Upstart (NASDAQ:UPST) has taken investors on a roller-coaster ride ever since it went public in late 2020. The company’s IPO or initial public offering was priced at $20 per share, and UPST stock surged to over $400 in October 2021. Now, it’s trading about 94% below all-time highs. While the fintech stock has grossly underperformed the market in the last two years, the pullback offers an opportunity to buy the dip and potentially benefit from outsized gains when market sentiment improves.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

I am bullish on Upstart due to its improving financials, reasonable valuation, and potential to gain market share across business segments.

What Does Upstart Do?

Upstart operates in the financial lending space. It offers an artificial intelligence (AI) lending platform to improve access to credit while reducing the risks and costs of its lending partners. According to Upstart, its platform uses robust machine learning models to identify risk accurately and enhance the applicant approval rate compared to legacy credit score-based lending models.

Upstart further emphasized that over 80% of borrowers are approved instantly due to its sophisticated platform, making the lending process extremely efficient.

The company has served close to three million customers to date. It has also partnered with more than 100 banks and originated $35 billion in total loans.

Upstart’s Revenue Growth Has Fallen Off a Cliff

A key driver of Upstart’s astonishing rise in 2021 was its revenue growth. The company increased its sales from $163 million in 2019 to $846 million in 2021. However, sales fell to $837.7 million in 2022 and are forecast to decline by 40% to $506 million in 2023. This massive decline has also hampered Upstart’s profit margins. While Upstart reported adjusted earnings of $0.21 per share in 2022, its forecast to end the current year with a loss of $0.62 per share.

Interest rate hikes coupled with elevated inflation levels in the past 20 months have led to a tepid lending environment. These factors caused Upstart’s sales to fall by 14% year-over-year to $135 million in Q3 2023.

Its lending partners originated 114,464 loans totaling $1.2 billion in Q3, a decline of 34% compared to the year-ago period. However, cost efficiencies allowed Upstart to report an operating loss of $43.8 million in the September quarter compared to a loss of $58 million in the last year.

Upstart is Entering New Markets

I am bullish on Upstart primarily due to its ability to enter new markets, such as auto loans and home loans, in the next few years, rapidly expanding its total addressable market. The global automotive financing market is forecast to reach $5.6 trillion in 2031, according to a report from Allied Market Research. Additionally, mortgage loans in the U.S. are the single largest component of household debt and are valued at $19.3 trillion.

Upstart entered the auto loan market in 2020 and recently entered the HELOC (home equity line of credit) market.

UPST Stock Doesn’t Come Without Risks

Investors should expect Upstart’s stock price to remain volatile until the macroeconomic situation improves. In the last seven quarters, Upstart has originated fewer loans, while car loan originations declined by 52% in Q3.

Moreover, the company will have to allocate significant resources to gain traction in the HELOC segment, which is dominated by entrenched players. Upstart’s reliance on third-party funding is also a huge risk, and it still has to successfully navigate a recessionary environment and come out largely unscathed.

Is UPST Stock a Buy, According to Analysts?

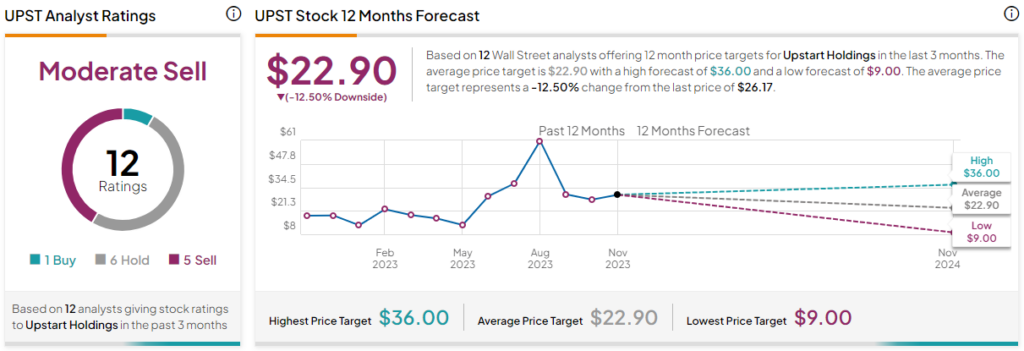

Priced at 3.1x 2024 sales, UPST stock is not too expensive, especially if it can shore up its profit margins in the next 12 months. Nonetheless, out of the 12 analysts covering Upstart stock, only one recommends a Buy, six recommend a Hold, and five recommend a Sell. The average UPST stock price target is $22.90, which is 12.5% below the current trading price.

The Takeaway

While Wall Street remains cautious on Upstart, I am bullish on the company in the long term. It has a widening portfolio of products, an expanding base of lending partners, and it’s positioned to gain traction in new business segments over time. These factors should enable Upstart to reaccelerate revenue growth while reporting consistent earnings and cash flows.