again demonstrate his use of the axiom. At least that is the opinion of Elon Musk, who recently said he “suspects Warren Buffett is going to be buying a lot of stock next year.”

Having called Buffett a “bean counter” in the past, Musk is not renowned for being a fan of the investing legend, but the Tesla/Twitter/SpaceX CEO can evidently see the merit in Buffett’s value-driven approach.

“If a company has very strong fundamentals, but then the market is doing some short-term panic situation, obviously that’s the right time to buy stock.” Musk opined.

We know that that is exactly what Buffett likes and with the market having gone into meltdown mode over the course of the past 12 months, Buffett might be getting ready to pounce.

So, let’s take a look at a couple of stocks already taking up space in the The Oracle of Omaha’s portfolio but which have seen big losses over the past year, making these beaten-down names likely candidates for some Buffett buying action.

With help from the TipRanks database, we can find out whether the Street’s analysts also think these names offer opportunities at current levels. Let’s take a closer look.

Snowflake Inc. (SNOW)

Let’s start with Snowflake, a company that could once be described as the poster boy for richly valued tech stocks. The data warehousing specialist made a big entrance into the public markets in September 2020, in what was the largest-ever software IPO, with the company becoming the biggest to double its market cap on the first day of trading.

Using cloud-based hardware and software, the company enables its users to store and analyze data, and despite its rich valuation periodically being called into question, Snowflake has continued to grow at an impressive rate.

This was also the case in the most recently reported quarter – for the third quarter of fiscal 2023. Revenue rose by 67% year-over-year to $557.03 million, beating the Street’s forecast by $18.12 million. Amounting to 66% year-over-year growth, remaining performance obligations (RPO) – the metric represents deals that will generate revenues in the future – hit $3 billion, while the company posted an impressive net revenue retention rate of 165%. Snowflake beat expectations on the bottom-line too, as adj. EPS of $0.11 trumped the $0.05 consensus estimate.

The shares, however, have encountered a similar fate to other tech names. Worries about inflation and growth in the face of global economic unrest have caused tech stocks to lose popularity, and as a result, Snowflake shares lost 58% of their value last year.

Buffett already owns 6,125,376 SNOW shares – currently worth just under $830 million – and being Buffett, the drop could entice the investing legend to load up.

JMP analyst Patrick Walravens certainly thinks that’s what investors should do. The analyst lists multiple reasons for taking a bullish SNOW view. These include: “1) the company is disrupting the data management industry with its data cloud and cloud-native architecture and with its philosophy of “enabling the work to come to the data”; 2) the company has 287 customers with over $1M in product revenue (up 94% y/y), and 6 of Snowflake’s top 10 customers grew faster than the company overall quarter-over-quarter in F3Q, 3) the cloud data platform addresses a massive ~$248B TAM; 4) Snowflake is led by a premier management team, including CEO Frank Slootman and CFO Mike Scarpelli; and 5) the company continues to grow rapidly at scale, while delivering impressive operating leverage, with a non-GAAP operating margin of 7.8% in F3Q, up from 3.5% last quarter.”

Quantifying his comments, Walravens rates SNOW shares an Outperform (i.e., Buy) along with a $215 price target. Investors are looking at 12-month returns of ~46%, should the forecast work out as planned. (To watch Walravens’ track record, click here)

Most on the Street agree; based on 17 Buys vs. 7 Holds, SNOW stock claims a Moderate Buy consensus rating. At $187, the average target implies one-year share appreciation of 26%. (See Snowflake stock forecast on TipRanks)

Floor & Decor Holdings (FND)

The second beaten-down we’ll look at is Floor & Decor, a specialty retailer focused specializing in hard surface flooring – tile, stone, wood, laminate, vinyl – and associated accessories, with its customer base ranging from the DIY crowd to professional installers and commercial entities. Since forming in 2000, the company has seen some serious growth and now boasts 178 warehouse-format stores and five design studios spread out across 35 states.

The growth – albeit slower – was on tap again when the company reported FQ3 financials in early November. Revenue hit $1.1 billion, amounting to a 25.5% year-over-year uptick while comp store sales rose by 11.6% from the same period a year ago. Adjusted diluted EPS climbed by 16.7% to $0.70. Both the top-and bottom-line figures beat expectations.

That said, the deteriorating macro conditions saw the company deliver a disappointing FY outlook, with net sales expected in the range between $4.25 billion to $4.285 billion, below consensus at $4.32 billion.

The story around FND’s beaten-down share price – the stock shed 46% throughout 2022 – is one of concern around the slowing housing market against a backdrop of soaring inflation and rising interest rates.

But that share price drop might entice Buffett to add to his position. He currently owns 4,780,000 shares, worth almost $333 million.

Turning to the analyst community, Evercore’s Greg Melich thinks that at current levels, the “risk/reward on FND is favorable into 2023.”

“The fundamental story of 15-20% sq footage growth, expansion of pro, digital, and services to drive share and profit gain remains intact – even in a softening economy,” the analyst said. “Given that FND’s long-term growth narrative (both organically and via store expansion) remains in-place and profit margins remain structurally elevated, opportunity remains.”

Accordingly, Melich rates FND shares an Outperform (i.e. Buy) while his $90 price target suggests the stock will be changing hands for a 36% premium a year from now. (To watch Melich’s track record, click here)

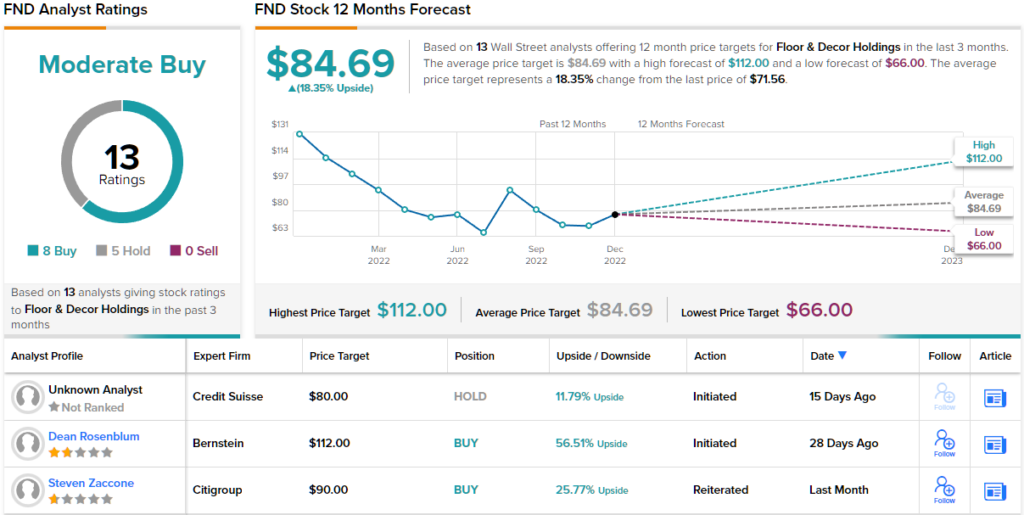

Overall, 13 analysts have thrown the hat in with FND reviews, and these break down 8 to 5 in favor of Buys over Holds. The average target stands at $84.69, implying potential one-year upside of ~18%. (See FND stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.